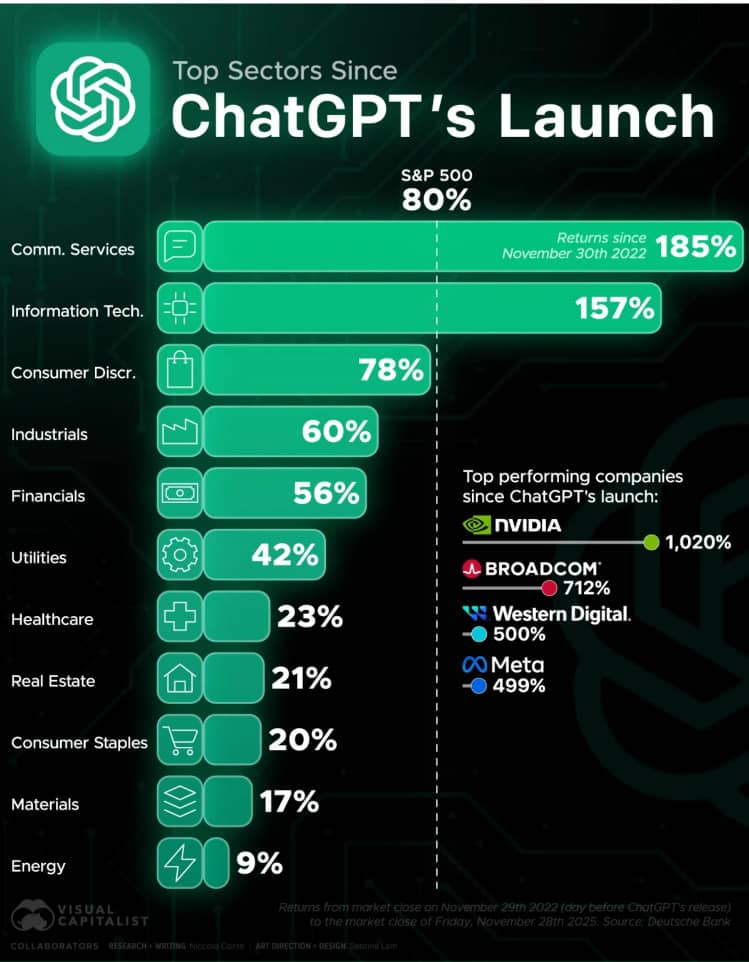

The Market After ChatGPT: Top Sectors Since AI Launch

When ChatGPT launched to the public in late November 2022, it was widely framed as a technological curiosity, an impressive chatbot capable of writing essays, answering questions, and mimicking human conversation.

Few observers, outside a narrow circle of technologists and venture capitalists, grasped what was unfolding beneath the surface. Yet within months, financial markets began to register something deeper: artificial intelligence was no longer a niche innovation cycle, but a structural economic shift.

The performance of global equities since ChatGPT’s release tells a story that goes far beyond one product or one company. It reveals how capital reallocates itself when a new general-purpose technology enters the mainstream.

Entire sectors surged ahead of the broader market, while others lagged behind, exposing fault lines between industries positioned to absorb AI and those structurally resistant to it.

The question is not whether AI changed markets; it did, but how, why, and at what cost.

ChatGPT as a Market Signal, Not a Market Cause

It is tempting to treat ChatGPT as the singular trigger of the current AI-driven market rally. That interpretation is neat, media-friendly, and ultimately incomplete. ChatGPT did not create artificial intelligence, nor did it invent the underlying technologies powering today’s models. What it did was more subtle and arguably more important: it made AI legible to the public and undeniable to investors.

For decades, machine learning evolved quietly inside data centers, recommendation engines, fraud detection systems, and enterprise software. Its economic impact was real but diffuse, difficult to narrate, and largely invisible to non-specialists.

ChatGPT changed that by offering a consumer-facing interface that collapsed technical abstraction into direct experience. Anyone with an internet connection could suddenly see, in real time, what advanced language models could do.

Markets respond not just to innovation, but to clarity. ChatGPT provided a clear signal that AI had crossed from experimental to deployable at scale. Within weeks of its release, earnings calls across industries began to include AI language that went beyond buzzwords. Executives spoke less about “exploring AI” and more about “integrating,” “deploying,” and “monetizing” it.

This shift in corporate rhetoric mattered. Markets are forward-looking mechanisms, and once investors understood that AI was no longer a distant promise but an operational tool, capital moved accordingly. The result was a sharp divergence in sector performance that mirrored AI readiness rather than overall economic health.

