Anthropic's Meteoric Rise: $380B Valuation Fuels Intense AI Race Against OpenAI

Artificial intelligence company Anthropic has officially declared a valuation of $380 billion, solidifying its standing among the world's most valuable startups. This places Anthropic in a highly watched trio alongside rival OpenAI and Elon Musk's SpaceX, as investors keenly anticipate whether these tech giants will pursue initial public offerings (IPOs) on Wall Street this year. According to Angelo Bochanis, an associate at Renaissance Capital, these three companies represent the most significant potential public listings for the year.

Anthropic, renowned for its advanced chatbot Claude, confirmed its increased valuation following a recent funding round that successfully secured $30 billion. This substantial investment was primarily spearheaded by Singapore’s sovereign wealth fund GIC and the U.S.-based investment firm Coatue, complemented by contributions from numerous other major investors. A notable portion of this funding also includes part of the $15 billion commitment from Nvidia and Microsoft, initially announced in November. As part of this strategic alliance, Anthropic is committed to procuring approximately $30 billion worth of computing capacity from Microsoft, essential for the development and operation of its sophisticated AI systems like Claude. Further reinforcing its robust backing, Anthropic has also received significant support from prominent cloud providers Amazon and Google.

Krishna Rao, Anthropic's chief financial officer, stated that the influx of investments would be strategically deployed to continue the development of "enterprise-grade products" and to enhance its cutting-edge AI models. Renaissance Capital's assessment places Anthropic as the third most valuable private firm globally, trailing behind OpenAI, the creator of ChatGPT, which boasts a valuation of $500 billion. Both San Francisco-based AI powerhouses are positioned below rocket manufacturer SpaceX, which recently integrated with Elon Musk’s AI startup xAI, responsible for the Grok chatbot.

Despite its impressive valuation and rapid growth trajectory, Anthropic is not yet a profitable entity. However, the company announced on Thursday that it is projected to achieve sales of $14 billion over the next year. This represents an exceptionally swift ascent from its inception, noting that the company generated its "first dollar in revenue" less than three years ago. While OpenAI has diversified its revenue strategies, including venturing into digital advertising, Anthropic has focused its Claude products on serving as a dedicated workplace assistant, adept at tasks such as software engineering.

Anthropic was founded in 2021 by former employees of OpenAI. Dario Amodei, co-founder and CEO, has consistently emphasized a clear commitment to ensuring the safety of artificial general intelligence (AGI), a technology that both San Francisco firms are striving to develop and which is expected to surpass human-level capabilities. In a related development this week, Anthropic also unveiled a new $20 million bipartisan organization, established with the explicit aim of influencing AI regulation within the United States.

The broader commercial potential of large language models in AI became widely apparent with OpenAI's release of ChatGPT in late 2022, demonstrating their capability to assist with tasks such as email composition, computer coding, and question answering. Anthropic subsequently launched its initial version of Claude in 2023. The race to be the first among these leading AI firms to conduct an initial public offering presents a significant advantage, as highlighted by Bochanis, offering "an opportunity to raise even more money" and "to be a big headline and get that sort of boost to your public image." However, going public also entails considerable risks, primarily the necessity to open their business models to public scrutiny, especially as they continue to operate at a loss. Bochanis noted the contrast with private markets, where "dozens of billions of dollars" have been invested, leading to multiplying valuations, but warned that "with public markets, there’s going to be a little more scrutiny. A single earnings report could tank a stock."

You may also like...

Title Race Shocker: Rodri's FA Showdown Could Gift Arsenal Premier League Advantage!

)

Manchester City midfielder Rodri faces an FA misconduct charge for comments implying referee bias after a match against ...

Blockbuster Transfer Alert: Haaland's Real Madrid Move Hinges on One Crucial Condition!

)

Erling Haaland is reportedly open to a sensational move to Real Madrid, but only if Jürgen Klopp is appointed as the clu...

