Fed Shakes Crypto: Interest Rate Cut Triggers Bitcoin Volatility

Bitcoin (BTC) experienced a significant price surge today, briefly climbing above $94,000 and reaching a seven-day high of $94,500, following a key decision by the Federal Reserve. The U.S. central bank announced a 25-basis-point reduction in its benchmark interest rate, setting the new target federal funds rate range to 3.50%–3.75%. This marks the third rate cut implemented by the Fed this year and the first since October, aligning policy closer to its long-term view of a neutral rate at 3%.

The Federal Reserve's decision was primarily aimed at supporting maximum employment and managing "somehow elevated" inflation, as stated by Fed Chair Jerome Powell. The central bank noted moderate economic expansion and slowing job gains as factors influencing the move. While the rate cut was largely anticipated by markets, with probabilities around 90% according to forecasts from major firms like Morgan Stanley, J.P. Morgan, and Bank of America, the vote was not unanimous. Most officials supported the reduction, but three dissented: one advocated for a larger 50-basis-point cut (Stephen Miran), and two preferred to maintain the rate unchanged (Austan Goolsbee and Jeffrey Schmid). Additionally, the Fed plans to inject liquidity into the U.S. financial system by purchasing $40 billion of Treasury bills per month.

Despite the immediate boost to Bitcoin's price, with BTC currently trading around $92,505 and showing a roughly 3% increase over the last 24 hours, broader financial markets presented mixed signals. The 10-year Treasury yield, for instance, has risen, indicating investor concerns that current easing policies might fuel future inflation. Fed forecasts, including the "dot plot" projections, remain modest for 2026 and 2027, anticipating small rate reductions, an unemployment rate of 4.4%, PCE inflation at 2.4%, and GDP growth at 2.3%. The previous rate cut in October saw Bitcoin price slip from $116,000 to $111,000, and Bitcoin has since plunged to lows of $80,000, showing varied responses to past Fed actions.

The current Bitcoin rally also reflects a broader trend of increased adoption and institutional interest in digital assets. PNC Bank, a major U.S. financial institution, has begun offering direct spot bitcoin trading to its eligible Private Bank clients, leveraging Coinbase's infrastructure. Concurrently, Bank of America recently advised its wealth management clients to allocate 1%–4% of their portfolios to digital assets. Coinbase Institutional further highlighted that speculative leverage has decreased significantly, from 10% to 4%–5% of total market capitalization, suggesting a potential reduction in extreme market volatility. Ark Invest CEO Cathie Wood has also posited that the market may have already experienced its four-year cycle lows.

From a technical analysis perspective, Bitcoin experienced a volatile week prior to the Fed's decision, dipping to $84,000 before being pushed up to $94,000, then slightly falling below $88,000, and ultimately closing the week at $90,429. Currently, key support levels for Bitcoin are identified at $87,200 and $84,000, with deeper support zones around $72,000–$68,000 and $57,700. Resistance levels are noted at $94,000, $101,000, $104,000, and a substantial zone between $107,000–$110,000, with momentum likely slowing above $96,000. While rate cuts traditionally lead to bullish momentum, the market's pre-emption of this particular cut means its impact might have been largely priced in already. Bitcoin remains approximately 25% below its all-time highs.

Recommended Articles

Crypto Carnage Strikes: Bitcoin Price Crashes to $75K Amid Market-Wide Sell-Off

Bitcoin's price plummeted to nearly $75,000 today in a high-volume sell-off, erasing over 10% from recent highs and trig...

Ancient Bitcoin Whale Awakens: $500M Dump After 12 Years Yields Jaw-Dropping 31,250% Profit!

A dormant Bitcoin whale, known as "5K BTC OG," has re-emerged after 12 years to sell half of its 5,000 BTC stash, earnin...

Bitcoin Bloodbath: $200 Million Liquidated as Price Plummets Below $87K

Bitcoin faces an extremely bearish outlook this week, struggling to hold the $84,000 support level after a significant w...

Crypto Crash: Bitcoin Tumbles to $88K, Yet JPMorgan Holds Firm on $170K Target!

Bitcoin recently plunged to $88,000s, but JPMorgan remains bullish with a $170,000 target, heavily influenced by corpora...

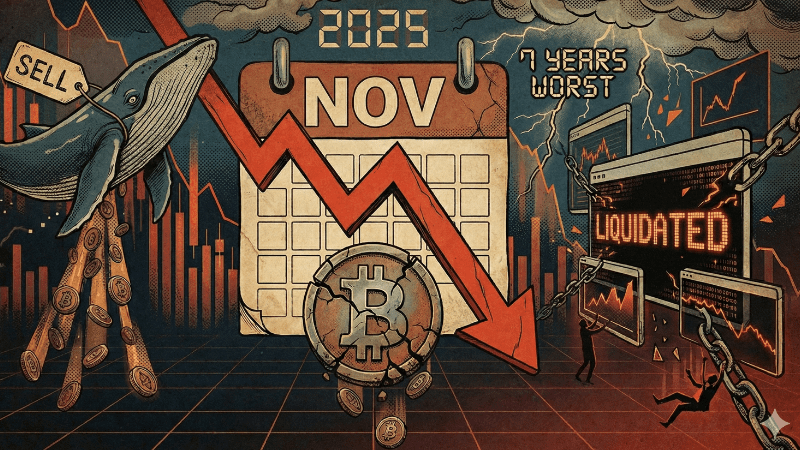

Crypto Carnage: Bitcoin Plummets 17%, Marking Worst Month in Seven Years!

Bitcoin endured a harsh November 2025, plunging 17.49% in its worst monthly drop since 2018, driven by massive ETF redem...

You may also like...

The Fresh Start Lie: What February Reveals About Your “New Year, New Me”

It’s February. After all the hype about the one million and one things you swore you’d do in January, you didn’t tick a ...

Is Our Phones Listening Or Do They Already Know Us Too Well?

AI has changed how ads work but at what cost? Read about this to explore AI, big tech, targeted advertising, and why onl...

February 2026 Horror Releases You Shouldn’t Miss

February ditches romance for terror as eight major horror releases—from Scream 7 to The Strangers: Chapter 3—turn 2026 i...

Common Fundraising Myths That Affect Early-Stage Founders

Fundraising is often misunderstood by early-stage founders. This article breaks down common fundraising myths and explai...

King Carlos Alcaraz Makes History! Youngest Man to Complete Grand Slam at Australian Open!

)

Carlos Alcaraz, at just 22, has claimed the Australian Open 2026 men's singles title, completing a historic Career Grand...

Super Eagles Star Ademola Lookman Shocks Fans, Picks Atletico Madrid Over Fenerbahce in Sensational €40M Move!

Super Eagles star Ademola Lookman has completed a €40 million transfer to Atlético Madrid from Atalanta, choosing the Sp...

Bridgerton Season 4 Shocks with Cinderella-esque Success & Hyacinth's Bold New Storyline

Bridgerton Season 4 triumphs on Netflix with the Cinderella-esque romance of Benedict Bridgerton and Sophie Baek, who is...

Oscar Nominee Renate Reinsve Dazzles at Göteborg with Bold New Film 'Butterfly'

The Indian SUV market sees compact SUVs leading sales in FY2025, with Tata Punch topping the charts. Maruti Brezza ...