Live54+ Drives Major Consolidation in Africa's Creative Capital Markets

The launch of Live54+ marks a shift for Africa’s creative industry.

What was once a culturally powerful but loosely structured sector is now moving toward a consolidated, investment-ready platform.

Headquartered in Nairobi, with coordination hubs in Dubai and Mauritius, Live54+ brings multiple creative businesses under one multinational holding structure focused on scale, governance, and cross-border capital.

The platform unites companies like Swangz Avenue, Buzz Group Africa, and The Quollective, operating across Uganda, Kenya, Tanzania, Rwanda, Ghana, and Burundi.

Unlike sectors such as telecoms and banking that consolidated over the past decade, Africa’s creative economy has largely remained fragmented and founder-led. Live54+ signals a deliberate move to change that.

For investors, the key development is aggregation. Africa’s creative economy — spanning music, media, experiential marketing, and digital content — has historically struggled with informal contracts, scattered revenues, and weak intellectual property structures.

These factors have limited access to private equity, structured debt, and public market participation.

By consolidating operations under unified governance and reporting systems, Live54+ aims to reduce investment risk and improve transparency for institutional capital.

Positioning coordination in Dubai and Mauritius is strategic.

Both are established gateways for African investment flows, offering regulatory clarity and tax efficiency.

Mauritius, in particular, has long served as a trusted entry point for private equity and development finance into sub-Saharan Africa.

This structure suggests Live54+ is building not just an operating company, but an investment-grade platform capable of attracting global capital.

The move reflects broader macroeconomic trends. Africa’s youthful population and rapid urbanization are driving increased demand for media, entertainment, and live experiences.

Yet much of the value generated has either flowed to foreign intermediaries or remained constrained by small-scale national operations.

A consolidated, multi-country platform gives multinational brands a single access point into diverse but coordinated markets — potentially keeping more advertising and intellectual property value within African-owned companies.

There are also labour implications.

A multinational structure introduces standardized contracts, stronger rights management, and better financial oversight.

That could mean more predictable income and stronger intellectual property protection for creatives.

At the same time, it brings corporate performance expectations that may reshape how artists and media professionals operate.

Expansion into Ghana strategically extends Live54+ into the ECOWAS region, linking East and West Africa under one umbrella.

If successful, the model could create one of the first African-owned creative holding companies with true continental scale — capable of negotiating multinational deals and attracting institutional capital similarly to telecoms or fintech firms.

Ultimately, Live54+ signals that Africa’s creative economy may be entering a consolidation phase similar to earlier transformations in financial services and logistics.

The real test will be whether scale translates into predictable earnings, strong intellectual property portfolios, and disciplined governance across multiple jurisdictions.

If it does, Africa’s creative sector could move from being seen primarily as cultural influence to becoming a structured, investable pillar of the continent’s growth story.

Recommended Articles

Nigeria's National Gallery Reveals Artistic Triumphs in 2025

The National Gallery of Art (NGA) had a transformative 2025, revitalizing Nigeria's national art collection and strength...

Bitcoin Rockets Past $71,000 as Institutional Investors Flood the Market

Bitcoin surges past $71,000 as institutional investors take advantage of a pullback below $70,000. Retail traders remain...

Egypt Unleashes Financial Future with Landmark Derivatives Market Launch

Egypt has officially launched its financial derivatives market, with the Egyptian Exchange (EGX) receiving its first lic...

Thailand Unleashes Crypto Future: Bitcoin ETFs & Futures Rules Set for Early 2026 Launch

Thailand is poised to become a crypto-friendly financial hub in Asia, with regulators finalizing new rules by early 2026...

Trump's AI Voice Stars in Fannie Mae Ad: A New Era of Permissioned Deepfakes

President Trump’s voice was AI-cloned for a Fannie Mae ad promoting housing access, highlighting a new era of permis...

You may also like...

Fela Kuti's Son Ignites Fury with 'Racist Country' Slam Amid Vinicius Jr Controversy

A UEFA Champions League match was disrupted by a racist incident involving Vinicius Jr and Gianluca Prestianni. Seun Kut...

Jaylen Brown Alleges 'Targeted' Shutdown as Beverly Hills Issues Apology

Beverly Hills has apologized to NBA star Jaylen Brown for an inaccurate statement concerning the shutdown of his brand e...

