Egypt Unleashes Financial Future with Landmark Derivatives Market Launch

Egypt has formally launched its financial derivatives market, a significant structural shift for the nation's capital markets, with the Egyptian Exchange (EGX) receiving its inaugural license to trade futures contracts linked to locally listed securities. This landmark development, announced on January 29, 2026, by Daba Finance/Egypt, aims to provide enhanced risk management tools, modernize Egypt’s financial landscape, and align it with global market standards.

The introduction of derivatives trading will be implemented in a carefully planned four-phase rollout, beginning in March. The initial phase will focus on futures contracts based on the EGX30 index, providing portfolio managers with crucial instruments to hedge exposure during periods of market volatility. Subsequently, the second phase will see the introduction of futures on the EGX70 index. The market will then expand further in the third phase to include futures on individual stocks, before culminating in the final phase with the addition of options contracts on both stocks and indices.

According to the Financial Regulatory Authority (FRA), this strategic move is an integral part of a broader initiative to rejuvenate Egypt's capital markets. The objective is to diversify the range of investment instruments available and significantly improve risk management capabilities for investors. Derivatives, such as futures and options, enable investors to manage risk or gain market exposure without directly owning the underlying asset, making them vital tools in global financial markets.

The launch positions Egypt among a growing number of emerging markets in the Middle East and Africa that are actively developing onshore derivatives trading. Until now, Egyptian investors had limited options for managing market risk, primarily relying on cash equities. The availability of futures on major indices is expected to allow for more effective hedging, particularly in a market that has experienced notable swings due to factors like currency devaluations, inflation, and shifting foreign capital flows.

For the Egyptian Exchange itself, the derivatives market is anticipated to stimulate increased trading volumes and attract a wider array of institutional investors, both local and international. However, the success of this initiative hinges on robust supervision. Derivatives, by their nature, can amplify both leverage and potential losses if misused. Therefore, rigorous margin rules, comprehensive transparency, and strong clearing mechanisms will be paramount to ensure the stability and integrity of the new market. If executed effectively, this derivatives market has the potential to elevate the EGX's regional competitiveness and integrate Egypt more closely with established global financial market practices.

You may also like...

How to Make LinkedIn Work for You in 2026

Learn how you can actively use LinkedIn strategically in 2026 by aligning your profile with proven trends, patterns and ...

5 Reasons Why Synthetic Wigs Are Bad for You

Are synthetic wigs safe? Learn the 5 hidden risks, including scalp irritation and hair damage, plus safer alternatives f...

Fela Kuti's Son Ignites Fury with 'Racist Country' Slam Amid Vinicius Jr Controversy

A UEFA Champions League match was disrupted by a racist incident involving Vinicius Jr and Gianluca Prestianni. Seun Kut...

Jaylen Brown Alleges 'Targeted' Shutdown as Beverly Hills Issues Apology

Beverly Hills has apologized to NBA star Jaylen Brown for an inaccurate statement concerning the shutdown of his brand e...

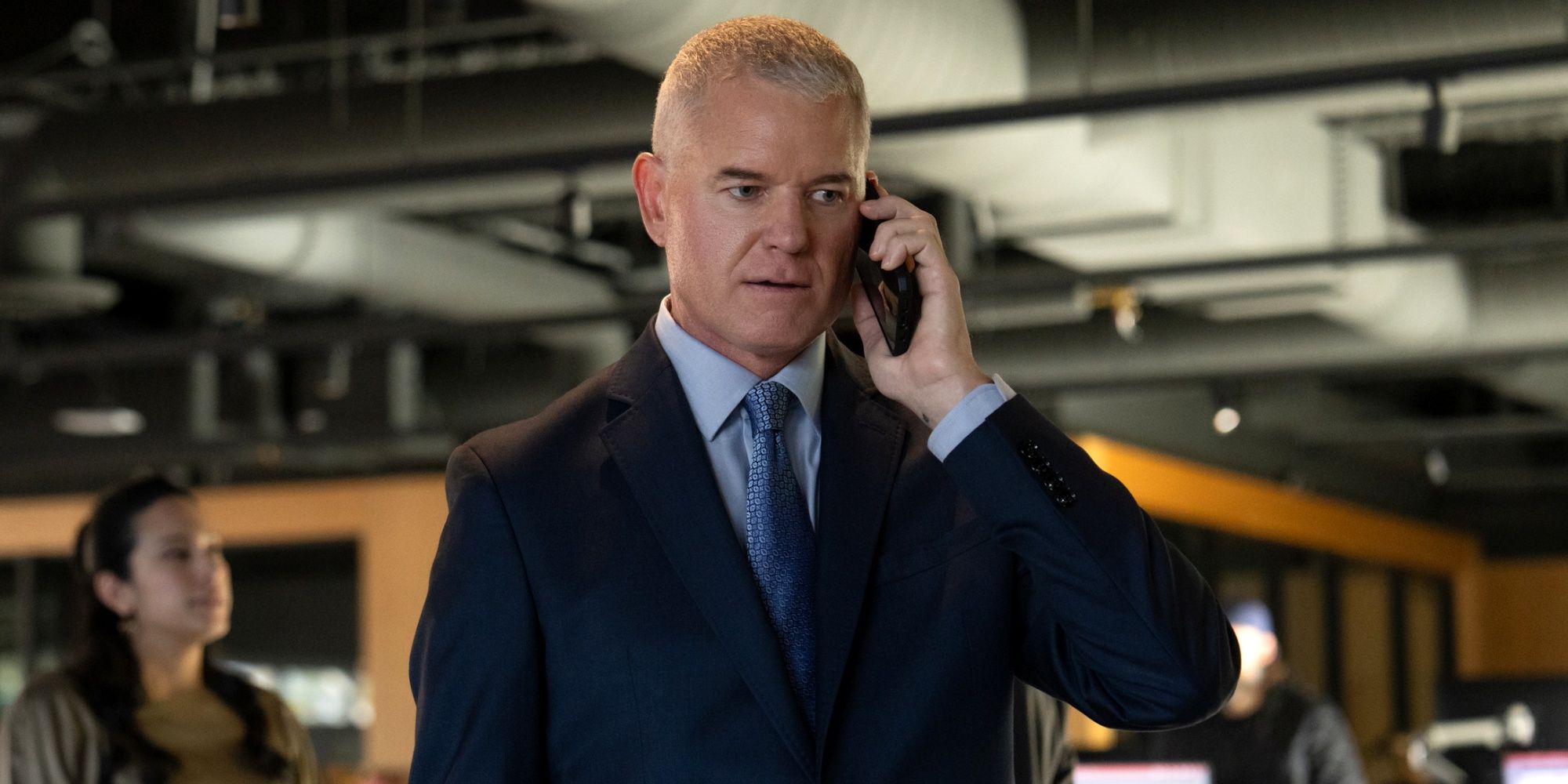

Hollywood Reacts as Tributes Pour In for Veteran Actor Eric Dane

Beloved actor Eric Dane, known for his iconic roles as "McSteamy" in "Grey's Anatomy" and the complex Cal Jacobs in "Eup...

Live54+ Drives Major Consolidation in Africa's Creative Capital Markets

Live54+ has launched to consolidate Africa's fragmented creative industries, uniting East and West African businesses in...

UK to Introduce Digital Visas for Nigerian Travelers by 2026

Nigerian nationals applying for UK visitor visas will transition to a digital eVisa system from February 25, 2026, repla...

Uganda Airlines Faces Scrutiny as Officials Warn of Tourism Impact

Ugandan government officials are raising alarms over negative publicity surrounding Uganda Airlines, warning it's causin...