Top Crypto Investment Strategies for 2026

Cryptocurrency which started off as a niche interest is now a global financial phenomenon.

But with the market constantly changing, it’s important to know the best ways to invest in 2026.

In this article, some of the top crypto investment strategies that can help you grow your money while managing risk will be explained, so read along.

1. HODLing (Long-Term Holding)

“HODL” is a popular term in the crypto community. It basically meansbuy a coin and hold it for the long term, instead of panicking when prices drop.

It works because many cryptocurrencies like Bitcoin and Ethereum have grown in value over years. Even if the price dips, holding onto your coins can pay off in the long run.

How to do it:

Pick strong, well-known coins like Bitcoin, Ethereum, or Solana.

Don’t try to “time the market”—buy and stay patient.

Keep your coins in a secure wallet, not just on an exchange.

Tip: Think of it like planting a tree, you water it, wait, and eventually, it grows

2. Staking and Earning Passive Income

Did you know your crypto can actually make money while you sleep? That’s what staking and yield farming do.

Staking locks your coins in a blockchain network to help it run, and earn rewards in return.

Yield Farming provides your crypto to DeFi platforms (like a crypto bank) and earn interest.

It’s cool because you get extra coins without selling your original ones.

Tip: Think of it like putting money in a savings account, but with higher rewards (and higher risk).

3. Diversifying Across Different Crypto Sectors

Never put all your eggs in one basket! This old advice is especially true for crypto.

For example, you might invest in Layer-1 blockchains like Ethereum or Avalanche, in Layer-2 solutions like Polygon or Arbitrum, in DeFi platforms like Aave or Uniswap, in NFTs or gaming-related tokens.

Diversification is important because if one coin loses value, your others can balance it out. Diversifying reduces risk and opens doors to new opportunities.

4. Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a strategy where you invest a fixed amount of money regularly, no matter the market price. It is a simple way to invest steadily over time, no matter what the market does.

You can decide an amount you can invest every week or month, you can also buy crypto consistently, regardless of the price.

It works because crypto prices are volatile. DCA helps you avoid buying too much when the price is high or too little when it’s low.

Tip: Think of it as “buying a little every week” rather than trying to guess the perfect moment.

5. Active Trading

If you have more experience, active trading can be another option.Some young investors like the thrill of buying low and selling high in the short term.

Watch crypto prices and charts closely, buy when the price is low, sell when it rises and use stop-loss orders to avoid losing too much money.

Warning: Trading can be risky. It’s easy to make mistakes if you don’t study the market carefully. Only trade with money you can afford to lose.

6. Exploring Emerging Projects

New coins and tokens can sometimes explode in value, but they’re also risky.

To explore new crypto safely, you can research the project’s team and goals, check if the community is active and supportive and avoid hype-driven projects that promise huge returns overnight.

Tip: Only put a small portion of your money into new or experimental coins.

7. Risk Management is Key

No matter which strategy you use, protecting your money is the most important step.

Traders often usetechnical analysis to study charts and predict market trends.

Don’t invest more than you can afford to lose.

Keep most of your money in established coins, and a smaller part in riskier projects.

Use secure wallets instead of leaving coins on exchanges.

Stay informed about laws and taxes in your country.

Remember, smart investing is about patience, research, and avoiding panic.

Conclusion

Whether you choose to HODL, stake, diversify, or trade, the key is to learn, stay safe, and think for the long term.

Crypto isn’t a get-rich-quick scheme, but with smart choices, it can be a valuable part of your financial journey.

Start small, stay curious, and watch your knowledge and maybe your portfolio grow.

You may also like...

Where is ₦5, ₦10, and ₦20 notes – Could the ₦50 Note Be Next?

Nigerian currency notes—₦5, ₦10, and ₦20—are disappearing due to inflation, rising production costs, changing spending h...

Top Crypto Investment Strategies for 2026

Looking to invest in cryptocurrency in 2026? To stay ahead in the crypto market with these proven investment strategies,...

The 16-Year-Old Who Called Out America on Live TV (and Changed Nigerian Broadcasting Forever)

In 1957, a fearless 16-year-old Nigerian challenged American racism on live TV and went on to redefine broadcasting in N...