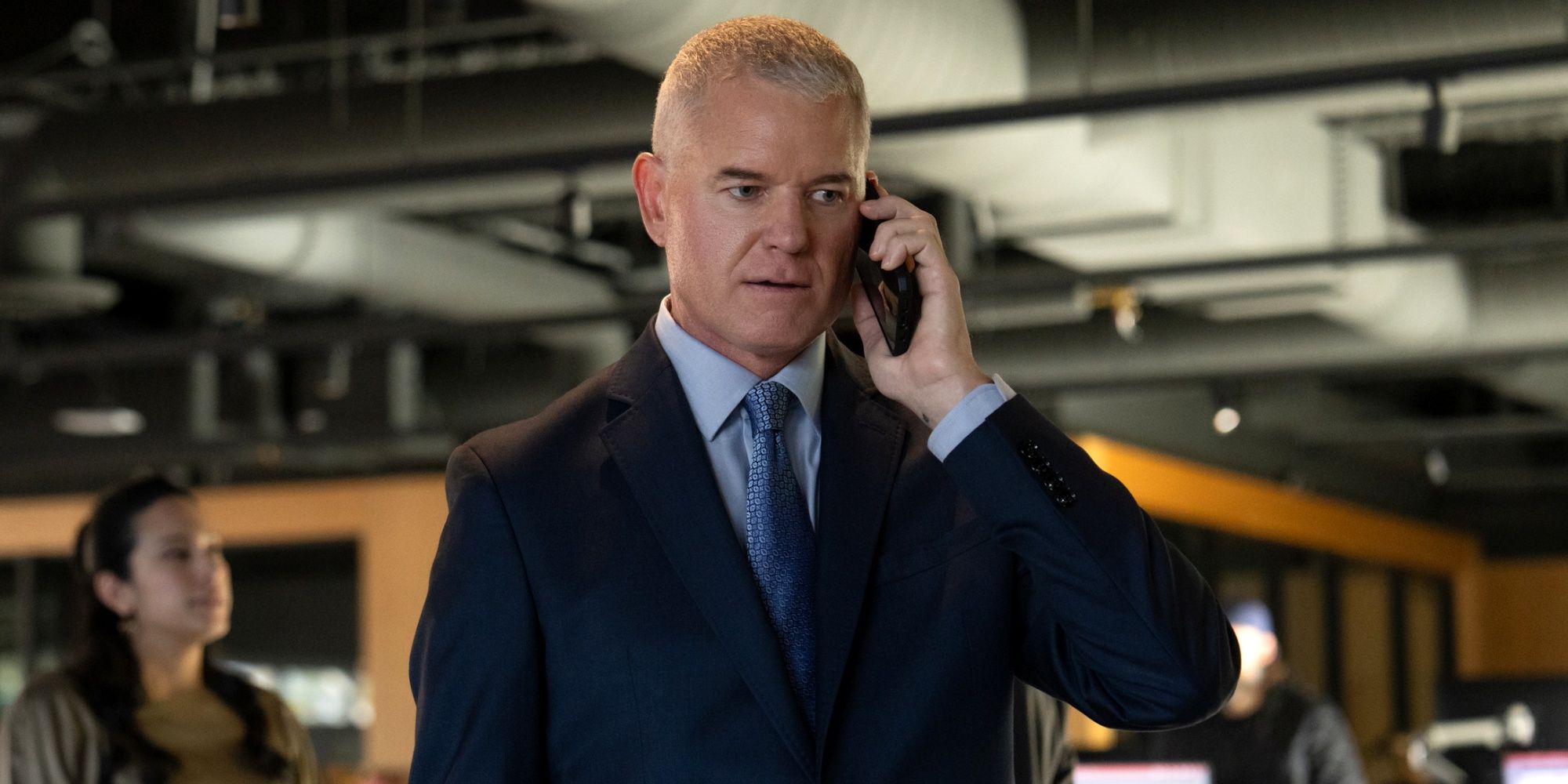

Hollywood Reacts as Tributes Pour In for Veteran Actor Eric Dane

Beloved actor Eric Dane, known for his iconic roles as "McSteamy" in "Grey's Anatomy" and the complex Cal Jacobs in "Eup...

Live54+ Drives Major Consolidation in Africa's Creative Capital Markets

Live54+ has launched to consolidate Africa's fragmented creative industries, uniting East and West African businesses in...

UK to Introduce Digital Visas for Nigerian Travelers by 2026

Nigerian nationals applying for UK visitor visas will transition to a digital eVisa system from February 25, 2026, repla...

Uganda Airlines Faces Scrutiny as Officials Warn of Tourism Impact

Ugandan government officials are raising alarms over negative publicity surrounding Uganda Airlines, warning it's causin...

Nigeria's Fintech Future Unveiled: Exploring Digital Finance Horizons

Nigeria's fintech sector, despite significant growth and over 500 startups, faces major obstacles including regulatory u...

Nvidia's Strategic Strike: Tech Giant Fuels India's AI Startup Boom

Nvidia is significantly boosting its engagement with India's early-stage AI startups through new partnerships with firms...