Crypto Crash: Bitcoin Tumbles to $88K, Yet JPMorgan Holds Firm on $170K Target!

Bitcoin experienced a significant price plunge on Friday, falling over 4% in the past 24 hours to trade in the $88,000s, nearing its seven-day low of $88,091. This represents a roughly 4% drop from its seven-day high of $92,805. Despite this recent decline, the global market capitalization for Bitcoin stands at $1.77 trillion, with a 24-hour trading volume of $48 billion.

Amidst the volatility, Wall Street banking giant JPMorgan maintains a long-term bullish outlook on Bitcoin. The bank reiterated its gold-linked, volatility-adjusted BTC target of $170,000, projecting this price point within the next six to twelve months. Analysts at JPMorgan indicate that their predictive model effectively accounts for fluctuations in Bitcoin's price and its associated mining costs.

A pivotal factor in the current Bitcoin market dynamics is Strategy (MSTR), recognized as the largest corporate Bitcoin holder globally, with a substantial ownership of 650,000 BTC. The company's enterprise-value-to-Bitcoin-holdings ratio, known as mNAV, is currently reported at an "encouraging" 1.13 by JPMorgan analysts. A ratio exceeding 1.0 suggests a reduced likelihood of Strategy facing forced sales of its Bitcoin assets. Furthermore, Strategy has strategically built a $1.44 billion U.S. dollar reserve, designated to cover dividend payments and interest obligations for at least 12 months, with an ambitious goal to extend this coverage to 24 months. Recently, Strategy's Michael Saylor clarified that the company is a publicly traded operating entity with a $500 million software business and a treasury strategy centered on Bitcoin, rather than being a fund, trust, or holding company. He highlighted recent financial activities, including five digital credit security offerings totaling over $7.7 billion in notional value.

However, Bitcoin continues to face considerable mining pressures. The network's hashrate and mining difficulty have notably decreased, primarily due to high-cost miners operating outside China retreating from operations. This retreat is driven by rising electricity costs coinciding with declining Bitcoin prices. Some miners have resorted to selling their Bitcoin holdings to maintain solvency. JPMorgan now estimates Bitcoin's production cost at $90,000, a decrease from $94,000 reported last month. While falling hashrates can reduce production costs in the long run, their immediate effect is sustained selling pressure from miners.

Institutional investor sentiment also shows signs of caution. BlackRock’s iShares Bitcoin Trust (IBIT) has experienced six consecutive weeks of net outflows, with investors withdrawing over $2.8 billion from the ETF during this period, according to Bloomberg data. These significant withdrawals underscore a subdued appetite among traditional investors, even as Bitcoin prices attempt to stabilize. Analysts observe that this trend marks a distinct reversal from the consistent inflows witnessed earlier in the year.

The broader cryptocurrency market is still in recovery following the severe liquidation event on October 10, which erased over $1 trillion in crypto market value and propelled Bitcoin into a bear market. Although Bitcoin prices have regained some ground recently, market momentum remains fragile. JPMorgan analysts now suggest that Bitcoin’s next significant price movement will be less dependent on miner behavior and more on Strategy’s sustained ability to hold its substantial Bitcoin assets without selling. The company’s healthy mNAV ratio and robust reserve fund instill confidence in its capacity to navigate market volatility.

Beyond these factors, other potential catalysts are on the horizon. The MSCI index decision, scheduled for January 15, could significantly impact Strategy’s stock performance, which in turn could indirectly influence Bitcoin's price. A positive outcome from this decision is widely expected to trigger a strong rally.

From a technical analysis perspective, Bitcoin Magazine analysts note a recently strengthened correlation between Bitcoin’s price and Gold, particularly during market downturns. This perspective offers a clearer assessment of Bitcoin’s purchasing power when evaluated against Gold rather than the U.S. dollar. Breaking below the 350-day moving average (approximately $100,000) and the critical psychological level of $100,000 signaled Bitcoin’s entry into a bear market, leading to an immediate drop of roughly 20%. While USD-denominated charts might indicate a peak in 2025, Bitcoin measured in Gold peaked earlier, in December 2024, and has since fallen over 50%, suggesting a potentially longer bear phase. Historical Gold-based bear cycles point towards approaching potential support zones, with current declines of 51% over 350 days reflecting factors like institutional adoption and constrained supply, rather than typical cycle shifts. For the present, Bitcoin’s price hovers near the $88,000 mark.

You may also like...

NBA Bombshell: LeBron James and Ayton Out for Pacers Clash!

The Los Angeles Lakers will be severely impacted by injuries, with LeBron James, Deandre Ayton, and Maxi Kleber all side...

Man City Stays: Pep Guardiola Drops Major Hint on Future!

Pep Guardiola has hinted at staying at Manchester City, expressing confidence that his team will reach its full potentia...

