Michael Saylor's BTC Dominance: MicroStrategy Now Commands 3.2% of Total Bitcoin Supply!

Despite recent market downturns causing widespread fear, Strategy, led by Michael Saylor, has continued its aggressive acquisition of Bitcoin. Over the last two months, the company has invested nearly $2 billion in Bitcoin, reinforcing its long-term conviction in the cryptocurrency. Strategy has systematically expanded its Bitcoin treasury since the third quarter of 2020, making 90 separate acquisitions to date.

Strategy's current Bitcoin holdings stand at an impressive 671,268 BTC, which the company states is equivalent to 3.2% of all Bitcoin ever expected to exist. The average purchase price for their substantial holdings is approximately $75,000 per BTC, with a total acquisition cost of $50 billion. The current net asset value of these Bitcoin holdings is estimated at $60 billion.

According to Bitcointreasuries.net, Strategy's Bitcoin treasury significantly surpasses that of any other publicly traded company, holding 12 times more Bitcoin than the next largest holder, MARA Holdings. While most companies in the top 10 typically hold between 13,000 and 53,000 BTC, Strategy's accumulation strategy underscores its unprecedented scale in the crypto asset space.

To bolster investor confidence and safeguard its Bitcoin assets, Strategy recently created a $1.44 billion cash reserve. This reserve, funded by recent Class A stock sales, is intended to cover future dividends and interest payments, initially securing 21 months of obligations with plans to extend to 24 months. CEO Phong Le affirmed that this strategic move sharply reduces the likelihood of liquidating any of the company's approximately $56 billion in Bitcoin, especially amidst broader market weaknesses, addressing prior investor concerns.

Michael Saylor, speaking at the Bitcoin MENA conference, further articulated his vision, positioning Bitcoin as the fundamental bedrock of a new digital capital and credit era. He addressed sovereign wealth funds, banks, and investors, framing Bitcoin as

You may also like...

7 Countries Where Valentine’s Day Isn’t February 14

Valentine’s Day isn’t always February 14. Some countries mark love on entirely different dates, and the traditions behin...

Countries That Have Restricted Valentine’s Day Celebration

Valentine’s Day is global but not universally accepted. In some countries, February 14 has been restricted, discouraged,...

What Exactly Is an African Man’s Business with Valentine?

Every February 14, love becomes loud, red and expensive. But what exactly is an African man’s business with Valentine’s ...

9 Ways to Survive Valentine’s Day As A Singlet

Single on Valentine’s Day? Forget the roses and rom-coms; here’s your perfect survival guide to survive the day and cele...

Roses Are Red, Naira Is Not for Bouquets This Valentine

Money bouquets may look romantic, but the CBN has a warning. Here’s why using naira notes as Valentine decorations could...

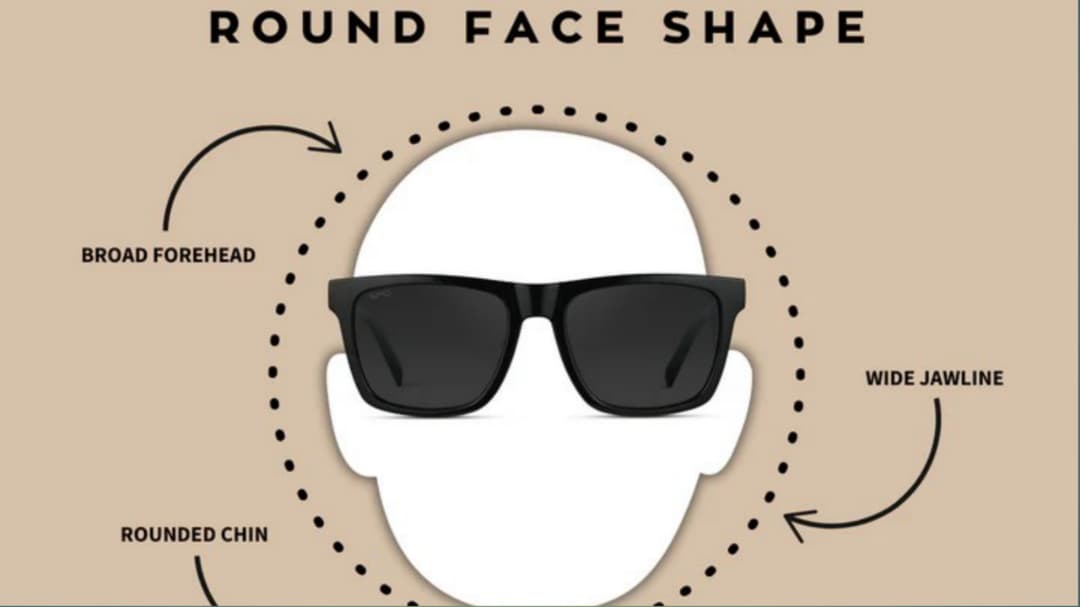

Have a Round Face? Avoid These 5 Sunglass Shapes

Have a round face? Avoid these 5 sunglass shapes that can make your face look wider and know the most flattering frame s...

Heavyweight Showdown! Wardley to Defend Title Against Dubois

The highly anticipated heavyweight title clash between Fabio Wardley and Daniel Dubois has been officially confirmed for...

WAFCON 2026 Host Revealed! CAF President Drops Major News

CAF President Patrice Motsepe has confirmed Morocco will host the 2026 Women's Africa Cup of Nations, dispelling recent ...