Crypto Carnage Strikes: Bitcoin Price Crashes to $75K Amid Market-Wide Sell-Off

Bitcoin experienced a significant price plunge today, falling to nearly $75,000 during a sharp, high-volume sell-off. This event erased over 10% from recent highs and marked the first time the asset traded below $80,000 since April 2025. Data indicates that BTC dropped from a 24-hour high of $84,356 to a low of $75,644 within a few hours, as an overwhelming number of sellers pressured bid support across major exchanges. This decline represents one of the steepest single-day drops of the year and triggered widespread liquidations in the derivatives markets.

The sell-off intensified after Bitcoin failed to maintain support near the $82,500 level. Once this crucial level was breached, the price moved rapidly through zones of thin liquidity, with minimal evidence of sustained dip-buying until it reached the mid-$70,000 range. Market participants characterized this movement as a "deleveraging event" rather than a gradual shift away from risk.

From a technical analysis perspective, the daily chart shows Bitcoin's price breaking below a rising trendline that had been firmly held since late December. Furthermore, the price decisively slipped under the 50-day exponential moving average, which was positioned near $90,000. This movement effectively flipped the 50-day EMA into an overhead resistance level, according to data from Bitcoin Magazine Pro. The breakdown was accompanied by expanded trading volume, suggesting forced exits and margin liquidations were primary drivers, rather than low-conviction selling.

Despite the sharp decline, on-chain data reveals a renewed interest from new buyers. Network statistics indicate a surge in new Bitcoin addresses over the past 24 hours, reaching the highest daily increase observed in nearly two months. In a comparative analysis with traditional markets, Bitcoin's drop, while substantial, outpaced most recent declines but still performed better than gold during the same period. While BTC fell approximately 6% to 8%, gold registered a steeper drawdown, underscoring Bitcoin's relative resilience amidst volatility.

Currently, the Bitcoin price is trading at $77,825, reflecting a 7% decrease over the last 24 hours, with daily trading volume reaching $75 billion. The asset is now 8% below its seven-day high of $84,368 and just 1% above its seven-day low of $77,534. Traders caution that downside risk remains elevated until the Bitcoin price reclaims the $82,000 to $84,000 range. The immediate key support zone is identified in the low-to-mid $70,000s, with longer-term market focus shifting towards achieving stabilization.

Adding to the market's complex environment, the U.S. government has entered a partial shutdown. This occurred after Congress failed to pass a full-year spending package by the Friday midnight deadline, leading to several major departments being temporarily unfunded. Although the Senate approved a funding deal intended to keep most agencies operational through September and a two-week stopgap for Homeland Security, this measure awaits approval from the House, which is not possible until lawmakers return from recess on Monday. The impasse is largely attributed to Democratic demands for changes to immigration enforcement practices, stemming from the fatal shooting of two U.S. citizens in Minnesota, alongside persistent divisions within the House GOP.

Recommended Articles

Ancient Bitcoin Whale Awakens: $500M Dump After 12 Years Yields Jaw-Dropping 31,250% Profit!

A dormant Bitcoin whale, known as "5K BTC OG," has re-emerged after 12 years to sell half of its 5,000 BTC stash, earnin...

Bitcoin Bloodbath: $200 Million Liquidated as Price Plummets Below $87K

Bitcoin faces an extremely bearish outlook this week, struggling to hold the $84,000 support level after a significant w...

Fed Shakes Crypto: Interest Rate Cut Triggers Bitcoin Volatility

The Federal Reserve cut its benchmark interest rate by 25 basis points, marking its third reduction this year. This deci...

Crypto Crash: Bitcoin Tumbles to $88K, Yet JPMorgan Holds Firm on $170K Target!

Bitcoin recently plunged to $88,000s, but JPMorgan remains bullish with a $170,000 target, heavily influenced by corpora...

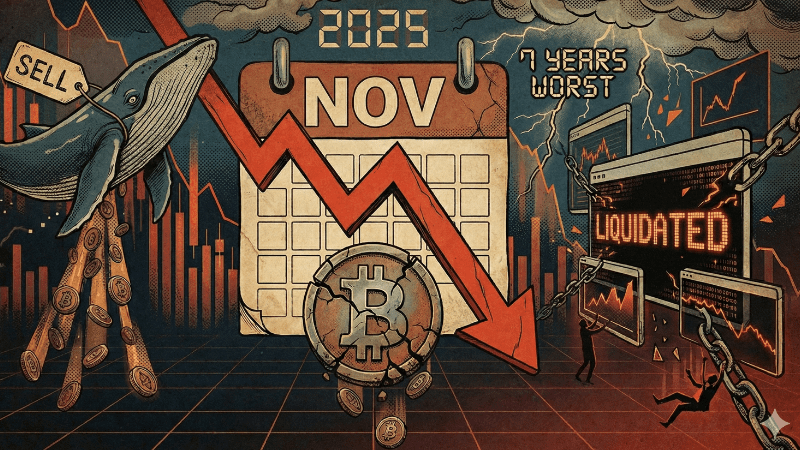

Crypto Carnage: Bitcoin Plummets 17%, Marking Worst Month in Seven Years!

Bitcoin endured a harsh November 2025, plunging 17.49% in its worst monthly drop since 2018, driven by massive ETF redem...

You may also like...

The Fresh Start Lie: What February Reveals About Your “New Year, New Me”

It’s February. After all the hype about the one million and one things you swore you’d do in January, you didn’t tick a ...

Is Our Phones Listening Or Do They Already Know Us Too Well?

AI has changed how ads work but at what cost? Read about this to explore AI, big tech, targeted advertising, and why onl...

February 2026 Horror Releases You Shouldn’t Miss

February ditches romance for terror as eight major horror releases—from Scream 7 to The Strangers: Chapter 3—turn 2026 i...

Common Fundraising Myths That Affect Early-Stage Founders

Fundraising is often misunderstood by early-stage founders. This article breaks down common fundraising myths and explai...

King Carlos Alcaraz Makes History! Youngest Man to Complete Grand Slam at Australian Open!

)

Carlos Alcaraz, at just 22, has claimed the Australian Open 2026 men's singles title, completing a historic Career Grand...

Super Eagles Star Ademola Lookman Shocks Fans, Picks Atletico Madrid Over Fenerbahce in Sensational €40M Move!

Super Eagles star Ademola Lookman has completed a €40 million transfer to Atlético Madrid from Atalanta, choosing the Sp...

Bridgerton Season 4 Shocks with Cinderella-esque Success & Hyacinth's Bold New Storyline

Bridgerton Season 4 triumphs on Netflix with the Cinderella-esque romance of Benedict Bridgerton and Sophie Baek, who is...

Oscar Nominee Renate Reinsve Dazzles at Göteborg with Bold New Film 'Butterfly'

The Indian SUV market sees compact SUVs leading sales in FY2025, with Tata Punch topping the charts. Maruti Brezza ...