The Kenyan Government Is Warning Against Cash Bouquets And Here’s What It’s Really About

Kenya’s Central Bank warns against Valentine’s cash bouquets. Read what this is really about and how damaged currency af...

Plastics and Priviledge: How Two Videos Reveal the Country’s Hidden Fault Lines

Two viral videos, one young man carrying plastics to survive, and a billionaire’s son shocked by fuel prices. This is wh...

Africans Who’ve Made Grammy History

Only a handful of Africans have ever crossed the Grammy line. Here are some Africans who made history at the world’s mos...

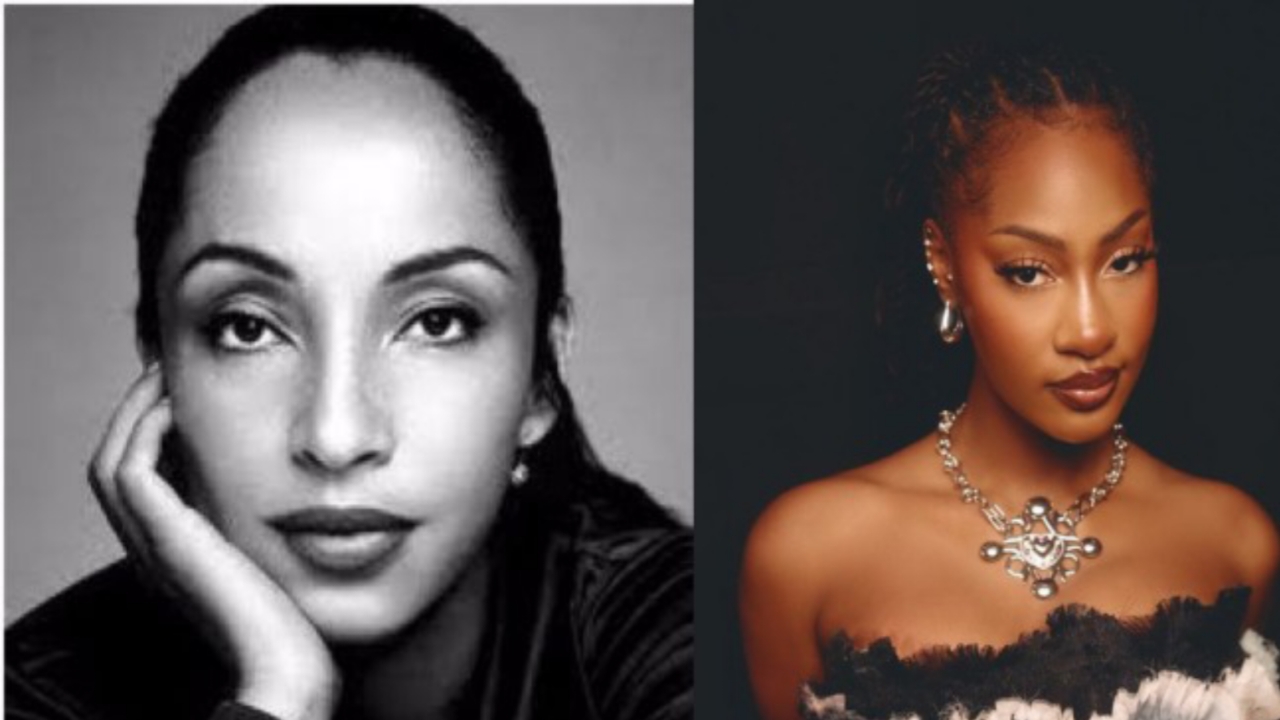

Tems Is Not the First Nigerian Female Artist to Win a Grammy

Tems’ Grammy win made headlines, but a forgotten Nigerian-born icon won decades earlier. Here’s the name most people lea...

Rewind to the Year Nigeria Was Sold in the 1899 Royal Niger Company Deal

In 1899, Britain bought out the Royal Niger Company for £865,000, taking control of territories that would become Nigeri...