IPO Alert: Gourmet Egypt Gears Up for EGX Listing via Secondary Sale

Gourmet Egypt, a prominent food producer and distributor under the control of B Investments Holding, is preparing for a significant listing on the Egyptian Exchange (EGX). This strategic move will take the form of a secondary share sale, with B Investments and other existing shareholders collectively offering up to 190.51 million shares. These shares represent approximately 47.6% of Gourmet Egypt’s total issued share capital, a substantial offering designed to bring new life to Egypt's equity market.

Following the successful completion of the listing, B Investments Holding plans to retain a considerable 40% stake in Gourmet Egypt. This continued significant ownership signals B Investments' ongoing commitment to the company's future performance and long-term growth. The Initial Public Offering (IPO) itself will be structured into two distinct tranches to cater to a broad range of investors. The first is a private placement, specifically targeting qualified investors within Egypt. The second tranche is a public offering, which will be accessible to retail investors, broadening participation. Both tranches are slated to be priced identically, with the final share price to be determined through a comprehensive book-building process.

Gourmet Egypt is currently in the process of securing the necessary approvals from the Financial Regulatory Authority and the Egyptian Exchange. Subject to receiving these regulatory clearances, trading of the company's shares on the EGX is anticipated to commence in February 2026. The company itself operates robustly within Egypt’s branded food segment, focusing on the production and distribution of packaged food products specifically for the local market.

This planned listing arrives at a crucial time, adding to a growing pipeline of consumer-focused IPOs as Egypt actively endeavors to revive and stimulate activity on its stock exchange. A key takeaway from Gourmet Egypt’s planned listing is its reflection of a renewed interest in Egypt’s equity market, particularly after several years characterized by thin IPO activity. The decision to opt for a secondary sale allows existing shareholders to effectively reduce their exposure without necessitating the raising of new capital by the company or diluting its existing share base.

The chosen structure of the IPO also strongly suggests a robust confidence in investor demand, particularly for businesses within the consumer and food sectors. These sectors are often perceived as offering more predictable cash flows compared to more cyclical industries. A significant aspect to monitor will be the level of retail participation, given that domestic investors have demonstrated caution recently amidst prevailing inflation and currency volatility. By retaining a 40% stake, B Investments ensures its continued alignment with Gourmet Egypt’s future trajectory, while simultaneously increasing the free float and enhancing liquidity on the exchange.

For the Egyptian Exchange, this deal represents a significant step forward in its efforts to diversify sector representation and to attract both local and institutional capital. If the IPO is completed as scheduled, it holds the potential to establish a vital benchmark for pricing and execution, which could guide other private companies contemplating listings in 2026. Conversely, a successful outcome would unequivocally signal improving confidence in Egypt’s public markets, whereas weak demand could potentially delay similar transactions currently in the pipeline.

Recommended Articles

Egypt Unleashes Financial Future with Landmark Derivatives Market Launch

Egypt has officially launched its financial derivatives market, with the Egyptian Exchange (EGX) receiving its first lic...

Egypt's Stock Market Poised for Boom: 2026 to See Startup Listing Spree!

The Egyptian Exchange (EGX) is gearing up for a strong 2026, with plans to list eight new companies, primarily in the me...

Anthropic's Meteoric Rise: $380B Valuation Fuels Intense AI Race Against OpenAI

Artificial intelligence firm Anthropic has announced a $380 billion valuation, joining OpenAI and SpaceX as a top startu...

xAI Exodus: Half of Founding Team Jumps Ship, Musk Hints at Internal Push

xAI is facing a significant exodus of talent, including six co-founders and multiple engineers, as the company prepares ...

Talent Drain at xAI: Fifth Founding Member Departs as Pressure Mounts Ahead of IPO

Elon Musk’s xAI faces mounting pressure after its fifth founding member departs, raising concerns over leadership stab...

You may also like...

Access or Exclusion? Madagascar’s Visa Increase and the Bigger Picture

Madagascar has tripled its 15-day e-Visa fee amid rising tourism numbers. Read about how visa costs affect travel acces...

How to Make LinkedIn Work for You in 2026

Learn how you can actively use LinkedIn strategically in 2026 by aligning your profile with proven trends, patterns and ...

5 Reasons Why Synthetic Wigs Are Bad for You

Are synthetic wigs safe? Learn the 5 hidden risks, including scalp irritation and hair damage, plus safer alternatives f...

Fela Kuti's Son Ignites Fury with 'Racist Country' Slam Amid Vinicius Jr Controversy

A UEFA Champions League match was disrupted by a racist incident involving Vinicius Jr and Gianluca Prestianni. Seun Kut...