HBO's New Crime Thriller Dethrones 'A Knight of the Seven Kingdoms' in Streaming Battle

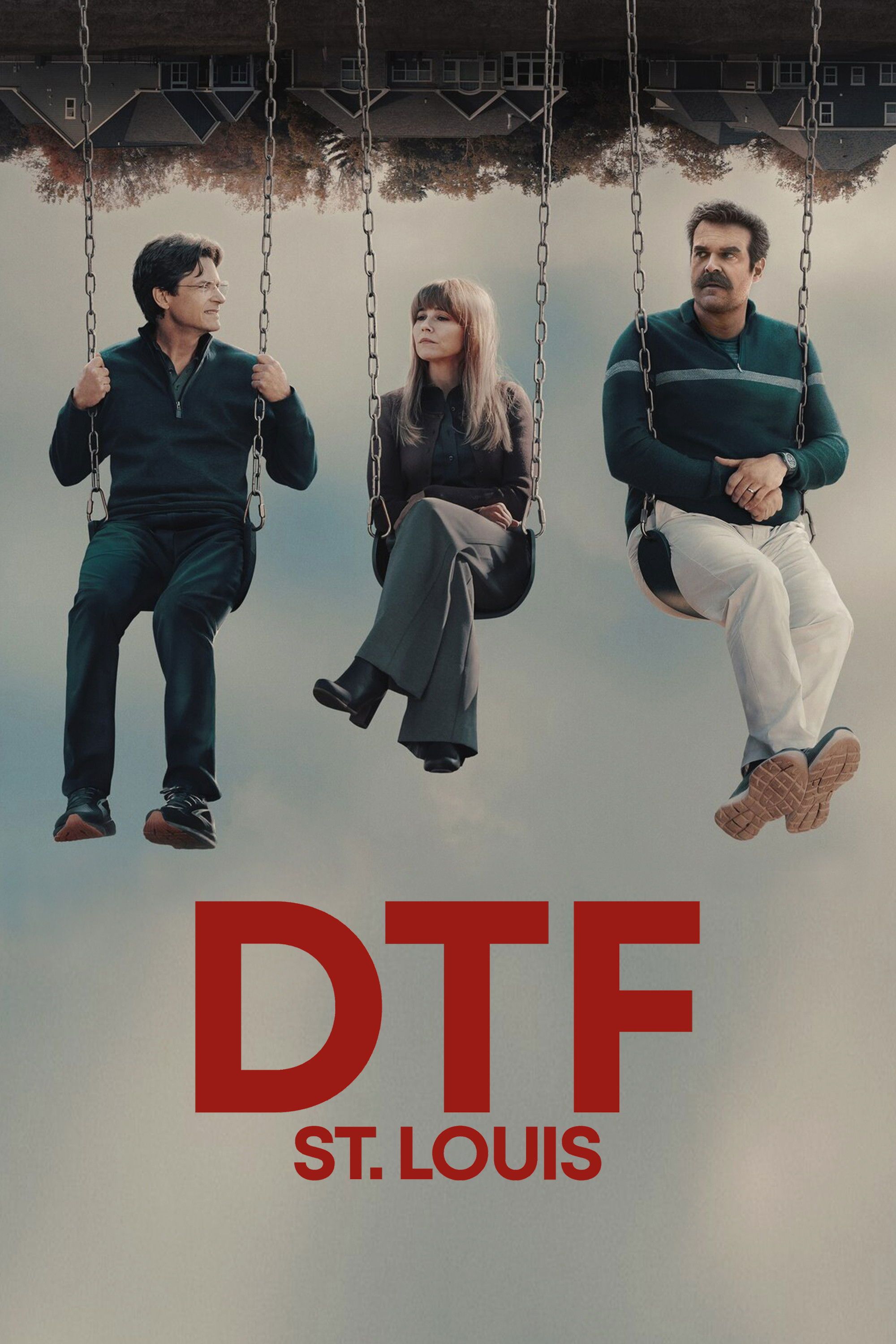

HBO Max is currently showcasing two notable series: 'DTF St. Louis,' a star-studded crime story praised for its blend of...

SZA Slams Chart Predictions, Defying Taylor Swift Comparison: 'Anything Is Possible!'

SZA's album SOS defied expectations by topping the Billboard 200 over Taylor Swift, a feat her label initially doubted. ...

Sam Asghari Demands Privacy Amid Britney Spears’ DUI Arrest After Explosive Comments

Sam Asghari has addressed Britney Spears' recent DUI arrest during a Fox News interview, calling for privacy for his ex-...

Giant Meets Miniature! World's Tallest Dog Shares Paws With the Smallest Canine Star!

The world's shortest dog, Pearl the Chihuahua, and a towering Great Dane named Reggie, had an unforgettable playdate arr...

End of an Era: Girl Scouts Announce Retirement of Two Beloved Cookie Flavors After 2025 Season!

Girl Scout cookie season is officially underway, but fans should prepare to say goodbye to Toast-Yay! and S’mores, which...

Unlock Peak Performance: Timing Magnesium for Ultimate Muscle Recovery

:max_bytes(150000):strip_icc()/Health-GettyImages-MagnesiumBeforeOrAfterWorkout-1012169458424c3791686bd6c68427e5.jpg)

Magnesium is vital for athletes, supporting muscle function, energy, and recovery, with increased demands during intense...