AI Tremors Shake Wall Street: Market Recovers from Tech-Induced Slump

U.S. stock markets stabilized on Friday, showing resilience after a week marked by anxieties over how artificial intelligence (AI) technology might reshape industries and concerns about inflation. The S&P 500 closed with a minimal gain, recovering from one of its most significant drops since Thanksgiving. The Dow Jones Industrial Average saw a slight increase, while the Nasdaq composite experienced a modest dip. Contributing to this stability was a decrease in Treasury yields, spurred by an encouraging inflation report that indicated a greater slowdown than economists had anticipated.

The report revealed that U.S. consumers faced an overall cost of living 2.4% higher than a year prior for goods like groceries and clothing. While this figure remains above the Federal Reserve's 2% target, it represented an improvement from December's 2.7% rate. More importantly, an underlying measure of inflation, which analysts consider a stronger indicator of future trends, receded to its lowest level in nearly five years. This development, as noted by Brian Jacobsen of Annex Wealth Management, suggests that while inflation is currently elevated, it is not a permanent state.

Beyond providing relief to households grappling with living costs, a deceleration in inflation could grant the Federal Reserve greater flexibility to implement interest rate cuts if deemed necessary. Although the Fed has paused rate reductions, there is a widespread expectation that cuts will resume later in the year. Such measures typically stimulate the economy and bolster stock prices. The primary concern for the Fed in cutting rates is the potential to reignite inflationary pressures. Nevertheless, the economy appears to be in a more favorable position than at the close of 2025, buoyed by both slowing inflation and a job market that surpassed economists' expectations last month.

On Wall Street, certain company stocks that had been targeted as potential casualties of AI disruption saw a recovery. AppLovin, for instance, had lost nearly a fifth of its value on Thursday despite reporting stronger-than-expected profits. Investors had worried that AI-powered competitors could erode its customer base and fundamentally alter its industry. On Friday, AppLovin rebounded with a 6.4% gain. Similarly, trucking and freight companies, which tumbled on Thursday after Algorhythm Holdings claimed its AI platform could significantly scale freight volumes without proportional increases in operational headcount, also saw improvements. C.H. Robinson Worldwide, after a 14.5% fall, rose 4.9% on Friday.

These aggressive and swift reactions to perceived AI threats have been a recent market trend, with analysts likening it to a "shoot first, ask questions later" approach. Conversely, some companies thrived from the AI narrative. Applied Materials emerged as the most significant positive force on the S&P 500, climbing 8.1% after reporting better-than-expected quarterly profits. CEO Gary Dickerson attributed this success to the "acceleration of industry investments in AI computing."

However, not all companies enjoyed an upturn. DraftKings experienced a 13.5% decline, despite its latest quarterly profit exceeding analysts' forecasts, due to a revenue forecast for the year that fell short of expectations. Norwegian Cruise Line Holdings shares dropped 7.6% following the announcement of a new CEO, John Chidsey, replacing Harry Sommer, just weeks before its quarterly results are due. The heaviest drag on the overall market was Nvidia, which fell 2.2%, reflecting its substantial weight on the S&P 500 as the largest stock on Wall Street.

In summary, the S&P 500 added 3.41 points to close at 6,836.17, concluding its poorest weekly performance since November. The Dow Jones Industrial Average increased by 48.95 points to 49,500.93, while the Nasdaq composite decreased by 50.48 points to 22,546.67. In the bond market, the yield on the 10-year Treasury note fell to 4.05% from 4.09%, and the two-year Treasury yield, a closer proxy for Fed action expectations, declined more sharply to 3.40% from 3.47%.

Internationally, stock markets in Asia generally declined, with Hong Kong's Hang Seng dropping 1.7% and Japan's Nikkei 225 falling 1.2%. European markets presented a more mixed picture.

You may also like...

Title Race Shocker: Rodri's FA Showdown Could Gift Arsenal Premier League Advantage!

)

Manchester City midfielder Rodri faces an FA misconduct charge for comments implying referee bias after a match against ...

Blockbuster Transfer Alert: Haaland's Real Madrid Move Hinges on One Crucial Condition!

)

Erling Haaland is reportedly open to a sensational move to Real Madrid, but only if Jürgen Klopp is appointed as the clu...

