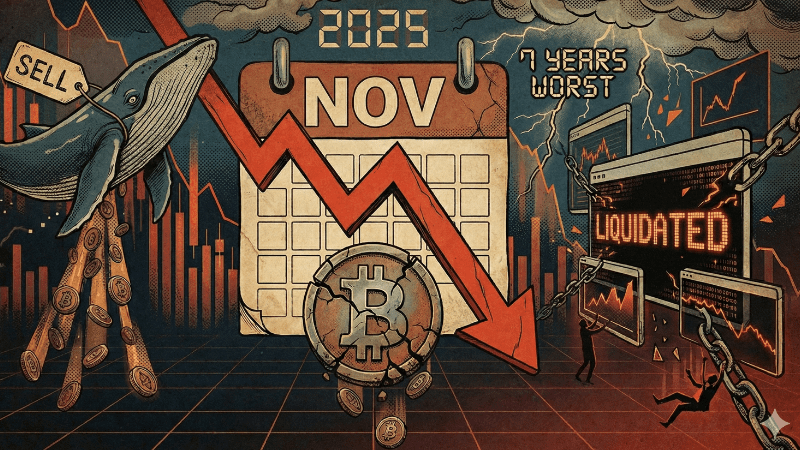

Bitcoin Bloodbath: $200 Million Liquidated as Price Plummets Below $87K

Bitcoin extended its weekend slide, dropping below $87,000, following a rejection from the $94,000 resistance level last week and closing at $88,170. This decline was accompanied by approximately $200 million in leveraged liquidations across the crypto market. At the time of writing, Bitcoin traded around $86,751-$86,770, down about 2% over the past 24 hours, indicative of thin liquidity and persistent sell pressure.

The market sentiment is "extremely bearish," with Bitcoin's price outlook described as "lethargic." The bulls failed to gain any momentum, leading to a significant weekly red candle close. Bears are now poised to challenge the critical $84,000 support level this week, aiming to drive the price further down.

The $84,000 support level is currently under intense pressure. While a slight defense around $85,000 is possible, it's unlikely to hold without a substantial influx of buying volume. Should the $84,000 level break, an accelerated descent towards $75,000 and potentially into the low $70,000 range is anticipated. Below this, the 0.618 Fibonacci retracement support at $57,000 represents a further downside target.

A more robust support zone lies between $72,000 and $68,000. This area is expected to act as a solid floor upon initial tests, likely requiring several weeks to breach if reached. If this zone is touched, a strong bounce is expected, potentially retesting the $84,000 level or even initiating a stronger reversal out of the current bear market.

On the upside, Bitcoin faces a formidable "blanket of resistance" extending from $94,000 all the way to $118,000. Conquering $94,000 would set the next target at $101,000, although strong selling pressure is expected above $97,000. Further progression towards $107,000 and eventually $118,000 would necessitate even greater buying pressure, but these levels appear largely unattainable under current market conditions.

In a counter-trend move amidst the bearish sentiment, Strategy, recognized as the world's largest publicly traded Bitcoin holder, recently acquired an additional 10,645 BTC for nearly $1 billion, at an average price of $92,098 per coin. This marks their second consecutive mega-purchase, increasing their total holdings to 671,268 BTC, acquired for an aggregate of $50.33 billion at an average cost of $74,972 each.

The acquisition was primarily funded through equity issuance, including $888.2 million from common stock sales. Executive Chairman Michael Saylor has demonstrated renewed conviction by accelerating buying despite ongoing shareholder concerns about dilution and market volatility. Strategy maintains a year-to-date BTC yield of 24.9% and continues its commitment to accumulating Bitcoin, increasingly operating like a dedicated Bitcoin investment vehicle rather than just a software company.

To comprehend the market dynamics, several terms are crucial. "Bulls" (Bullish) refer to buyers expecting prices to rise, while "Bears" (Bearish) denote sellers expecting prices to fall. A "Support level" is where prices are expected to hold, at least initially, becoming weaker with more tests. Conversely, a "Resistance level" is where prices are likely to be rejected, also weakening with repeated touches. "Fibonacci Retracements" are ratios based on the golden ratio (Phi 1.618 and phi 0.618), used to identify potential support and resistance levels in growth and decay cycles.

Recommended Articles

Crypto Carnage Strikes: Bitcoin Price Crashes to $75K Amid Market-Wide Sell-Off

Bitcoin's price plummeted to nearly $75,000 today in a high-volume sell-off, erasing over 10% from recent highs and trig...

Ancient Bitcoin Whale Awakens: $500M Dump After 12 Years Yields Jaw-Dropping 31,250% Profit!

A dormant Bitcoin whale, known as "5K BTC OG," has re-emerged after 12 years to sell half of its 5,000 BTC stash, earnin...

Fed Shakes Crypto: Interest Rate Cut Triggers Bitcoin Volatility

The Federal Reserve cut its benchmark interest rate by 25 basis points, marking its third reduction this year. This deci...

Crypto Crash: Bitcoin Tumbles to $88K, Yet JPMorgan Holds Firm on $170K Target!

Bitcoin recently plunged to $88,000s, but JPMorgan remains bullish with a $170,000 target, heavily influenced by corpora...

Crypto Carnage: Bitcoin Plummets 17%, Marking Worst Month in Seven Years!

Bitcoin endured a harsh November 2025, plunging 17.49% in its worst monthly drop since 2018, driven by massive ETF redem...

You may also like...

The Fresh Start Lie: What February Reveals About Your “New Year, New Me”

It’s February. After all the hype about the one million and one things you swore you’d do in January, you didn’t tick a ...

Is Our Phones Listening Or Do They Already Know Us Too Well?

AI has changed how ads work but at what cost? Read about this to explore AI, big tech, targeted advertising, and why onl...

February 2026 Horror Releases You Shouldn’t Miss

February ditches romance for terror as eight major horror releases—from Scream 7 to The Strangers: Chapter 3—turn 2026 i...

Common Fundraising Myths That Affect Early-Stage Founders

Fundraising is often misunderstood by early-stage founders. This article breaks down common fundraising myths and explai...

King Carlos Alcaraz Makes History! Youngest Man to Complete Grand Slam at Australian Open!

)

Carlos Alcaraz, at just 22, has claimed the Australian Open 2026 men's singles title, completing a historic Career Grand...

Super Eagles Star Ademola Lookman Shocks Fans, Picks Atletico Madrid Over Fenerbahce in Sensational €40M Move!

Super Eagles star Ademola Lookman has completed a €40 million transfer to Atlético Madrid from Atalanta, choosing the Sp...

Bridgerton Season 4 Shocks with Cinderella-esque Success & Hyacinth's Bold New Storyline

Bridgerton Season 4 triumphs on Netflix with the Cinderella-esque romance of Benedict Bridgerton and Sophie Baek, who is...

Oscar Nominee Renate Reinsve Dazzles at Göteborg with Bold New Film 'Butterfly'

The Indian SUV market sees compact SUVs leading sales in FY2025, with Tata Punch topping the charts. Maruti Brezza ...