Bitcoin Rainbow Chart Flashes 'Fire Sale': BTC Enters Undervalued Zone!

Bitcoin's price has recently entered what long-term valuation models, particularly the Bitcoin Rainbow Chart, categorize as "fire sale" levels, indicating deep undervaluation. This sentiment, often shared lightheartedly in bitcoin communities, now carries a more serious tone amidst one of the most significant corrective phases in recent market history. The Bitcoin Rainbow Chart, a logarithmic valuation tool, overlays price against colored bands that historically signify oversold, fairly valued, or overbought conditions. After an extended period of decline from its cycle highs, Bitcoin's current price position falls within these lower bands, confirming its "fire sale" status.

At the time of writing, Bitcoin (BTC) is struggling around the $83,000 level, following months of repeated sell-offs. The cryptocurrency has shed approximately 30% of its value since early October 2025, trading as low as the $80,000s, which triggered widespread leveraged liquidations. A multibillion-dollar cascade wiped out numerous leveraged positions, with BTC alone accounting for nearly $960 million in forced exits during a single session, according to Bitcoin Magazine Pro data. Specifically, BTC plunged to lows around $81,000 recently, dropping roughly 10% from its 48-hour highs above $90,000.

This sharp reversal is attributed to a combination of factors, including broader macro uncertainty and a fragile market structure. A key trigger for the recent downturn was the Federal Reserve meeting, where Chairman Powell highlighted labor market resilience without signaling immediate policy easing. This turned the event into a "sell the news" moment for speculative assets like Bitcoin. Adding to the market's unease, the White House is scheduled to convene banking and crypto executives next week to discuss efforts to revive stalled U.S. crypto legislation, potentially introducing further regulatory uncertainty.

The question on many traders' minds is whether this current "fire sale" represents the bottom for Bitcoin. BTC has decisively fallen below its two-month-long safety net at the 100-week moving average, which was around $85,000, a clear signal that sellers have taken control of the market. Traders are now closely monitoring the $75,000 mark as the next critical support level. A more significant drop towards the 200-week moving average, situated near $58,000, could potentially trigger even further substantial losses, intensifying the bearish sentiment.

The cryptocurrency market's turmoil is not isolated, occurring amidst broader market instability. This includes a massive $357 billion drop in Microsoft's market value and growing concerns over investments in artificial intelligence, which have spooked institutional and retail investors alike. These wider market anxieties contributed to the liquidation of an additional $1.6 billion in crypto long positions across the market. Furthermore, over the last two days, gold prices experienced a sharp reversal from record highs above $5,500, falling back below $5,000 as investors booked profits and reacted to a stronger U.S. dollar. Silver also saw significant volatility, plunging over 20% at times. The fluctuations in both precious metals underscore a broader market correction following historic gains, with sharp pullbacks testing the sustainability of the early-year rally across various asset classes.

You may also like...

Future Unclear: Is Pep Guardiola Set to Depart Man City?

Intense speculation surrounds Pep Guardiola's future at Manchester City, with rumors suggesting he might leave earlier t...

Saudi League Slams Ronaldo: 'You Are Not Bigger Than The League' Amid Al-Nassr Strike

)

Cristiano Ronaldo protested the Saudi Pro League's transfer dealings, citing perceived financial bias against Al-Nassr, ...

Set Secrets Unveiled: Rebecca Ferguson Details On-Set Abuse, Keeps 'Idiot' Actor Anonymous

Rebecca Ferguson opened up about a past incident where a co-star screamed at her on set, emphasizing that her story high...

Hollywood Shockwave: Timothy Busfield Indicted on Child Sex Abuse Charges

Timothy Busfield, director of "The Cleaning Lady," has been indicted on four counts of child sexual abuse in New Mexico,...

Must-Read: Yejide Kilanko's 'In Our Own Ways' Offers Exclusive Sneak Peek

Fadaka's spiritual quest, guided by Aunty Kike, leads her through a deceptive journey to a secluded ministry for a 'spec...

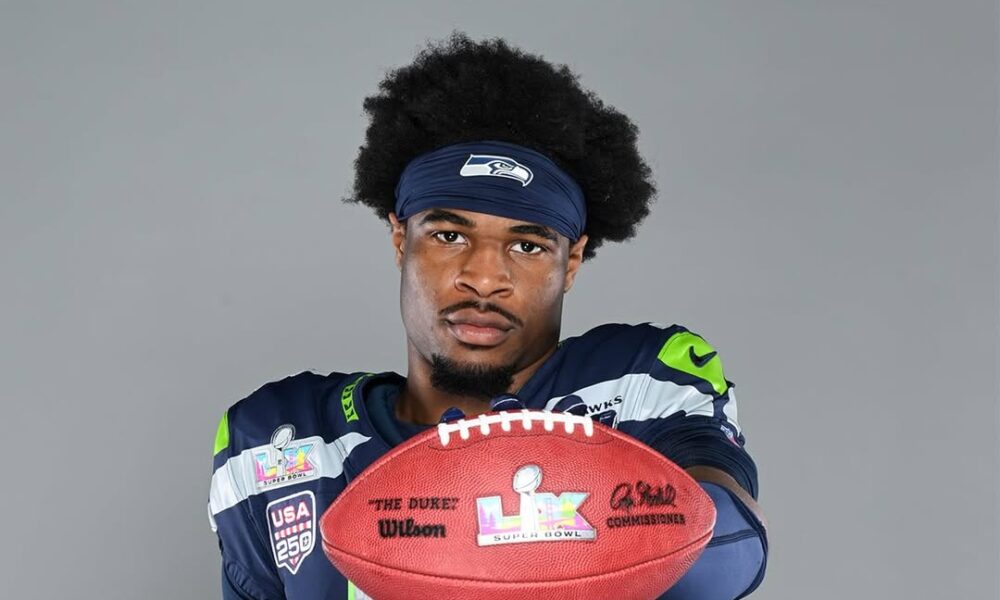

Super Bowl LX 2026: Anticipation Builds for Halftime Spectacle

Super Bowl LX is set to electrify Levi’s Stadium on February 8, 2026, featuring a star-studded halftime show by Bad Bunn...

Probiotic Powerhouse: Yogurt's Reign Challenged by 7 Surprising Dairy Rivals!

:max_bytes(150000):strip_icc()/Health-GettyImages-DairyWithMoreProbioticsThanYogurt-61aceb114e8542caae52b4e4a6067ac6.jpg)

While yogurt is a popular source of probiotics, many other fermented foods surprisingly offer significantly higher conce...

Miracle Spice? Turmeric's 10 Shocking Health Benefits Uncovered

:max_bytes(150000):strip_icc()/Health-GettyImages-ConditionsTurmericCanHelpWith-73e93e547c534162b3a55d2dc5b121d6.jpg)

Discover the extensive health benefits of turmeric and its active compound, curcumin, a potent anti-inflammatory and ant...