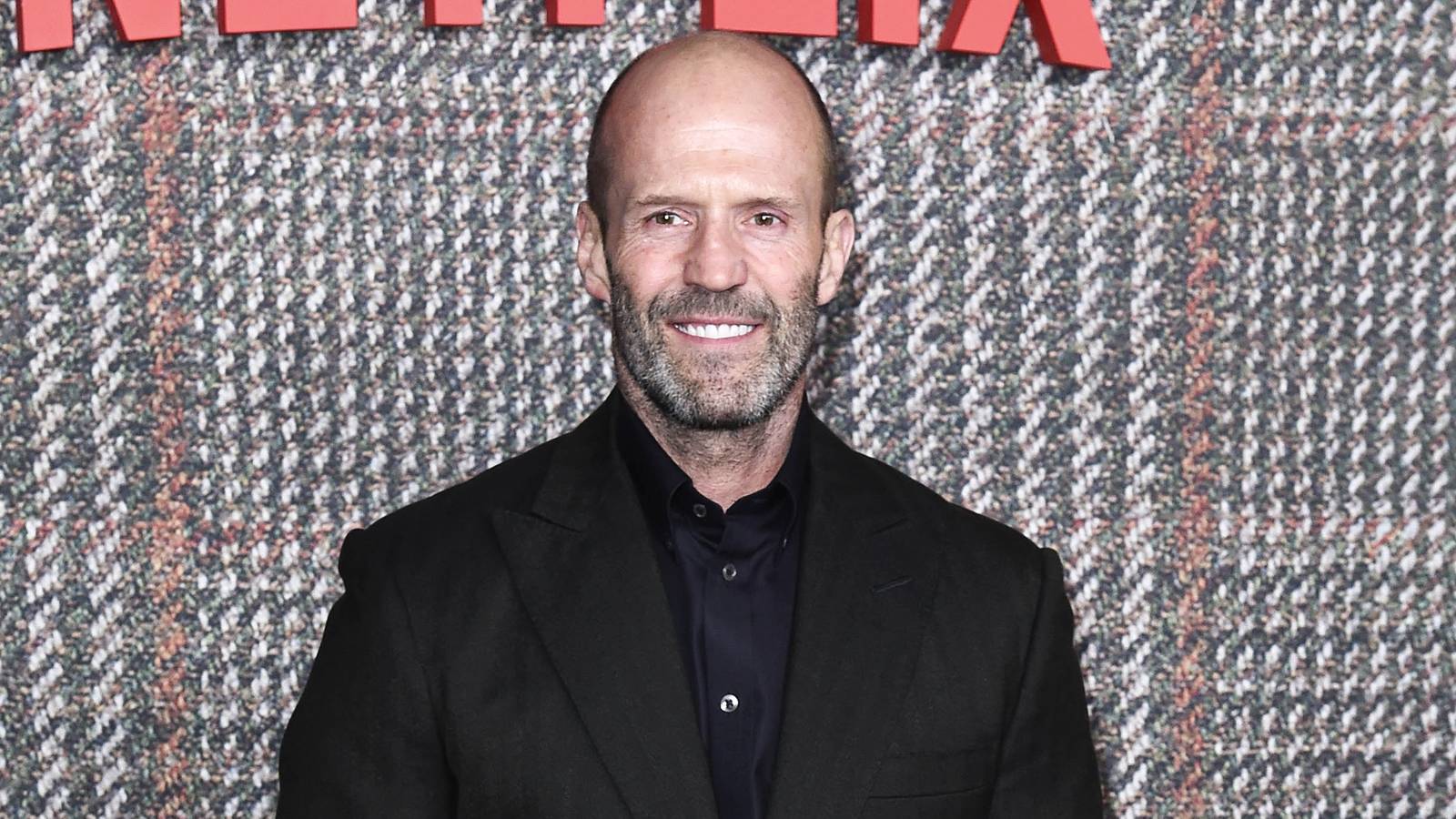

Statham Unleashed: Action Icon Plays Himself in Meta Comedy from 'Bullet Train' Director!

Despite a challenging start to the year with his film "Shelter," Jason Statham is set to reunite with director David Lei...

Mandalorian & Grogu Saga Expands: Jon Favreau Drops Epic New Chapter!

Star Wars continues its rich tradition of merchandise tie-ins with a new launch for <i>The Mandalorian and Grogu</i>, pr...

Motown Legacy Shattered: Family Betrayed by New Sylvia Moy Biography!

A new biography, "It’s No Wonder: The Life and Times of Motown’s Legendary Songwriter Sylvia Moy," explores the acclaime...

Rap Queens Clash: BIA Fires Back in Fiery Cardi B Feud!

The feud between rappers BIA and Cardi B has intensified following Cardi B's performance of a diss track on her 'Little ...

AI Exodus: Why Key Minds Are Abandoning OpenAI and xAI

The AI industry is currently facing a significant talent exodus, with major shakeups at companies like xAI and OpenAI. H...

AI Tremors Shake Wall Street: Market Recovers from Tech-Induced Slump

U.S. stocks steadied on Friday, buoyed by an encouraging inflation report that hinted at potential Federal Reserve inter...