Why Communication Services and Technology Left the Market Behind

Among all sectors, communication services and information technology experienced the most dramatic post-ChatGPT gains, significantly outperforming the broader market. This was not accidental, nor was it purely speculative.

Communication services, which include social media platforms, digital advertising firms, and content distribution networks, sit at the intersection of language, attention, and data, precisely the domains where large language models excel.

Latest Tech News

Decode Africa's Digital Transformation

From Startups to Fintech Hubs - We Cover It All.

Companies in this sector were among the first to recognize AI not as an auxiliary tool but as a core product enhancer. Automated content moderation, ad targeting, customer interaction, and creator tools all became immediate beneficiaries of generative AI.

Technology companies, particularly those involved in semiconductors, cloud infrastructure, and enterprise software, saw even stronger tailwinds. The reason is structural: AI is computationally expensive.

Training and deploying large models requires massive processing power, specialized chips, and scalable cloud architecture. Firms positioned along this supply chain captured value long before end-users saw tangible benefits.

This explains why semiconductor companies, especially those producing advanced GPUs and AI-optimized hardware, emerged as the single most dominant winners of the post-ChatGPT era.

Their performance was not driven by speculative narratives alone, but by exploding demand for the physical infrastructure of intelligence. Data centers expanded, cloud contracts multiplied, and AI workloads reshaped capital expenditure priorities across industries.

Crucially, these gains did not occur in isolation. They reflected a re-pricing of technological necessity. AI shifted from being a competitive advantage to becoming a baseline requirement. Companies unable to integrate it risked obsolescence; those enabling it became indispensable.

The Uneven Middle: Industries That Benefited Without Transforming

Not all sectors experienced explosive growth, but several recorded solid, above-market returns. Consumer discretionary, industrials, and financials occupy this middle ground, industries that benefit from AI adoption without being fundamentally rebuilt by it.

In consumer discretionary, AI improved demand forecasting, inventory management, and personalized marketing. Retailers and e-commerce platforms used generative models to optimize pricing strategies and customer engagement, improving margins without altering their core business models. The gains were real but incremental, reflected in respectable rather than spectacular returns.

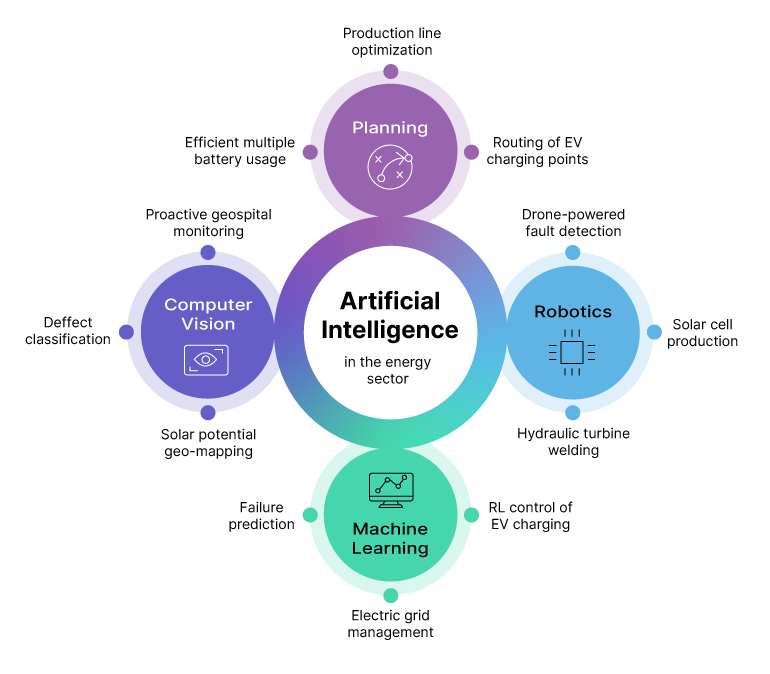

Industrials followed a similar pattern. AI enhanced predictive maintenance, logistics optimization, and manufacturing efficiency. These improvements reduced downtime and operational waste, but they did not radically disrupt industrial value chains.

Heavy machinery still needs to be built; supply chains still require physical movement. AI acted as an efficiency multiplier, not a replacement.

Financial services present a more complex case. Banks and financial institutions were early adopters of machine learning, long before ChatGPT. Fraud detection, risk modeling, and algorithmic trading had already integrated AI at scale.

