West Africa's BRVM Celebrates 29 Years of Anchoring Regional Capital Markets

The Regional Stock Exchange (BRVM), the world’s only fully regional stock exchange, recently marked its 29th anniversary on December 18. Established in 1996, the BRVM operates as a unified capital market for the eight member states of the West African Economic and Monetary Union (WAEMU), offering a single marketplace for both government and corporate financing across the bloc.

Over nearly three decades, the BRVM has consolidated its role as a critical funding channel for WAEMU economies. Governments across the region have relied heavily on the exchange to issue sovereign bonds to finance public expenditures, while private companies have used equity and debt listings to fund expansion, strengthen corporate governance, and enhance regional visibility. This distinctive regional model has played a vital role in pooling savings, harmonizing financial regulations, and deepening financial integration among economies with varying structures and levels of development.

The BRVM has also demonstrated a strong commitment to continuous modernization, aligning its market practices with international standards on transparency, disclosure, and investor protection. These sustained efforts have encouraged greater participation from both domestic and foreign investors, while simultaneously strengthening confidence in the regional financial system.

As it enters its thirtieth year of operation, the BRVM is focused on implementing further reforms aimed at expanding access to capital markets, enhancing support for small and medium-sized enterprises, and reinforcing its position as a strategic instrument for economic integration and long-term development in West Africa. The exchange’s regional structure is particularly significant as WAEMU countries confront rising financing needs for infrastructure development, industrialization, and the energy transition.

By maintaining a single, integrated market, the BRVM effectively reduces market fragmentation, allowing issuers to tap into a much broader pool of regional savings than individual national markets could provide. The exchange is increasingly positioning itself around key future growth themes, including the digitalization of market processes, expanded investor participation, and the development of sustainable finance instruments. These initiatives are intended to attract more private capital, especially long-term institutional investors, while supporting responsible financing aligned with social and environmental priorities. In a context where bank lending is often constrained, capital markets and the BRVM in particular, are expected to play a growing role in financing regional development.

Looking ahead, the central challenge for the BRVM will be converting its institutional stability and broad regional reach into higher liquidity, increased listings, and deeper secondary market activity. Achieving this transition will be critical in determining whether a regional exchange can evolve from a dependable funding platform into a dynamic engine for private-sector growth and shared prosperity across the WAEMU region.

You may also like...

Access or Exclusion? Madagascar’s Visa Increase and the Bigger Picture

Madagascar has tripled its 15-day e-Visa fee amid rising tourism numbers. Read about how visa costs affect travel acces...

How to Make LinkedIn Work for You in 2026

Learn how you can actively use LinkedIn strategically in 2026 by aligning your profile with proven trends, patterns and ...

5 Reasons Why Synthetic Wigs Are Bad for You

Are synthetic wigs safe? Learn the 5 hidden risks, including scalp irritation and hair damage, plus safer alternatives f...

Fela Kuti's Son Ignites Fury with 'Racist Country' Slam Amid Vinicius Jr Controversy

A UEFA Champions League match was disrupted by a racist incident involving Vinicius Jr and Gianluca Prestianni. Seun Kut...

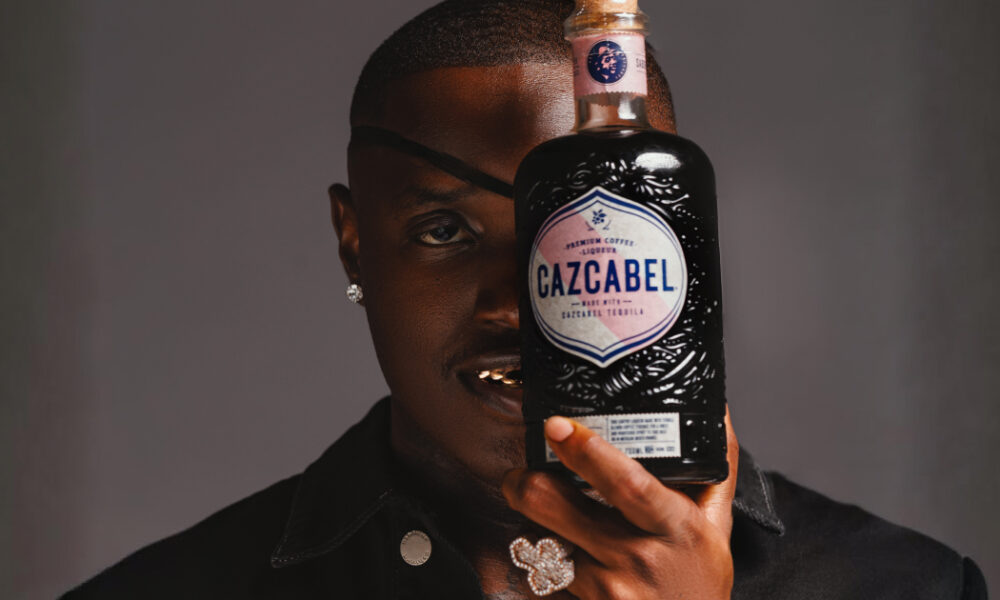

Jaylen Brown Alleges 'Targeted' Shutdown as Beverly Hills Issues Apology

Beverly Hills has apologized to NBA star Jaylen Brown for an inaccurate statement concerning the shutdown of his brand e...

