Bitcoin Titan Michael Saylor Unleashes $2.13B Whale Move, Snapping Up 22,305 BTC!

Strategy (MSTR), recognized globally as the largest publicly traded corporate holder of bitcoin, has substantially increased its digital asset reserves with another major acquisition. Over the past week, ending January 19, 2026, the company purchased an additional 22,305 bitcoin for approximately $2.13 billion. This significant acquisition was made at an average price of roughly $95,284 per bitcoin, which was about 4% higher than the prevailing market prices at the time of disclosure.

This recent purchase marks Strategy's largest weekly bitcoin acquisition since November 2024 and stands as its fifth-largest bitcoin purchase announcement to date. As of January 19, 2026, Strategy's total bitcoin holdings have surged to 709,715 BTC. These assets were acquired for an approximate total of $53.92 billion, reflecting an average purchase price of $75,979 per coin. The latest acquisition was primarily funded through the company's capital markets activities, specifically a combination of common stock issuance and sales of its perpetual preferred equity, Stretch (STRC).

Led by executive chairman Michael Saylor, Strategy continues to pursue an aggressive, near-weekly accumulation strategy, effectively converting traditional financial assets into bitcoin exposure. Regulatory filings confirm that the company raised approximately $2.125 billion in net proceeds between January 12 and January 19 through its at-the-market (ATM) programs. The bulk of these funds, about $1.83 billion, came from the sale of 10.4 million shares of MSTR Class A common stock. An additional $294.3 million was generated by issuing roughly 2.95 million STRC preferred shares, with smaller amounts raised via STRK preferred stock, while no shares were issued under the STRF or STRD programs during this period.

Despite this continued accumulation, Strategy's shares faced pressure in early trading, falling approximately 5% as bitcoin prices slid below $91,000. This decline occurred amidst a broader crypto market sell-off, which followed a period last week when BTC had traded above $94,000. With its substantial holdings, Strategy now controls over 3% of bitcoin’s total circulating supply. Furthermore, the company previously announced an increase in its U.S. dollar reserve to $2.25 billion, up from $1.44 billion in December, a move intended to support dividend payments on preferred shares and meet interest obligations on outstanding debt.

Earlier this month, Strategy received a notable reprieve from potential market pressure when MSCI concluded its review of digital asset treasury companies. The index provider decided against excluding such firms from its major global equity indexes, stating that bitcoin-heavy companies would remain eligible under existing rules while it conducts further research into distinguishing operating companies from investment-like entities. This decision eased months of market anxiety, as MSCI had initially proposed reclassifying companies with over 50% of assets in digital assets as fund-like, which would have rendered them ineligible for inclusion and potentially triggered billions of dollars in forced passive selling. Strategy, alongside industry groups, had strongly pushed back against this proposal.

You may also like...

NBA Bombshell: LeBron James and Ayton Out for Pacers Clash!

The Los Angeles Lakers will be severely impacted by injuries, with LeBron James, Deandre Ayton, and Maxi Kleber all side...

Man City Stays: Pep Guardiola Drops Major Hint on Future!

Pep Guardiola has hinted at staying at Manchester City, expressing confidence that his team will reach its full potentia...

