Do You Know You Lose Money When You Save in Your Kolo or Saving Box?

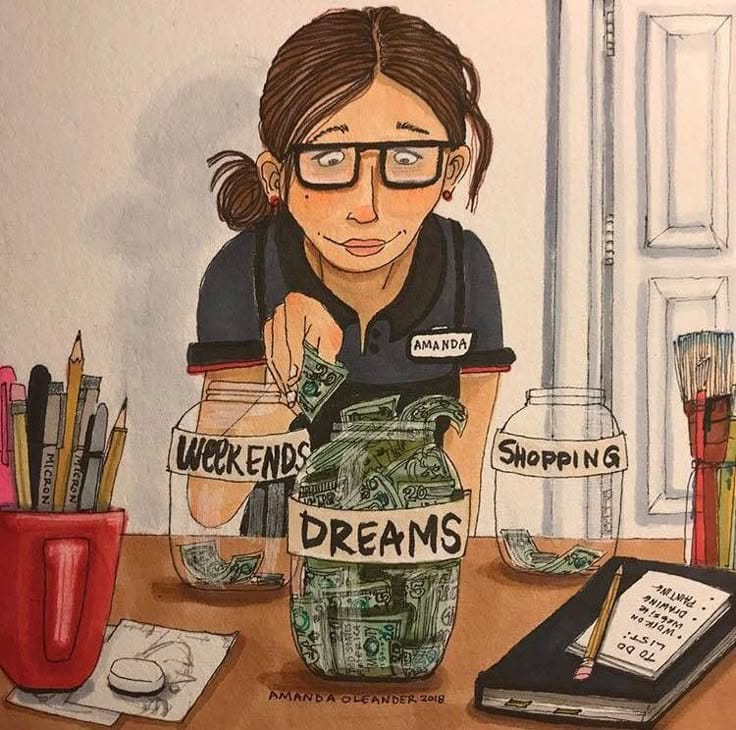

You have probably gone to beg Mr. Chizoba, the carpenter who stays opposite your street, for a “kolo” in exchange for a cold malt.

You’ve sworn that you must save at least ₦2,000 daily and promised yourself that by the end of the year, you would have almost a million naira stacked neatly under your mattress or hidden in a small tin.

Permit me to hold your hand and say this: you are losing money; please go and collect your malt back. I can see you happily squeezing your old one thousand naira note inside your wooden saving box.

Yes, every naira you carefully tuck away in a kolo or your personal saving box is silently shrinking. And it’s not because your money is “lazy” or because Mr. Chizoba isn’t trustworthy. It’s because of forces beyond your control, forces you need to understand if you want your savings actually to grow.

The Hidden Thief: Inflation

Think of inflation as the invisible worm slowly nibbling at your money. It is the reason why ₦1,000 today buys less in six months than it does today.

If inflation in Nigeria averages 15% a year, which is a conservative figure, your ₦10,000 in a box will only have the purchasing power of roughly ₦8,700 in a year. You didn’t spend a naira, yet the value of your “savings” is smaller.

In other words, while you’ve been working hard, clipping coins, and honouring your pledge to Mr. Chizoba, your money is quietly losing its worth.

Opportunity Cost: The Money That Could Have Been

Every naira in your kolo isn’t just losing value; it’s also missing out on growth opportunities.

Banks and fintech savings platforms like PiggyVest, Kuda, and Carbon offer interest rates ranging from 5% to 10% annually. That’s free money for simply keeping your money in their hands.

Let’s do a quick comparison:

If you save ₦10,000 in your kolo for a year, your money stays ₦10,000; no growth, no interest. In fact, with inflation eating about 15% per year, its actual value drops to ₦8,700.

Now, if you put that same ₦10,000 in a bank savings account earning 10% interest, you end up with ₦11,000 at the end of the year. That’s ₦1,000 extra without lifting a finger.

And if you use a fintech savings app with similar interest rates, your ₦10,000 could grow to ₦11,000 to ₦11,200, depending on compounding. That’s money working for you instead of just sitting idle in a box.

So imagine you save one million in a fintech saving platform, at the end of the year, you'd have more than one hundred thousand naira extra.

See that? While your kolo lets you feel like you are saving, the money could have been actively growing in a savings account or fintech platform. That growth is called compounding interest, and your kolo doesn’t do that.

The Compounding Advantage

Compounding is where the magic happens. Money earns interest, then the interest earns interest, creating exponential growth over time. Even small, regular contributions can multiply your savings faster than you think.

But your kolo? It doesn’t compound, It only sits there.

Let’s not forget security. Tucking money under your bed exposes it to theft, fire, or simple human error. Banks and fintech apps provide security measures, digital records, and instant access.

Some even allow automatic savings and goal tracking, so you never have to physically manage your money every day.

It’s easy to fool yourself into thinking a kolo is “real saving” because you can touch and see your money. But that tangibility is a trap. Without interest, your money loses value, and without growth, your discipline doesn’t translate into real wealth.

The smartest savers are not those who hide money; they are those who make their money work for them.

So What Should You Do?

First, go and collect your malt back. After that, you need to note that saving in a “kolo” or under your mattress is financial nostalgia, not financial strategy. Every day your money sits idle, it loses value to inflation and misses opportunities to grow through interest.

If your goal is to truly build wealth, the first step is to move your savings from physical containers into banks, micro-savings apps, or other interest-bearing platforms. Automate contributions, set goals, and watch compounding do the heavy lifting.

Your future self won’t just thank you; they’ll wonder why you ever trusted Mr. Chizoba’s kolo in the first place. So if you start now, you’ll have extra cash to obleeeee really hard in December.

You may also like...

Slot's Shocking Truth: Liverpool 'Got More Than Deserved' vs Nottingham Forest

Liverpool clinched a last-gasp victory over Nottingham Forest, a win manager Arne Slot surprisingly called their "worst ...

Arteta's Stunning Confession: 'Ashamed' of Arsenal's Grit in Tottenham Win

Arsenal secured a convincing 4-1 victory over Tottenham in the north London derby, extending their lead at the top of th...

Shocking Box Office Upset: Rebecca Ferguson's Misfire Beats Johnny Depp's $100 Million Flop!

The sci-fi film <em>Mercy</em>, starring Chris Pratt and Rebecca Ferguson, has become a box office dud, failing to recou...

Epic DC Spectacle That 'Changed Hollywood' Now a Streaming Sensation!

Zack Snyder's directorial career has seen a distinctive evolution from early hits like "300" to his impactful, often con...

Breaking Out: 'Hunger Games' Star Shines as Action Heroine in New Thriller

A Q&A session with the director and stars of "One Mile: Chapter One" reveals the intensive "guerrilla-style" filmmaking ...

Unveiled: Baz Luhrmann Discovers Long-Lost Elvis Presley Film Hoard

Filmmaker Baz Luhrmann discusses his new project, EPiC: Elvis Presley in Concert, revealing the discovery and restoratio...

Ethiopia on Edge: Troop Movements Spark Fears of Renewed Conflict at Eritrea-Tigray Border

Ethiopia and Eritrea are reportedly deploying troops and equipment near the Tigray region, sparking fears of renewed con...

Africa's Mineral Gold Rush: A Looming Geopolitical Battle for Resources

Africa is experiencing a new, quieter scramble centered on critical minerals essential for the global green transition. ...