Crypto Giant Twenty One Capital Storms NYSE with $4 Billion Bitcoin Treasury Next Week!

Bitcoin treasury firm Twenty One Capital is set to commence trading on the New York Stock Exchange (NYSE) on December 9, utilizing the ticker symbol XXI. This significant public listing is the culmination of a merger with Cantor Equity Partners (CEP), a deal that received approval from CEP shareholders, paving the way for the transaction to finalize around December 8. Operating under the Twenty One Capital name, the newly merged entity will launch with an impressive treasury of approximately 43,514 BTC, valued at roughly $4 billion at current prices. This substantial holding positions Twenty One Capital as the largest Bitcoin treasury company listed on the NYSE and the second-largest corporate BTC holder globally, trailing only Strategy.

The firm's inception was first announced in April as a strategic joint venture involving prominent entities such as Tether, Bitfinex, SoftBank, and Cantor Fitzgerald. The name 'Twenty One Capital' is a direct homage to Bitcoin’s finite total supply of 21 million coins, of which approximately 19.95 million have already been mined. Jack Mallers, the CEO and co-founder of Twenty One Capital, enthusiastically confirmed the NYSE listing. The company significantly bolstered its Bitcoin reserves in July with an additional 5,800 BTC contributed by Tether, bringing its total holdings to over 43,000 BTC at launch. Twenty One Capital has articulated a core strategy of continuously expanding its Bitcoin holdings post-listing.

In the lead-up to its public debut, financial maneuvers played a crucial role in building the firm's robust Bitcoin treasury. Pre-merger, Cantor Equity Partners successfully raised $585 million through Private Investment in Public Equity (PIPE) financing. Concurrently, Twenty One Capital also secured $100 million by selling convertible notes. A portion of these significant funds was strategically allocated to further increase the company's Bitcoin treasury, underscoring its commitment to its primary asset.

Twenty One Capital's innovative model is designed to provide investors with direct exposure to Bitcoin through its corporate balance sheet. To enhance transparency and investor confidence, the company will introduce a unique metric called 'Bitcoin Per Share.' This measure will clearly indicate the amount of BTC held per share and will rely on on-chain proof-of-reserves, offering investors a verifiable and real-time reference to track the firm's Bitcoin holdings. This commitment to transparency and direct exposure aims to distinguish Twenty One Capital in the digital asset market.

The firm explicitly aims to differentiate itself from other digital asset treasury companies. Unlike competitors such as Strategy and Metaplanet, which manage diverse business operations, Twenty One Capital is specifically structured to focus solely on Bitcoin accumulation and related services. Its foundational partners remain integral to its operations: Tether and Bitfinex continue as majority shareholders, lending their significant support to the firm’s public listing. Cantor Fitzgerald provides invaluable expertise in investment banking and capital markets, while CEP offered the necessary Special Purpose Acquisition Company (SPAC) vehicle to facilitate the merger and bring the company to the NYSE.

Upon its eagerly anticipated debut, Twenty One Capital is poised to become a key influential player within the landscape of publicly listed Bitcoin treasuries. Its substantial treasury, unique trading structure, and the innovative 'Bitcoin Per Share' metric are designed to offer a novel investment model for those seeking direct exposure to BTC. The company has articulated plans to broaden its services connected to Bitcoin, including ventures into payments and infrastructure. CEO Jack Mallers has clearly stated his overarching goal: to consistently increase Bitcoin per share, thereby reinforcing shareholder value. Shares of Twenty One Capital, under the ticker XXI, are officially expected to begin trading on December 9, precisely one day after the merger's closure.

You may also like...

7 Countries Where Valentine’s Day Isn’t February 14

Valentine’s Day isn’t always February 14. Some countries mark love on entirely different dates, and the traditions behin...

Countries That Have Restricted Valentine’s Day Celebration

Valentine’s Day is global but not universally accepted. In some countries, February 14 has been restricted, discouraged,...

What Exactly Is an African Man’s Business with Valentine?

Every February 14, love becomes loud, red and expensive. But what exactly is an African man’s business with Valentine’s ...

9 Ways to Survive Valentine’s Day As A Singlet

Single on Valentine’s Day? Forget the roses and rom-coms; here’s your perfect survival guide to survive the day and cele...

Roses Are Red, Naira Is Not for Bouquets This Valentine

Money bouquets may look romantic, but the CBN has a warning. Here’s why using naira notes as Valentine decorations could...

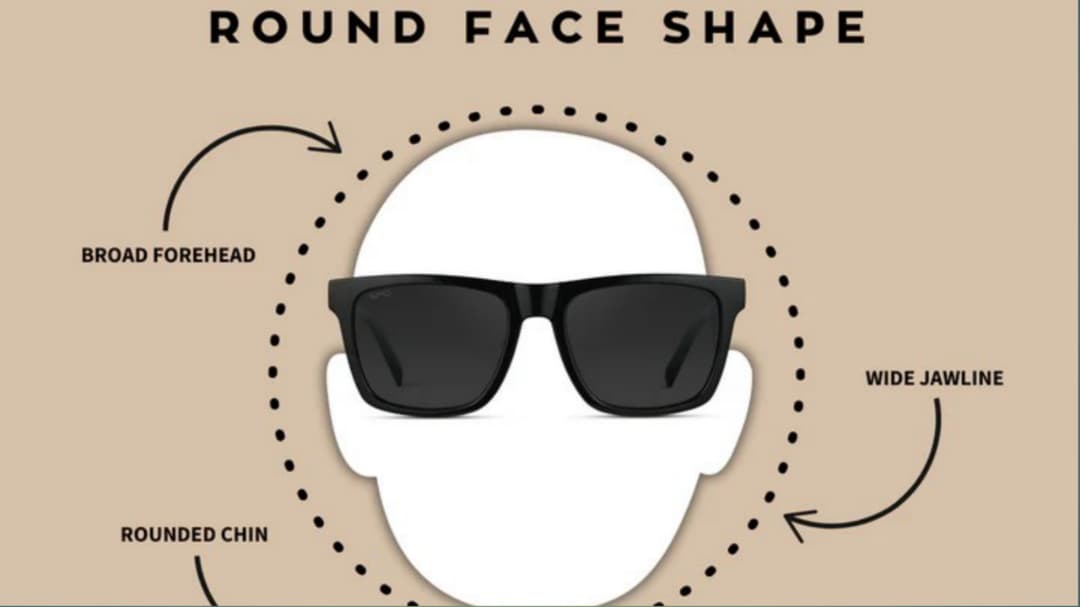

Have a Round Face? Avoid These 5 Sunglass Shapes

Have a round face? Avoid these 5 sunglass shapes that can make your face look wider and know the most flattering frame s...

Heavyweight Showdown! Wardley to Defend Title Against Dubois

The highly anticipated heavyweight title clash between Fabio Wardley and Daniel Dubois has been officially confirmed for...

WAFCON 2026 Host Revealed! CAF President Drops Major News

CAF President Patrice Motsepe has confirmed Morocco will host the 2026 Women's Africa Cup of Nations, dispelling recent ...