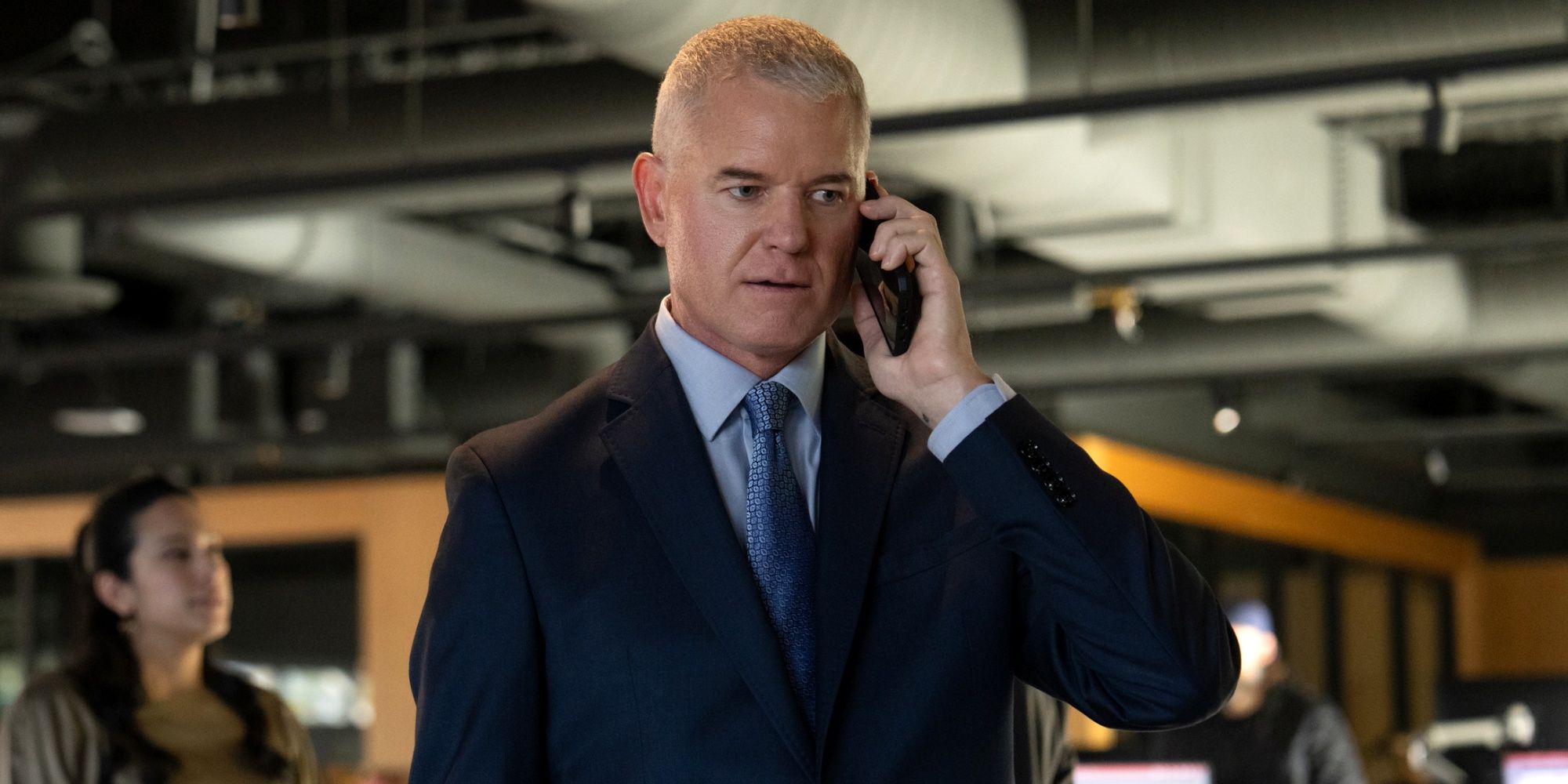

Hollywood Reacts as Tributes Pour In for Veteran Actor Eric Dane

Beloved actor Eric Dane, known for his iconic roles as "McSteamy" in "Grey's Anatomy" and the complex Cal Jacobs in "Eup...

Live54+ Drives Major Consolidation in Africa's Creative Capital Markets

Live54+ has launched to consolidate Africa's fragmented creative industries, uniting East and West African businesses in...

UK to Introduce Digital Visas for Nigerian Travelers by 2026

Nigerian nationals applying for UK visitor visas will transition to a digital eVisa system from February 25, 2026, repla...