The Kenyan Government Is Warning Against Cash Bouquets And Here’s What It’s Really About

Across many parts of Africa, money has long been more than a medium of exchange. It is a symbolic gesture across various cultures and societies, one that you can likened to be a show of performance in some cases.

Wealth is supposed to be loud and deafening if possible and some Africans prefer that version of noise and not the quiet wealth.

During different seasons and periods like Valentine’s Day, weddings, birthdays, and celebrations of love, cash bouquets, notes folded, pinned, sprayed, and arranged like flowers, have become a visual language of affection.

The giver shows effort and the receiver enjoys the spectacle while social media and its users get to enjoy the moment and all the spectacle there is to watch.

So when the Central Bank of Kenya (CBK) recently stepped in to warn against the growing trend of cash flower bouquets, many people reacted to the information with confusion and mild outrage.

Vendors make money from arranging them and the recipients of this money bouquet enjoy flaunting them.

Culturally, it doesn’t feel foreign—at least not in the continent and in other countries like Nigeria, where such practices are largely tolerated.

But beyond all the romance and aesthetics of money bouquet, the CBK’s warning opens up a deeper conversation that we all need to see and discuss about money, regulation, and how physical cash fits into a fintech-driven financial ecosystem.

Why the Central Bank Is Stepping In and Why It Makes Sense

The CBK’s concern about money bouquets is not just a moral one whether it is right or wrong, it is structural one about fiscal matters and movement of cash around the country.

In a formal notice issued ahead of Valentine’s Day, the regulator warned that cash bouquets and ornamental displays damage currency notes and violate the country’s Penal Code.

According to information about the Central Bank of Kenya, practices such as stapling, pinning, taping, spraying, or gluing notes compromise their integrity and shorten their lifespan.

This matters more than it seems on the surface and it's something that needs to be deeply looked into.

Currency is expensive to produce, it cannot simply be reprinted endlessly without cost and effect on the nation's economy.

When notes are damaged, the central bank must withdraw them from circulation and replace them, an expensive process that strains public resources.

A seasonal spike in damaged banknotes, especially during periods of heavy celebration, creates avoidable financial waste.

More importantly, damaged notes do not exist in isolation, if you are aware prior to now, be aware now that it actually disrupts the broader financial system.

Torn, folded, or chemically altered notes interfere with ATMs, cash-counting machines, sorting equipment, and bank processing systems.

In a financial ecosystem increasingly reliant on automation, even small physical damage can cause large operational inefficiencies.

From a fintech perspective, this is critical, banks, payment processors, and cash-handling infrastructure depend on currency that machines can read, sort, and verify.

When cash bouquets flood the system, fintech infrastructure quietly absorbs the cost, through machine errors, rejected deposits, increased maintenance, and downtime.

Also despite the widespread use of digital payments such as M-Pesa and Airtel Money over the past decade, cash is still king in Kenya, with money bouquets emerging as a popular way to gift, a trend that has now caught the regulator’s eye.

The CBK is not banning gift-giving. It is asking for restraint in how physical cash is treated, because money must remain functional as a medium of exchange, a unit of account, and a store of value.

Seen this way, the regulation feels less like overreach and more like preventive maintenance.

Fintech, Digital Alternatives, and the Question We Avoid Asking

What makes this debate even more interesting is that the tools to avoid this problem already exist.

In today’s Africa, we have bank transfers, mobile money, fintech apps, QR payments, and instant peer-to-peer transfers.

If you are paying a vendor to arrange cash, plus gifting the cash itself, why not simply transfer the full amount directly? Because if you ask me, I don't really buy the idea of a money bouquet and the whole fuss about it.

It's just my opinion though, because I know that the sentiment around it still remains and it's actually only the inefficiency disappears.

Culture and behavioral practices do not always move at the speed of technology because they are deeply tied to traditional and analog methods.

Cash bouquets persist because they are visual, tangible, and performative, digital transfers are quiet. They do not trend on Instagram even if you post the transaction receipt.

But as fintech adoption grows, regulators are increasingly forced to reconcile tradition with system sustainability and what is expected in handling cash.

Kenya’s stance signals something larger: as financial systems modernize, emotional expressions involving money will be scrutinized through the lens of infrastructure, cost, and legality.

This stance from the Central Bank of Kenya is not planning to eliminate cash overnight, but it wants to reshape how cash is expected to behave within the system.

Conclusion: Romance Can Be Creative Without Being Costly

The CBK’s warning is not an attack on culture or celebration. It is a reminder that money is not just symbolic, it is infrastructural.

It moves through machines, systems, banks, and digital rails that depend on order and durability.

Love can still be expressed, gifts can still be given. But as Africa’s financial systems mature, some traditions may need reinterpretation rather than abandonment.

