Major Player Reloads Bitcoin War Chest, Snapping Up 1,229 BTC for $109 Million!

Strategy, recognized as the largest publicly traded holder of bitcoin, has notably resumed its aggressive accumulation strategy, making a significant purchase of 1,229 coins for approximately $108.8 million during the week that concluded on December 28, 2025. This latest acquisition, executed at an average price of $88,568 per bitcoin, further solidified the company's position in the cryptocurrency market. This move comes shortly after the company had temporarily paused its bitcoin purchases, having previously bolstered its U.S. dollar reserves to around $2.2 billion, demonstrating a strategic flexibility in its market entry timings.

The funding for this recent substantial acquisition was secured through the sale of 663,450 shares of Strategy's Class A common stock under its at-the-market (ATM) equity program, which successfully generated $108.8 million in net proceeds. Strategy confirmed that no preferred securities were sold during this period, indicating that the company maintains substantial capacity for future issuances, allowing for continued flexibility in its investment approach.

Following this latest purchase, Strategy's total bitcoin holdings have surged to an impressive 672,497 BTC. The company has now invested approximately $50.44 billion in acquiring bitcoin, with an average cost basis of $74,997 per coin. This monumental investment underscores Strategy's deep commitment to bitcoin as its primary treasury reserve asset and its long-term conviction in the cryptocurrency's value.

In the broader market context, bitcoin was trading near $87,200 at press time, slightly below Strategy’s most recent purchase price, following a session marked by volatility where BTC briefly soared above $90,000 before experiencing a reversal. Despite such market fluctuations, Strategy’s extensive bitcoin holdings are currently valued at nearly $59 billion, resulting in significant unrealized gains exceeding $8 billion for the firm, highlighting the success of its accumulation strategy.

The performance of Strategy's shares (MSTR) has often mirrored the volatility of bitcoin. In premarket trading, MSTR slipped about 1% to approximately $156.51, reflecting bitcoin's recent dip. Year-to-date, the stock is down roughly 45%, a performance that analysts attribute to both the inherent volatility of bitcoin and investor sensitivity to Strategy's leveraged exposure to BTC.

This recent purchase is part of a broader pattern of aggressive accumulation observed throughout December 2025. In the first two weeks of the month, Strategy executed back-to-back purchases totaling nearly $2 billion. During the period between December 1 and December 14, the company acquired 21,269 bitcoin. This included an initial purchase of 10,624 BTC for about $963 million at an average price of $90,615, followed by another acquisition of 10,645 BTC for roughly $980 million at an average price of $92,098. These represent Strategy's largest weekly purchases since mid-2025, underscoring its intensified accumulation efforts when BTC prices had pulled back toward the $90,000 level.

Strategy has consistently reinforced its long-term accumulation strategy, reporting a year-to-date bitcoin yield of 23.2% in 2025. Crucially, the company has not reported any bitcoin sales since adopting BTC as its primary treasury reserve asset, further emphasizing its unwavering commitment to holding bitcoin for the long term.

You may also like...

7 Countries Where Valentine’s Day Isn’t February 14

Valentine’s Day isn’t always February 14. Some countries mark love on entirely different dates, and the traditions behin...

Countries That Have Restricted Valentine’s Day Celebration

Valentine’s Day is global but not universally accepted. In some countries, February 14 has been restricted, discouraged,...

What Exactly Is an African Man’s Business with Valentine?

Every February 14, love becomes loud, red and expensive. But what exactly is an African man’s business with Valentine’s ...

9 Ways to Survive Valentine’s Day As A Singlet

Single on Valentine’s Day? Forget the roses and rom-coms; here’s your perfect survival guide to survive the day and cele...

Roses Are Red, Naira Is Not for Bouquets This Valentine

Money bouquets may look romantic, but the CBN has a warning. Here’s why using naira notes as Valentine decorations could...

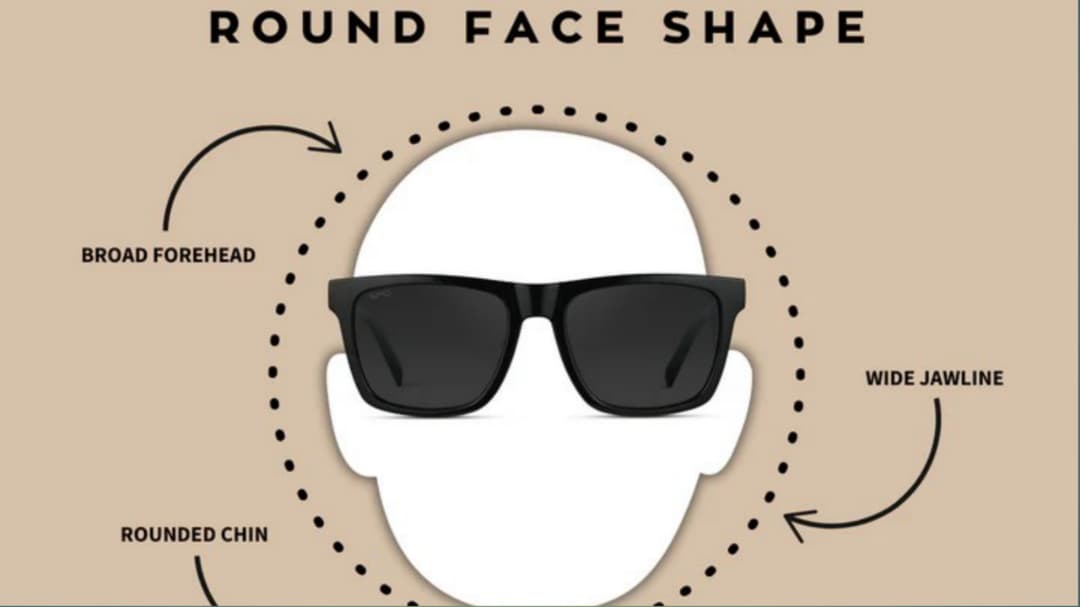

Have a Round Face? Avoid These 5 Sunglass Shapes

Have a round face? Avoid these 5 sunglass shapes that can make your face look wider and know the most flattering frame s...

Heavyweight Showdown! Wardley to Defend Title Against Dubois

The highly anticipated heavyweight title clash between Fabio Wardley and Daniel Dubois has been officially confirmed for...

WAFCON 2026 Host Revealed! CAF President Drops Major News

CAF President Patrice Motsepe has confirmed Morocco will host the 2026 Women's Africa Cup of Nations, dispelling recent ...