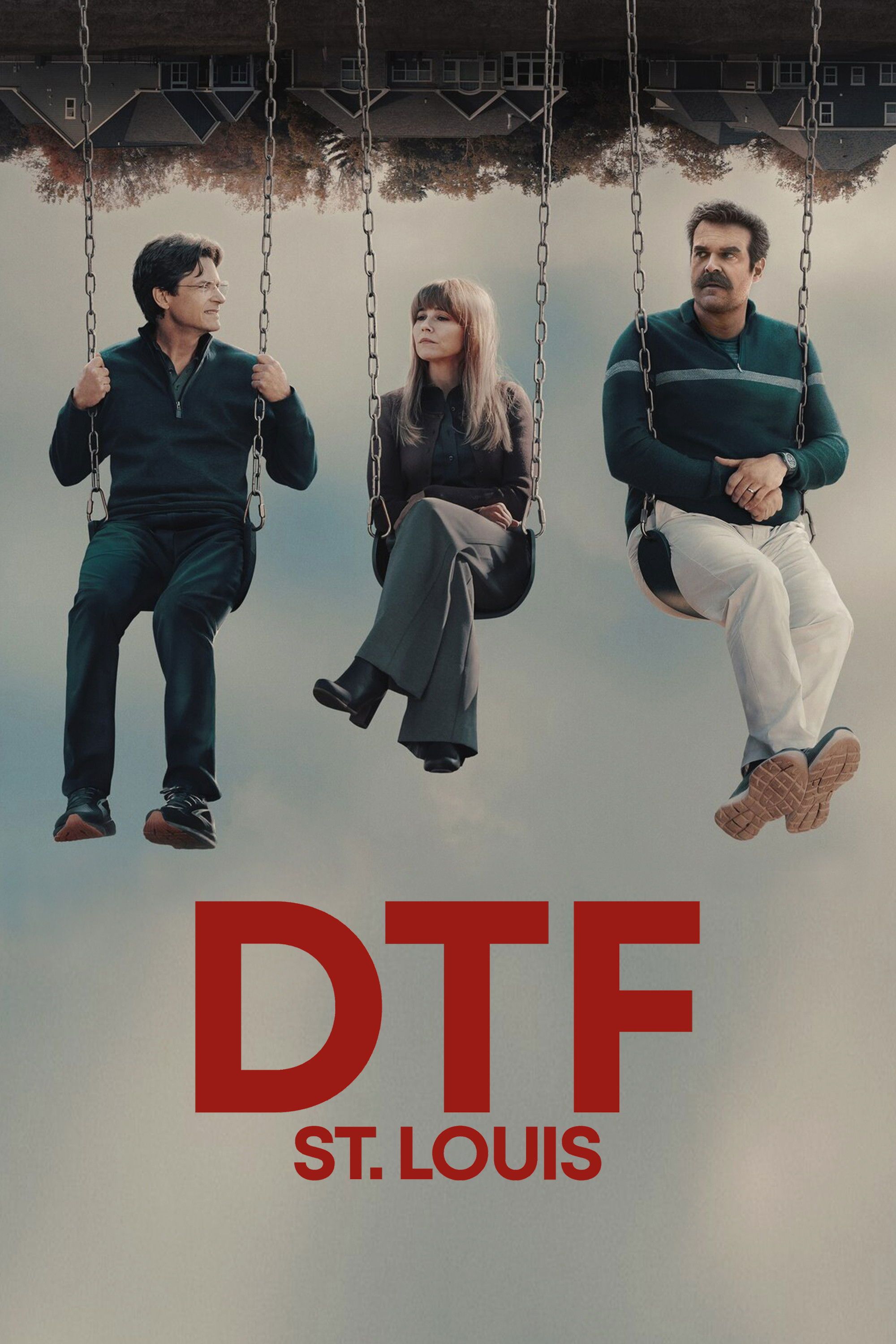

HBO's New Crime Thriller Dethrones 'A Knight of the Seven Kingdoms' in Streaming Battle

HBO Max is currently showcasing two notable series: 'DTF St. Louis,' a star-studded crime story praised for its blend of...

SZA Slams Chart Predictions, Defying Taylor Swift Comparison: 'Anything Is Possible!'

SZA's album SOS defied expectations by topping the Billboard 200 over Taylor Swift, a feat her label initially doubted. ...

Sam Asghari Demands Privacy Amid Britney Spears’ DUI Arrest After Explosive Comments

Sam Asghari has addressed Britney Spears' recent DUI arrest during a Fox News interview, calling for privacy for his ex-...

Giant Meets Miniature! World's Tallest Dog Shares Paws With the Smallest Canine Star!

The world's shortest dog, Pearl the Chihuahua, and a towering Great Dane named Reggie, had an unforgettable playdate arr...

End of an Era: Girl Scouts Announce Retirement of Two Beloved Cookie Flavors After 2025 Season!

Girl Scout cookie season is officially underway, but fans should prepare to say goodbye to Toast-Yay! and S’mores, which...

Unlock Peak Performance: Timing Magnesium for Ultimate Muscle Recovery

:max_bytes(150000):strip_icc()/Health-GettyImages-MagnesiumBeforeOrAfterWorkout-1012169458424c3791686bd6c68427e5.jpg)

Magnesium is vital for athletes, supporting muscle function, energy, and recovery, with increased demands during intense...