BREAKING: Crypto Giant Strategy Unleashes Massive Bitcoin Purchase, Largest Since July

MicroStrategy has significantly bolstered its Bitcoin holdings with two substantial purchases in December, further cementing its position as a major corporate holder of the cryptocurrency. Between December 8 and 14, the company acquired 10,645 Bitcoins for a total of $980.3 million, averaging an impressive $92,124 per Bitcoin. This latest acquisition, which was MicroStrategy's largest since July, was strategically financed through proceeds derived from at-the-market (ATM) equity offerings, highlighting the company's commitment to leveraging its equity to expand its digital asset treasury.

These recent acquisitions have propelled MicroStrategy's total Bitcoin holdings to an astounding 671,268 BTC. Preceding this, MicroStrategy had also purchased 10,624 Bitcoins, valued at approximately $963 million, between December 1 and 7. Despite these significant investments, the price of Bitcoin has remained below the psychologically crucial $90,000 threshold, illustrating the broader market dynamics at play.

While MicroStrategy continues its aggressive accumulation strategy, questions regarding the potential sale of its extensive Bitcoin reserves have arisen. CEO Fong Lee addressed these concerns by stating that he did not entirely rule out the possibility of selling some of MicroStrategy’s Bitcoin holdings should the market experience a prolonged "crypto winter." However, Lee emphatically reiterated that Bitcoin remains a fundamental and core component of MicroStrategy’s long-term strategic plan, implying that any near-term liquidation of its current holdings appears highly unlikely.

In other notable developments, MicroStrategy recently secured its inclusion in the prestigious Nasdaq 100 index, successfully navigating a potential delisting and reaffirming its standing in the financial markets. This positive news comes amidst growing scrutiny from financial bodies regarding companies heavily invested in digital assets. Reuters reported persistent concerns about the long-term sustainability of crypto treasury companies. Independently, MSCI has also expressed reservations about digital-asset treasury firms and is slated to make a decision in January regarding the potential exclusion of MicroStrategy and similar entities from its influential benchmarks. This ongoing evaluation by MSCI underscores the evolving regulatory and investment landscape for companies with substantial cryptocurrency treasuries.

You may also like...

7 Countries Where Valentine’s Day Isn’t February 14

Valentine’s Day isn’t always February 14. Some countries mark love on entirely different dates, and the traditions behin...

Countries That Have Restricted Valentine’s Day Celebration

Valentine’s Day is global but not universally accepted. In some countries, February 14 has been restricted, discouraged,...

What Exactly Is an African Man’s Business with Valentine?

Every February 14, love becomes loud, red and expensive. But what exactly is an African man’s business with Valentine’s ...

9 Ways to Survive Valentine’s Day As A Singlet

Single on Valentine’s Day? Forget the roses and rom-coms; here’s your perfect survival guide to survive the day and cele...

Roses Are Red, Naira Is Not for Bouquets This Valentine

Money bouquets may look romantic, but the CBN has a warning. Here’s why using naira notes as Valentine decorations could...

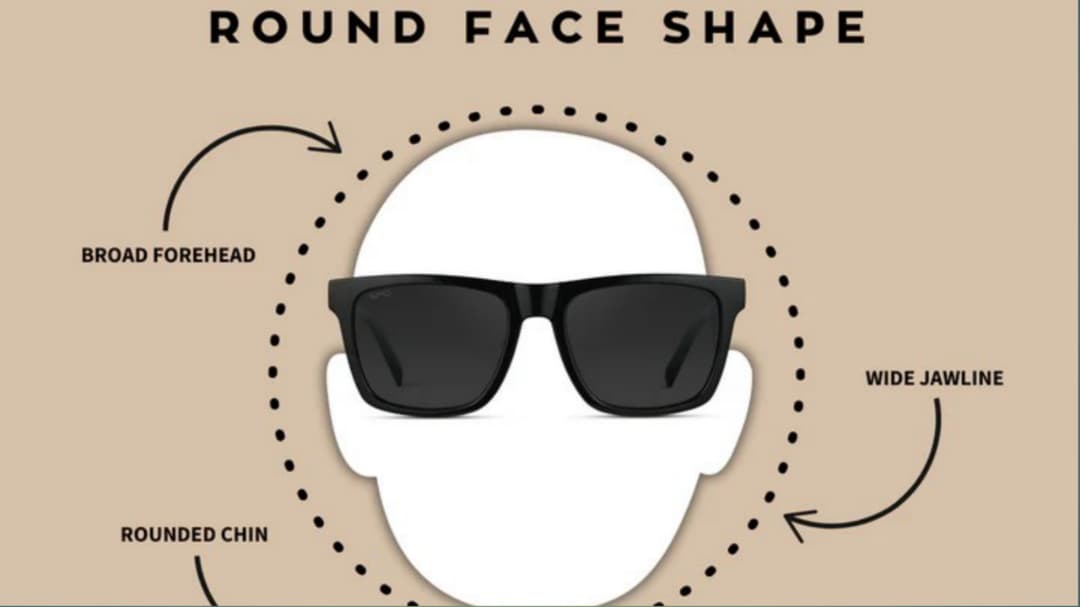

Have a Round Face? Avoid These 5 Sunglass Shapes

Have a round face? Avoid these 5 sunglass shapes that can make your face look wider and know the most flattering frame s...

Heavyweight Showdown! Wardley to Defend Title Against Dubois

The highly anticipated heavyweight title clash between Fabio Wardley and Daniel Dubois has been officially confirmed for...

WAFCON 2026 Host Revealed! CAF President Drops Major News

CAF President Patrice Motsepe has confirmed Morocco will host the 2026 Women's Africa Cup of Nations, dispelling recent ...