Thailand Opens Doors for Crypto Derivatives: Bitcoin Gains Regulatory Legitimacy

Thailand is making major strides to integrate digital assets into its regulated financial markets. The Cabinet recently approved a proposal allowing cryptocurrencies and tokens to serve as underlying assets in derivatives and capital markets. This landmark decision recognizes digital assets as a legitimate asset class, moving beyond their traditional speculative role and reshaping the country’s financial landscape.

Nirun Fuwattananukul, CEO of Binance Thailand, hailed the move as a “watershed moment” for Thailand’s capital markets. Speaking to the Bangkok Post, he stated that the decision “sends a strong signal that Thailand is positioning itself as a forward-looking leader in Southeast Asia’s digital economy,” signaling ambition to become a key player in the regional digital asset ecosystem.

Under the new framework, the Securities and Exchange Commission (SEC) will amend the Derivatives Trading Act to formally recognize digital assets as reference instruments for derivatives contracts.

This allows licensed operators to offer crypto-linked contracts, such as futures and options, under stringent regulatory oversight. SEC Secretary-General Pornanong Budsaratragoon explained that the move supports emerging asset classes, strengthens portfolio diversification, and improves investor risk management strategies.

The SEC is also developing detailed rules and licensing frameworks for derivatives brokers, exchanges, and clearinghouses to ensure safe handling of crypto-based products. Collaborating with the Thailand Futures Exchange (TFEX), the SEC aims to finalize contract specifications aligned with both the risk profile and practical trading of digital assets.

Beyond cryptocurrencies, the amendments reclassify carbon credits as “goods” rather than variables, enabling physically delivered carbon credit futures in addition to cash-settled contracts. This aligns with Thailand’s climate initiatives and carbon neutrality commitments under the draft Climate Change Act.

Thailand is further solidifying its position as a regional bitcoin hub by rolling out regulatory frameworks for bitcoin ETFs, futures trading, and tokenized investment products. Investors may allocate up to 4–5% of diversified portfolios to crypto ETFs trading on the Stock Exchange of Thailand, offering exposure without directly holding digital currencies. Following approval of its first spot bitcoin ETF in 2024, Thailand plans to expand offerings to ether and diversified crypto baskets, establishing a robust legal foundation for digital assets in the region.

You may also like...

Access or Exclusion? Madagascar’s Visa Increase and the Bigger Picture

Madagascar has tripled its 15-day e-Visa fee amid rising tourism numbers. Read about how visa costs affect travel acces...

How to Make LinkedIn Work for You in 2026

Learn how you can actively use LinkedIn strategically in 2026 by aligning your profile with proven trends, patterns and ...

5 Reasons Why Synthetic Wigs Are Bad for You

Are synthetic wigs safe? Learn the 5 hidden risks, including scalp irritation and hair damage, plus safer alternatives f...

Fela Kuti's Son Ignites Fury with 'Racist Country' Slam Amid Vinicius Jr Controversy

A UEFA Champions League match was disrupted by a racist incident involving Vinicius Jr and Gianluca Prestianni. Seun Kut...

Jaylen Brown Alleges 'Targeted' Shutdown as Beverly Hills Issues Apology

Beverly Hills has apologized to NBA star Jaylen Brown for an inaccurate statement concerning the shutdown of his brand e...

