Bitcoin Price Explodes: Breaches $92,000 Mark, Ends 4-Year Cycle!

The price of Bitcoin has recently shown significant upward momentum, climbing above $92,000 from lows near $88,000, reaching a seven-day high of $92,203. This movement has prompted leading financial analysis firms to revise their outlooks on the cryptocurrency's market trajectory and institutional involvement.

Bernstein analysts, for instance, have articulated a belief in a fundamental structural shift within Bitcoin's market cycle. They contend that the traditional four-year cycle, which historically saw price peaks every four years, has been disrupted. Instead, Bernstein now foresees Bitcoin entering an 'elongated bull cycle,' predominantly powered by sustained institutional purchasing activity that effectively counterbalances any retail selling. Despite a recent correction of approximately 30%, exchange-traded fund (ETF) outflows have remained notably minimal, staying under 5%. Reflecting this revised outlook, the bank has elevated its 2026 price target for Bitcoin to $150,000, further projecting that the current cycle could culminate in 2027 with a peak around $200,000. For the long term, Bernstein maintains a robust 2033 target of approximately $1 million per BTC.

Concurrently, Wall Street giant JPMorgan maintains a bullish stance on Bitcoin for the coming year. Their analysts project a gold-linked, volatility-adjusted target of $170,000 for BTC over the next six to twelve months, taking into account expected price fluctuations and the ongoing costs associated with Bitcoin mining.

MicroStrategy (MSTR) continues to play a pivotal role in the institutional dynamics of the Bitcoin market. As the largest corporate holder of Bitcoin, the company possesses an impressive 660,624 BTC, acquired at an average cost of $74,696 per coin. The current market value of these holdings is estimated to be near $60.5 billion, resulting in unrealized gains of approximately $11 billion. MicroStrategy recently executed a significant purchase, acquiring 10,624 BTC last week for about $963 million, at an average price of $90,615 per coin, marking its largest recent buying spree as market volatility subsided. JPMorgan observes that MicroStrategy's enterprise-value-to-Bitcoin holdings ratio (mNAV) of 1.13 is 'encouraging,' suggesting a low likelihood of the company being compelled to sell its holdings. Furthermore, MicroStrategy has established a substantial $1.44 billion U.S. dollar reserve, intended to cover dividend payments and interest obligations for at least 12 months, with ambitions to extend this coverage to 24 months. While Bernstein maintained its 'Outperform' rating on MicroStrategy, it did adjust its price target downwards from $600 to $450, a reflection of the recent broader market correction. Following its latest Bitcoin acquisition, MicroStrategy shares saw a rise of about 3% in early trading, rebounding from a December 1 low near $155, though they still remain more than 50% below their six-month peak.

As of now, the Bitcoin price trades at $90,886, marking a 3% increase over the past 24 hours, with a 24-hour trading volume reaching $46 billion. The cryptocurrency's total market capitalization currently stands at $1.82 trillion. There are 19.96 million BTC in circulation, moving closer to the hard cap of 21 million maximum supply.

You may also like...

7 Countries Where Valentine’s Day Isn’t February 14

Valentine’s Day isn’t always February 14. Some countries mark love on entirely different dates, and the traditions behin...

Countries That Have Restricted Valentine’s Day Celebration

Valentine’s Day is global but not universally accepted. In some countries, February 14 has been restricted, discouraged,...

What Exactly Is an African Man’s Business with Valentine?

Every February 14, love becomes loud, red and expensive. But what exactly is an African man’s business with Valentine’s ...

9 Ways to Survive Valentine’s Day As A Singlet

Single on Valentine’s Day? Forget the roses and rom-coms; here’s your perfect survival guide to survive the day and cele...

Roses Are Red, Naira Is Not for Bouquets This Valentine

Money bouquets may look romantic, but the CBN has a warning. Here’s why using naira notes as Valentine decorations could...

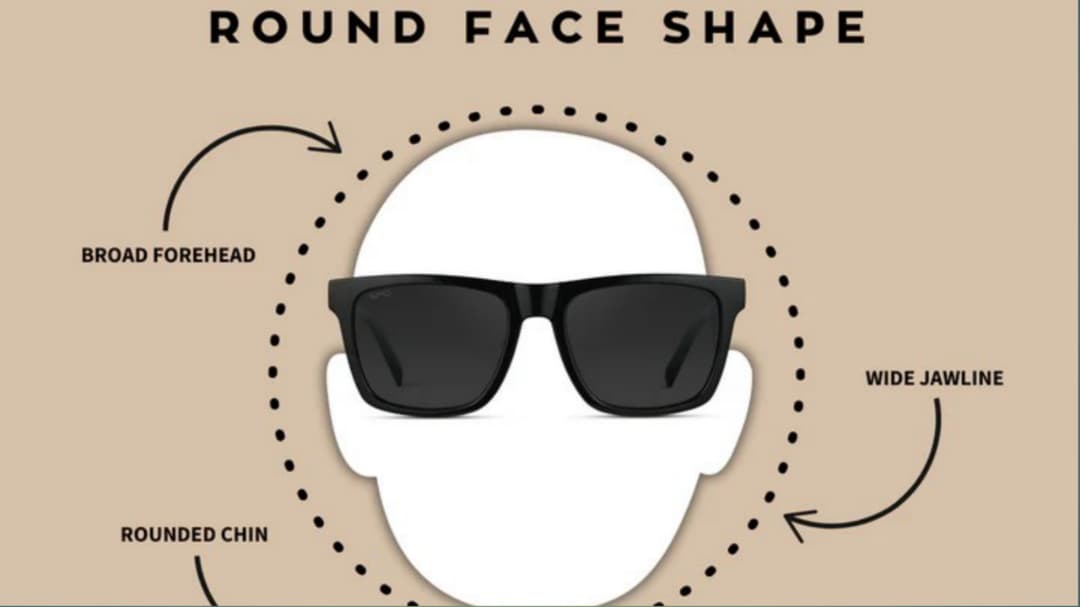

Have a Round Face? Avoid These 5 Sunglass Shapes

Have a round face? Avoid these 5 sunglass shapes that can make your face look wider and know the most flattering frame s...

Heavyweight Showdown! Wardley to Defend Title Against Dubois

The highly anticipated heavyweight title clash between Fabio Wardley and Daniel Dubois has been officially confirmed for...

WAFCON 2026 Host Revealed! CAF President Drops Major News

CAF President Patrice Motsepe has confirmed Morocco will host the 2026 Women's Africa Cup of Nations, dispelling recent ...