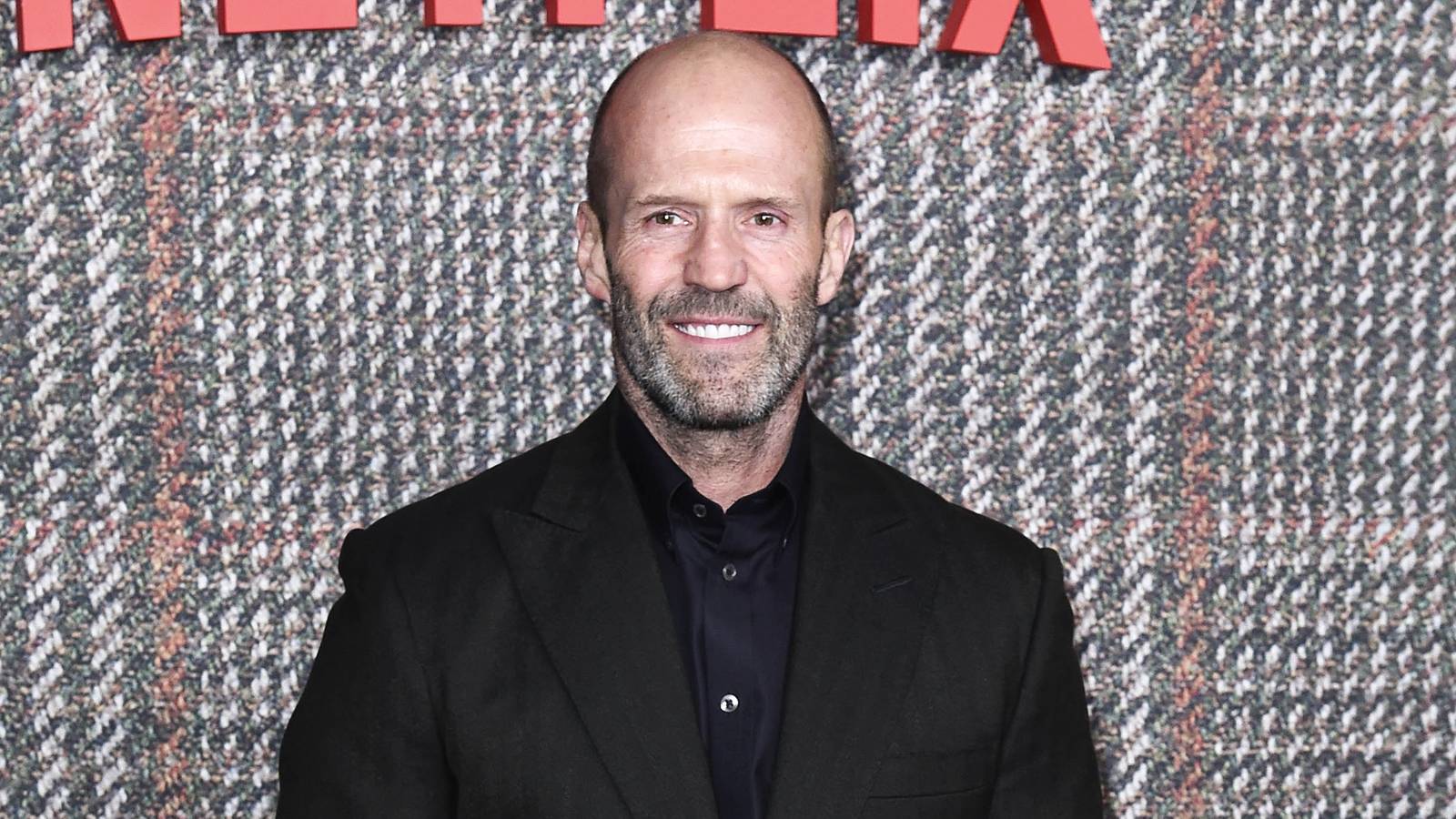

Statham Unleashed: Action Icon Plays Himself in Meta Comedy from 'Bullet Train' Director!

Despite a challenging start to the year with his film "Shelter," Jason Statham is set to reunite with director David Lei...

Mandalorian & Grogu Saga Expands: Jon Favreau Drops Epic New Chapter!

Star Wars continues its rich tradition of merchandise tie-ins with a new launch for <i>The Mandalorian and Grogu</i>, pr...

Motown Legacy Shattered: Family Betrayed by New Sylvia Moy Biography!

A new biography, "It’s No Wonder: The Life and Times of Motown’s Legendary Songwriter Sylvia Moy," explores the acclaime...

Rap Queens Clash: BIA Fires Back in Fiery Cardi B Feud!

The feud between rappers BIA and Cardi B has intensified following Cardi B's performance of a diss track on her 'Little ...

AI Exodus: Why Key Minds Are Abandoning OpenAI and xAI

The AI industry is currently facing a significant talent exodus, with major shakeups at companies like xAI and OpenAI. H...

AI Tremors Shake Wall Street: Market Recovers from Tech-Induced Slump

U.S. stocks steadied on Friday, buoyed by an encouraging inflation report that hinted at potential Federal Reserve inter...