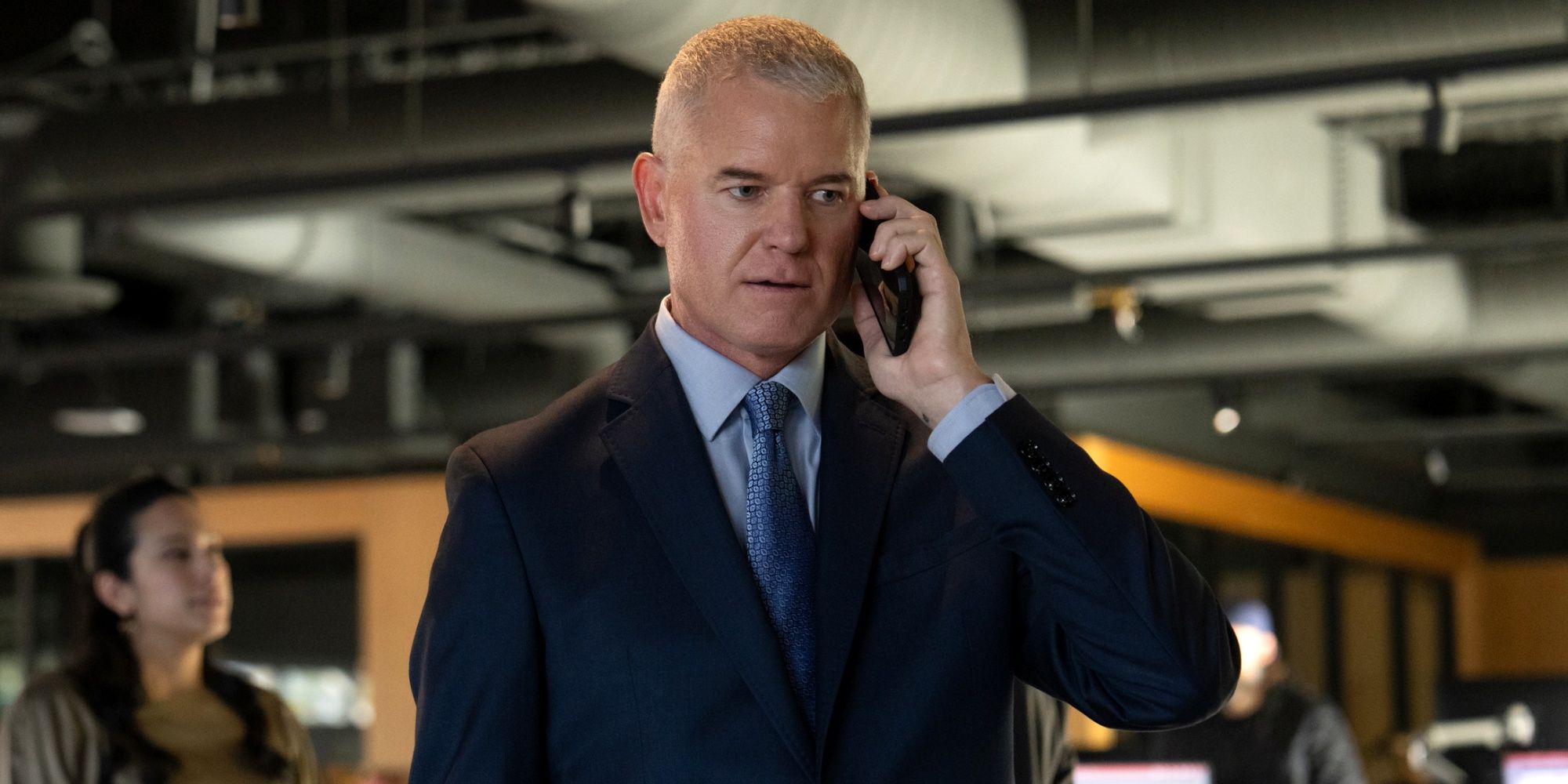

Hollywood Reacts as Tributes Pour In for Veteran Actor Eric Dane

Beloved actor Eric Dane, known for his iconic roles as "McSteamy" in "Grey's Anatomy" and the complex Cal Jacobs in "Eup...

Live54+ Drives Major Consolidation in Africa's Creative Capital Markets

Live54+ has launched to consolidate Africa's fragmented creative industries, uniting East and West African businesses in...

UK to Introduce Digital Visas for Nigerian Travelers by 2026

Nigerian nationals applying for UK visitor visas will transition to a digital eVisa system from February 25, 2026, repla...