Generative models added new capabilities: customer service automation, document analysis, and compliance monitoring, but these enhancements layered onto an already mature digital infrastructure.

The market rewarded these sectors for adaptability rather than transformation. Their performance suggests that AI’s economic impact is not uniform. It amplifies existing strengths more than it creates entirely new ones in structurally constrained industries.

Why Defensive Sectors Lagged the AI Boom

Latest Tech News

Decode Africa's Digital Transformation

From Startups to Fintech Hubs - We Cover It All.

While some sectors surged and others held steady, several lagged notably behind the broader market. Utilities, healthcare, real estate, consumer staples, materials, and energy form the defensive backbone of the economy. Their slower growth in the post-ChatGPT period reveals important truths about AI’s limits.

These industries are capital-intensive, heavily regulated, and often constrained by physical infrastructure. While AI can optimize processes within them, it cannot easily overcome regulatory barriers, long investment cycles, or resource dependency.

A utility company cannot deploy generative AI to instantly expand grid capacity. A healthcare provider cannot bypass clinical trials or ethical oversight through automation.

Healthcare, in particular, illustrates the tension between technological potential and institutional reality. AI promises breakthroughs in diagnostics, drug discovery, and patient care, but translating these promises into revenue requires regulatory approval, clinical validation, and public trust. Markets price in this delay, resulting in more muted performance despite long-term optimism.

Energy and materials face similar constraints. AI can improve exploration efficiency and operational safety, but it cannot change the fundamental economics of extraction, commodity pricing, or geopolitical risk. These sectors move at the pace of physical reality, not software iteration.

What this reveals is critical: AI is not an equal-opportunity disruptor. Its impact is filtered through regulatory frameworks, asset structures, and time horizons. Markets understand this, and capital flows accordingly.

Beyond the Numbers: What the Post-ChatGPT Market Really Tells Us

The rally that followed ChatGPT’s launch is not just a tale of technological enthusiasm. It is a case study in how markets interpret structural change. Investors did not bet on chatbots; they bet on a reorganization of economic value around intelligence.

The divergence between sectors reflects readiness, adaptability, and infrastructural position. The dominance of a few firms reflects control over computational resources. The lagging performance of defensive sectors reminds us that not all problems yield to code.

Perhaps most importantly, this moment challenges simplistic narratives about innovation. AI is neither a universal saviour nor an abstract threat. It is a tool whose impact depends on who controls it, who deploys it, and which systems it enters.

The post-ChatGPT market is still unfolding. Volatility will return. Expectations will adjust. Some bets will fail. But the structural reallocation of capital has already occurred. Markets have spoken, not in hype, but in sustained divergence.

And what they have said is clear: intelligence has become an asset class, and the world is still learning how to price it.

You may also like...

Explosive Racism Claims Rock Football: Ex-Napoli Chief Slams Osimhen's Allegations

Former Napoli sporting director Mauro Meluso has vehemently denied racism accusations made by Victor Osimhen, who claime...

Chelsea Forges Groundbreaking AI Partnership: IFS Becomes Shirt Sponsor!

Chelsea Football Club has secured Artificial Intelligence firm IFS as its new front-of-shirt sponsor for the remainder o...

Oscar Shockwave: Underseen Documentary Stuns With 'Baffling' Nomination!

This year's Academy Awards saw an unexpected turn with the documentary <i>Viva Verdi!</i> receiving a nomination for Bes...

The Batman Sequel Awakens: Robert Pattinson's Long-Awaited Return is On!

Robert Pattinson's take on Batman continues to captivate audiences, building on a rich history of portrayals. After the ...

From Asphalt to Anthems: Atlus's Unlikely Journey to Music Stardom, Inspiring Millions

Singer-songwriter Atlus has swiftly risen from driving semi-trucks to becoming a signed artist with a Platinum single. H...

Heartbreak & Healing: Lil Jon's Emotional Farewell to Son Nathan Shakes the Music World

Crunk music icon Lil Jon is grieving the profound loss of his 27-year-old son, Nathan Smith, known professionally as DJ ...

Directors Vow Bolder, Bigger 'KPop Demon Hunters' Netflix Sequel

Directors Maggie Kang and Chris Appelhans discuss the phenomenal success of Netflix's "KPop Demon Hunters," including it...

From Addiction to Astonishing Health: Couple Sheds 40 Stone After Extreme Diet Change!

South African couple Dawid and Rose-Mari Lombard have achieved a remarkable combined weight loss of 40 stone, transformi...