Because in a fintech-driven economy, even romance has to coexist with regulation.

So if you're reading this and you're a Kenyan or you have Kenyan friends know and let them know that cash bouquets especially as Valentine draws closer could land them in serious legal trouble.

See you on the next one!

You may also like...

Where is ₦5, ₦10, and ₦20 notes – Could the ₦50 Note Be Next?

Nigerian currency notes—₦5, ₦10, and ₦20—are disappearing due to inflation, rising production costs, changing spending h...

Top Crypto Investment Strategies for 2026

Looking to invest in cryptocurrency in 2026? To stay ahead in the crypto market with these proven investment strategies,...

The 16-Year-Old Who Called Out America on Live TV (and Changed Nigerian Broadcasting Forever)

In 1957, a fearless 16-year-old Nigerian challenged American racism on live TV and went on to redefine broadcasting in N...

The Kenyan Government Is Warning Against Cash Bouquets And Here’s What It’s Really About

Kenya’s Central Bank warns against Valentine’s cash bouquets. Read what this is really about and how damaged currency af...

Plastics and Priviledge: How Two Videos Reveal the Country’s Hidden Fault Lines

Two viral videos, one young man carrying plastics to survive, and a billionaire’s son shocked by fuel prices. This is wh...

Africans Who’ve Made Grammy History

Only a handful of Africans have ever crossed the Grammy line. Here are some Africans who made history at the world’s mos...

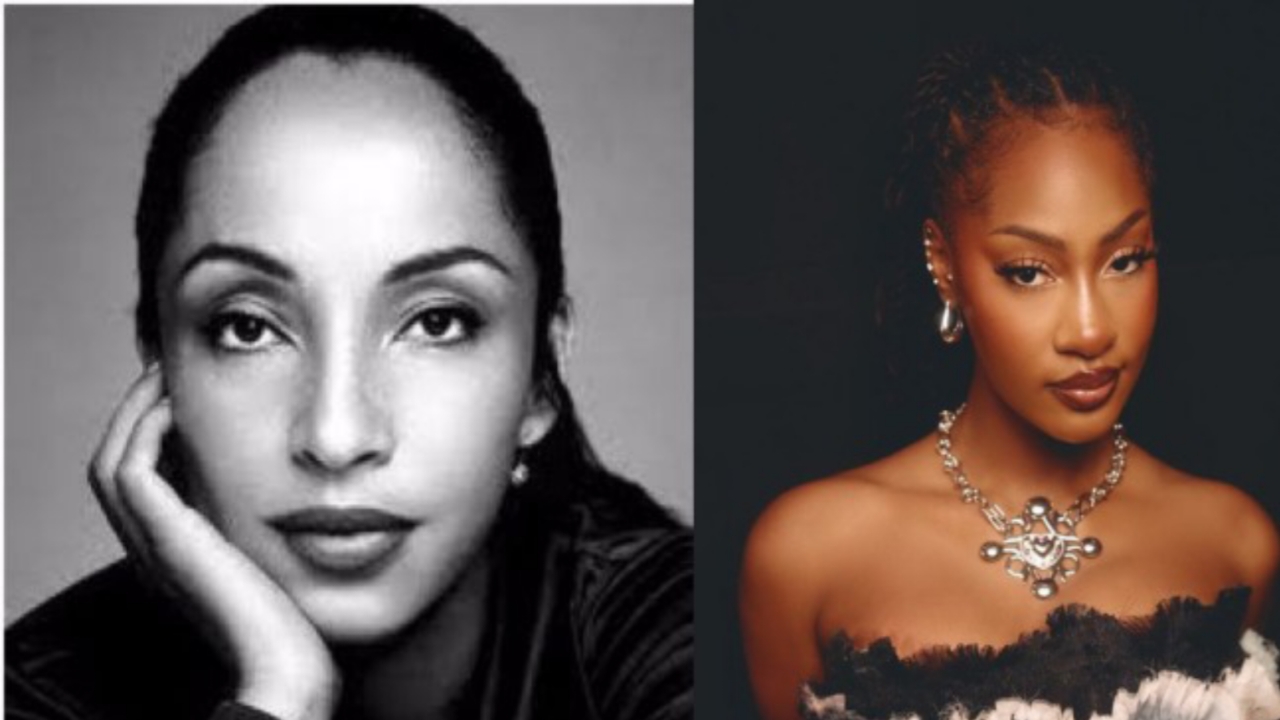

Tems Is Not the First Nigerian Female Artist to Win a Grammy

Tems’ Grammy win made headlines, but a forgotten Nigerian-born icon won decades earlier. Here’s the name most people lea...

Rewind to the Year Nigeria Was Sold in the 1899 Royal Niger Company Deal

In 1899, Britain bought out the Royal Niger Company for £865,000, taking control of territories that would become Nigeri...