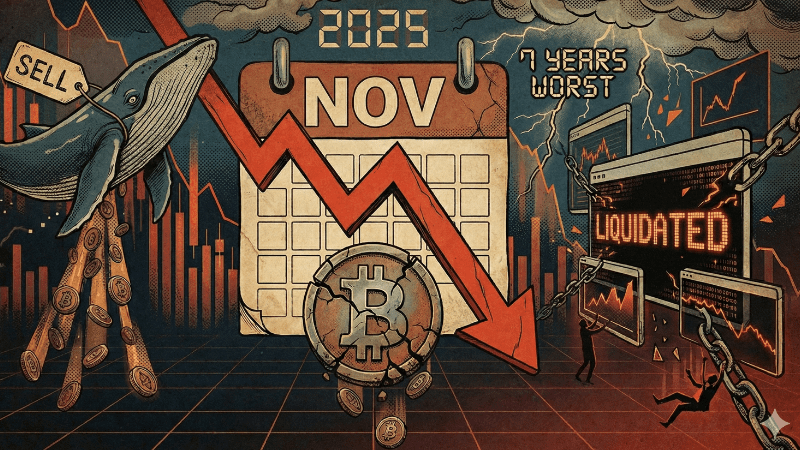

Crypto Carnage: Bitcoin Plummets 17%, Marking Worst Month in Seven Years!

Bitcoin experienced a severe downturn in November 2025, recording a 17.49% plummet, marking its worst monthly performance since the 2018 bear market and the second-worst of the year, just surpassing February’s 17.39% slide. The cryptocurrency, which began the month near $110,000, dipped to a seven-month low near $80,000 before a brief recovery and subsequent collapse to approximately $86,000 by month-end, including a 5% drop within three hours on a Sunday.

Initially, November saw cautious optimism for Bitcoin, fueled by post-halving momentum and anticipated institutional inflows. However, this sentiment quickly dissolved as U.S. spot Bitcoin ETFs faced a surge in redemptions, with outflows reaching $3.48 billion, making it the second-heaviest monthly drain since the ETFs’ launch in 2024. Notably, BlackRock’s iShares Bitcoin Trust alone witnessed billions in withdrawals, as risk-averse funds pulled back, leading to significant losses for short-term holders, with over 10,200 BTC wiped out in a single event.

Adding to the pressure were several macroeconomic headwinds. Donald Trump’s expanded tariffs on China, implemented on October 10, triggered a global risk reassessment that negatively impacted both equities and crypto markets. The record U.S. government shutdown further squeezed liquidity from traditional markets, leaving Bitcoin starved. Federal Reserve Chair Jerome Powell’s unenthusiastic comments on rate cuts, coupled with ongoing quantitative tightening, leaving the Fed’s balance sheet at $6.6 trillion, diverted dollars from high-risk assets like Bitcoin. In contrast, gold demonstrated stronger performance, highlighting Bitcoin’s vulnerability during periods of flight to safety.

A major factor in November’s carnage was aggressive selling by Bitcoin whales, defined as mega-holders with over 10,000 BTC. These long-term holders, including those from Bitcoin’s early Satoshi era, began cashing in significant gains. On-chain data revealed an exodus of over 50,000 BTC, equivalent to $4.6 billion, in a single week, the largest whale sell-off of 2025. Long-term holders collectively offloaded $43 billion since July, including a notable instance where Owen Gunden moved 2,400 BTC ($237 million) to Kraken, and another Satoshi-era whale liquidated a 15-year stash worth $1.5 billion. This whale frenzy intensified market instability, leading to $870 million in ETF redemptions in one day due to margin calls on leveraged positions. Technically, the 50-day moving average neared a “death cross” below the 200-day, a historically bearish indicator.

Market sentiment, as reflected by the Fear & Greed Index, plummeted to 28, firmly in “fear” territory. Despite the widespread sell-off, figures such as Michael Saylor maintained their accumulation strategy, adding thousands of BTC, underscoring the divergence in investor conviction. November’s rout also defied historical seasonal trends; while history showed a 42% average November gain (skewed by 2013’s 449% surge) and an 8.8% median, 2025 joined the ranks of losing Novembers, echoing 2018’s 36% drop. Altcoins suffered even more, with Ethereum down 22% and the total crypto market cap shedding $1 trillion, indicating Bitcoin’s deep scars exposed underlying fragilities masked by ETF hype.

Looking ahead, December presents a mixed outlook. Historically, red Novembers often precede red Decembers, with a median decline of -3.2%. Key support levels to watch are $85,000, with a break potentially leading to $80,000. Conversely, resistance between $90,000 and $95,000 could trigger a “Santa rally” towards or above $100,000. While whale sales have been brutal, they often signal the capping of corrections. Despite the November slump, Bitcoin’s year-to-date performance remains positive at 7%. The market continues to observe whether November’s bearish trends will persist or if Bitcoin will find new momentum in 2026.

You may also like...

Relocation Might Just Be Becoming Harder Than Before

Relocating abroad is becoming more difficult due to stricter immigration policies, rising financial costs, inflation, an...

Runways, Beefs & Secret Weddings: Your Mid-Week Celebrity Roundup

From Zendaya and Tom Holland’s secret wedding reveal to T.I. and 50 Cent’s escalating feud, plus Paris Fashion Week high...

The Igbo Traditional Dance Positioning in Nigerian Culture

Igbo dance positioning in Nigeria uses circles, lines, and paired movements to reflect community, social hierarchy, ritu...

Top 10 African Countries with the Strongest Soft Power in 2026

Africa is no longer just watched; it’s being heard. From Egypt’s historic power to Nigeria’s booming music and tech, the...

Mental Health in Professional Sports: The Hidden Battle Behind the Game

Behind the trophies and fame, professional athletes face intense pressure, injury setbacks, public criticism, and caree...

Skipping Breakfast, Harmful Myth or Healthy Choice?

Is breakfast truly the most important meal of the day, or is skipping it perfectly healthy? While some believe missing b...

How to Save Money as an NYSC Corper (Without Starting a GoFundMe)

A humorous but practical guide to surviving, and actually saving, on the ₦77,000 NYSC allowance. From cooking hacks to ...

OPINION: Men Who Know Their Worth Might Just Die Single, Is That a Threat or a Lie?

Will men who know their worth die single? Read this opinion piece examining whether men who know their worth risk dying ...