Bitcoin Rockets Past $90K Amidst High-Stakes Fed Meeting and Senate Crypto Vote!

The price of Bitcoin experienced a significant surge early Wednesday, successfully reclaiming the $90,000 level. This upward movement was influenced by a combination of fresh macro signals and increasing momentum around potential U.S. crypto regulation. The cryptocurrency demonstrated a sharp reversal from its weekend lows, which had approached $86,000, climbing to peaks of $90,361 according to Bitcoin Magazine Pro data.

This market activity unfolded as investors and traders prepared for the Federal Reserve’s first rate decision of the year. Futures markets had largely priced in a near-certain hold on interest rates for Wednesday. With unemployment currently at 4.4%, market participants were shifting their focus away from inflation and towards Federal Reserve Chair Jerome Powell’s potential comments regarding labor market softness. Concerns arose that if Powell emphasized job market resilience and signaled resistance to near-term rate cuts, a seemingly “neutral” Fed meeting could quickly lead to bearish sentiment for the cryptocurrency market.

Bitcoin appeared to benefit from broader macro tailwinds, similar to those boosting gold. Gold itself continued its surge, reaching new all-time highs above $5,300 per ounce, underscoring a renewed demand for hard assets amid increasing currency uncertainty. This global shift in investor preference helped Bitcoin reverse the cautious sentiment that had pervaded trading following the previous weekend’s dip. Adding to the bullish atmosphere, a late-day Bitcoin price rally occurred as President Donald Trump, during a speech in Iowa, dismissed concerns over the weakening U.S. dollar, stating he was “not concerned” and insisting the dollar was “doing great.”

This price rally also arrives at a critical juncture for U.S. crypto policy. The Senate Agriculture Committee is scheduled to vote on a significant crypto market structure bill on Thursday. This markup aims to clarify regulatory jurisdiction over digital asset markets and is anticipated to include several amendments. Lawmakers will determine whether to advance the bill to the Senate floor, as reported by Crypto in America. While there remains uncertainty regarding Democratic support for the legislation, the absence of unrelated amendments often considered deal-breakers has bolstered expectations for the bill’s potential progression. For market participants, any movement on this legislation represents a crucial step toward achieving long-sought regulatory clarity in the United States.

Bitcoin’s price action directly mirrored this evolving backdrop. After struggling for the past 24 hours to reclaim the $88,000 level, contending with ETF outflows, Federal Reserve uncertainty, and persistent bearish technical pressure, buyers ultimately reasserted control as the trading day concluded. At the time of publication, Bitcoin was trading at $90,075, reflecting an approximate 2% increase over the preceding 24 hours, with daily trading volume reaching around $43 billion. The asset’s circulating supply was recorded at 19.98 million BTC, out of a maximum fixed supply of 21 million.

You may also like...

Future Unclear: Is Pep Guardiola Set to Depart Man City?

Intense speculation surrounds Pep Guardiola's future at Manchester City, with rumors suggesting he might leave earlier t...

Saudi League Slams Ronaldo: 'You Are Not Bigger Than The League' Amid Al-Nassr Strike

)

Cristiano Ronaldo protested the Saudi Pro League's transfer dealings, citing perceived financial bias against Al-Nassr, ...

Set Secrets Unveiled: Rebecca Ferguson Details On-Set Abuse, Keeps 'Idiot' Actor Anonymous

Rebecca Ferguson opened up about a past incident where a co-star screamed at her on set, emphasizing that her story high...

Hollywood Shockwave: Timothy Busfield Indicted on Child Sex Abuse Charges

Timothy Busfield, director of "The Cleaning Lady," has been indicted on four counts of child sexual abuse in New Mexico,...

Must-Read: Yejide Kilanko's 'In Our Own Ways' Offers Exclusive Sneak Peek

Fadaka's spiritual quest, guided by Aunty Kike, leads her through a deceptive journey to a secluded ministry for a 'spec...

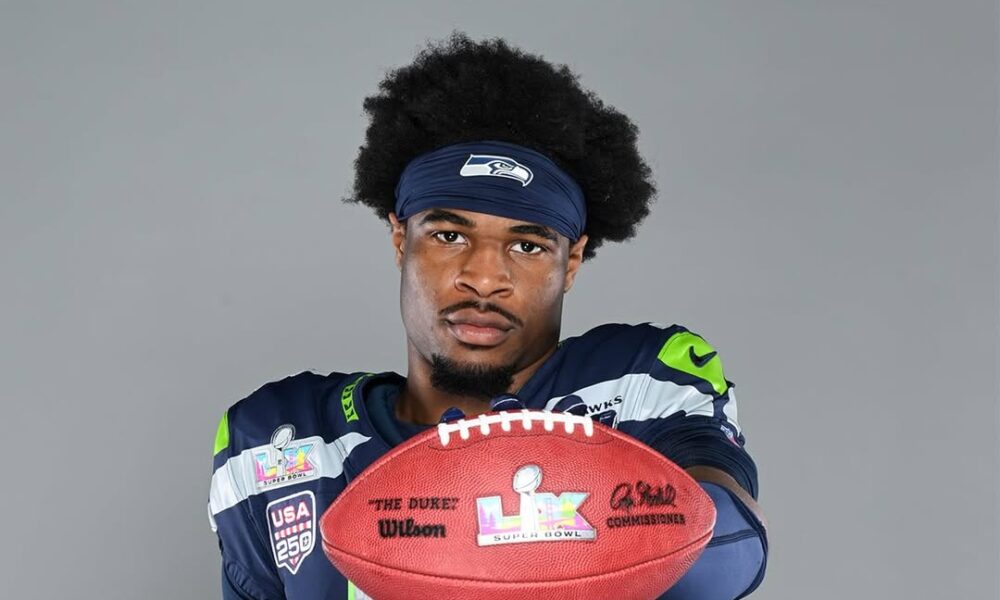

Super Bowl LX 2026: Anticipation Builds for Halftime Spectacle

Super Bowl LX is set to electrify Levi’s Stadium on February 8, 2026, featuring a star-studded halftime show by Bad Bunn...

Probiotic Powerhouse: Yogurt's Reign Challenged by 7 Surprising Dairy Rivals!

:max_bytes(150000):strip_icc()/Health-GettyImages-DairyWithMoreProbioticsThanYogurt-61aceb114e8542caae52b4e4a6067ac6.jpg)

While yogurt is a popular source of probiotics, many other fermented foods surprisingly offer significantly higher conce...

Miracle Spice? Turmeric's 10 Shocking Health Benefits Uncovered

:max_bytes(150000):strip_icc()/Health-GettyImages-ConditionsTurmericCanHelpWith-73e93e547c534162b3a55d2dc5b121d6.jpg)

Discover the extensive health benefits of turmeric and its active compound, curcumin, a potent anti-inflammatory and ant...