Jaylen Brown Alleges 'Targeted' Shutdown as Beverly Hills Issues Apology

Beverly Hills has apologized to NBA star Jaylen Brown for an inaccurate statement concerning the shutdown of his brand e...

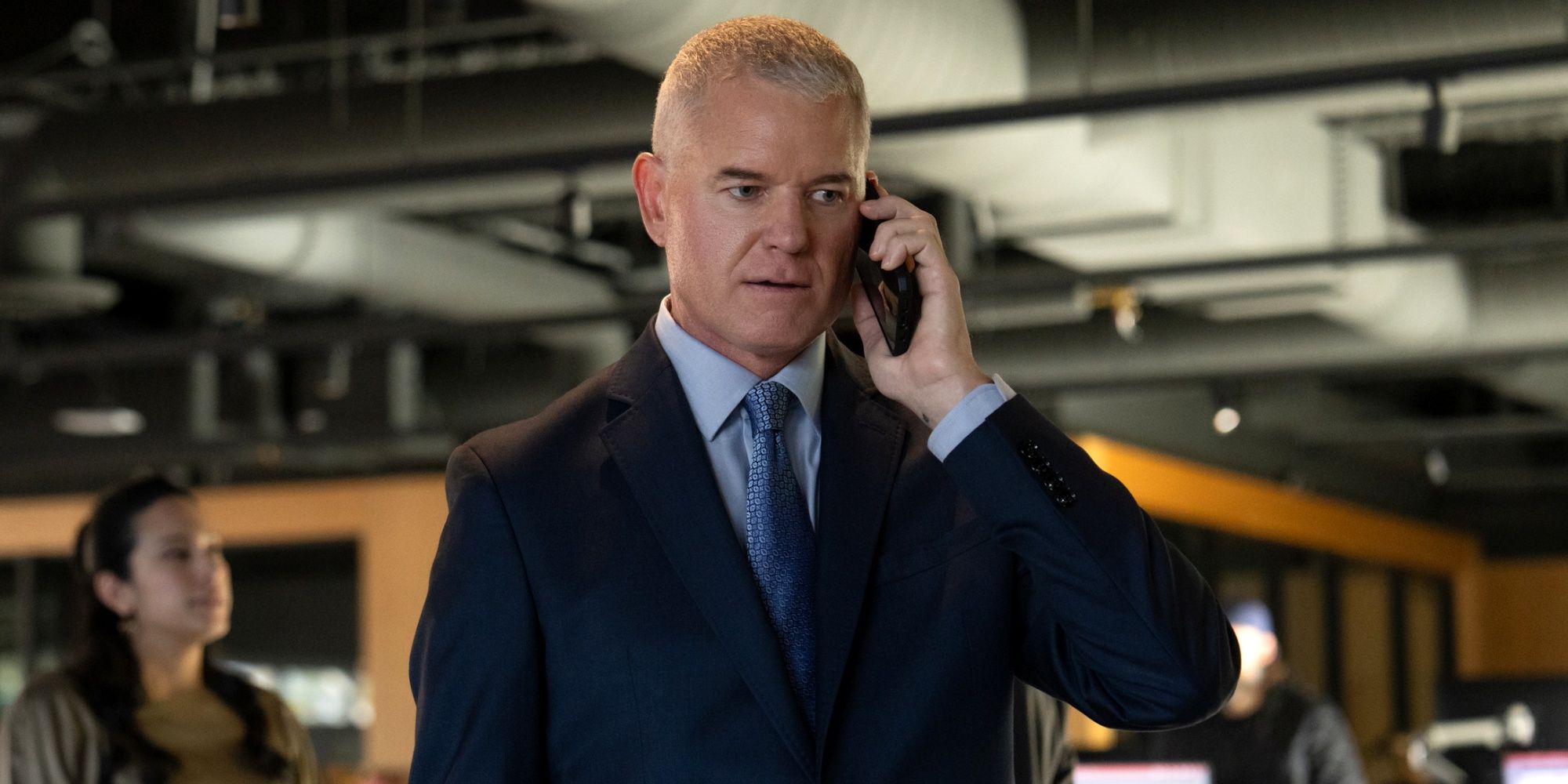

Hollywood Reacts as Tributes Pour In for Veteran Actor Eric Dane

Beloved actor Eric Dane, known for his iconic roles as "McSteamy" in "Grey's Anatomy" and the complex Cal Jacobs in "Eup...

Live54+ Drives Major Consolidation in Africa's Creative Capital Markets

Live54+ has launched to consolidate Africa's fragmented creative industries, uniting East and West African businesses in...

UK to Introduce Digital Visas for Nigerian Travelers by 2026

Nigerian nationals applying for UK visitor visas will transition to a digital eVisa system from February 25, 2026, repla...