Oil Prices React as OPEC+ Maintains Output Hike Schedule for July

Oil prices experienced a significant rebound on Monday, climbing more than $1 a barrel. This surge followed the decision by the Organization of the Petroleum Exporting Countries and their allies, collectively known as OPEC+, to increase oil output in July by 411,000 barrels per day (bpd). This figure matched the increases made in each of the preceding two months and came as a relief to market participants who had anticipated a potentially larger hike.

Specifically, Brent crude futures saw an increase of $1.46, or 2.33%, to reach $64.24 a barrel by 0626 GMT, after having settled 0.9% lower on the previous Friday. Similarly, U.S. West Texas Intermediate (WTI) crude was trading at $62.45 a barrel, up $1.66, or 2.73%, following a 0.3% decline in the prior session. It's noteworthy that both benchmarks had registered a decline of more than 1% in the preceding week.

The OPEC+ decision, made on Saturday, to raise output by 411,000 bpd for July marks the third consecutive month the group has implemented an increase of this magnitude. The group's strategy appears aimed at wrestling back market share and addressing instances of over-production by some member countries. Analysts noted that a larger, unexpected increase could have led to a significantly negative market reaction. Harry Tchilinguirian of Onyx Capital Group commented, "Had they gone through with a surprise larger amount, then Monday's price open would have been pretty ugly indeed."

Oil traders indicated that the 411,000 bpd output hike had largely been anticipated and was already factored into the prevailing Brent and WTI futures prices. The Commonwealth Bank of Australia, in a note, suggested that a key motive behind the decision was to discipline OPEC+ members like Iraq and Kazakhstan, which have been persistently producing above their agreed-upon quotas. In a related development, Kazakhstan reportedly informed OPEC that it does not plan to reduce its oil production, as per a report by Russia's Interfax news agency citing Kazakhstan's deputy energy minister.

Looking ahead, analysts at Goldman Sachs anticipate that OPEC+ will likely implement a final production increase of 410,000 bpd in August. Their reasoning, outlined in a note, points to "relatively tight spot oil fundamentals, beats in hard global activity data, and seasonal summer support to oil demand." These factors suggest that the expected slowdown in demand is unlikely to be severe enough to deter OPEC+ from further raising production when they convene to decide on August levels on July 6th.

Several other market dynamics are also influencing oil prices. Low levels of U.S. fuel inventories have stoked supply jitters, particularly with expectations of an above-average hurricane season, which could disrupt production and refining operations. On a more encouraging note for demand, ANZ analysts highlighted a "huge spike in gasoline implied demand" in the U.S. as the traditional driving season commenced. This increase, nearly 1 million bpd, was reported as the third-highest weekly gain in the last three years.

Traders are also keeping a close watch on the impact of price fluctuations on U.S. crude production, which achieved an all-time high of 13.49 million bpd in March. However, recent data indicates a potential slowdown, as the number of operating oil rigs in the U.S. fell for a fifth consecutive week. According to Baker Hughes' weekly report, the count dropped by four to 461, marking the lowest level since November 2021.

You may also like...

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

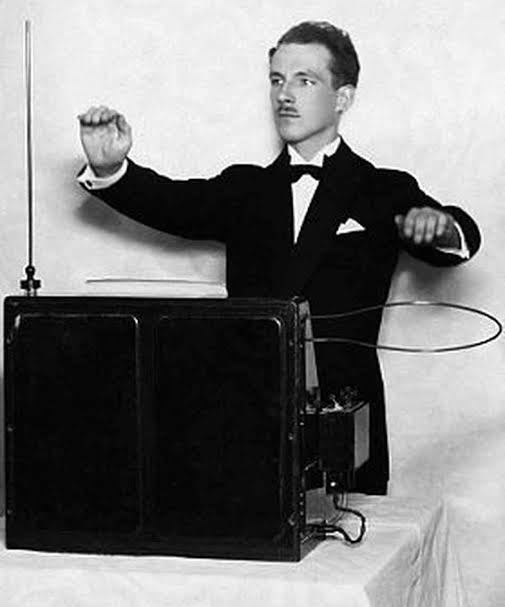

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...