Israel-Iran Conflict Escalation Roils Markets and Spikes Oil Prices

US stock markets experienced a sharp downturn on Friday, closing the trading day significantly lower, as geopolitical tensions escalated following Israel's airstrikes on Iranian nuclear and military facilities and subsequent Iranian retaliatory missile strikes. The Dow Jones Industrial Average plummeted by approximately 770 points, or 1.8%, while the S&P 500 and Nasdaq also closed near their session lows, down 1.1% and 1.3% respectively. This single day's decline dragged all three major market indexes to close the week lower, with the Dow falling 1.3%, the S&P 500 dipping 0.4%, and the Nasdaq losing 0.6%.

The market's reaction was immediate and pronounced across various sectors. Energy was the sole sector to close in the green on Friday, driven by surging crude oil prices. Over the week, a few more sectors, including healthcare, utilities, and real estate, remained in positive territory or were largely unchanged. However, financials and information technology sectors took the biggest hit, declining by 2.06% and 1.5% respectively on Friday, with financials down two and a half percent for the week. Industrials, despite being the best-performing sector earlier in the year, were also down 1.6%. Declining stocks heavily outnumbered advancers on the S&P 500 by a ratio of 6.1 to 1.

Individual stock performances reflected this broader trend. Among the Magnificent 7, most stocks were down, with the notable exception of Tesla, which gained 2%, and Palantir, up 1.5%. Johnson & Johnson and Chevron were the only two stocks in the Dow to close in the green. Conversely, airline stocks such as Delta Air Lines, United Airlines, and American Airlines saw significant declines (3.8% to 4.9%) due to rising fuel costs and waning travel interest. Major tech companies like Nvidia and Apple also saw their share prices fall by 2.1% and 1.4% respectively, while Visa and Mastercard shares dropped over 4% each. Defense stocks, however, rallied, with Lockheed Martin, RTX Corporation, and Northrop Grumman all gaining over 3%. Oracle shares jumped 7.7% to a record high, while regional banks and gambling stocks took a notable tumble.

A major catalyst for the market's volatility was the dramatic surge in commodity prices, particularly crude oil. Brent crude futures settled up 7.02% at $74.23 a barrel, after soaring over 13% earlier in the session to an intraday high of $78.50, its strongest level since January 27. US West Texas Intermediate (WTI) crude finished 7.62% higher at $72.98 a barrel, having jumped over 14% to its highest since January 21. Both benchmarks recorded their largest intraday moves since 2022, when Russia's invasion of Ukraine caused a similar spike in energy prices. This increase was fueled by investor worries about widespread disruption to oil exports from the Middle East, especially through the vital Strait of Hormuz, a narrow passage through which about a fifth of the world’s total oil consumption (18 to 19 million barrels per day) passes. Despite reports from Iran's National Iranian Oil Refining and Distribution Company that its oil refining and storage facilities, including Kharg Island (responsible for 90% of Iran's crude exports), remained undamaged and operational, concerns persisted. Analysts also noted that OPEC and its allies, including Russia, possess spare capacity roughly equivalent to Iran's 3.3 million barrels per day production (over 2 million bpd exported), which could potentially offset some supply disruptions. However, the possibility of an

You may also like...

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

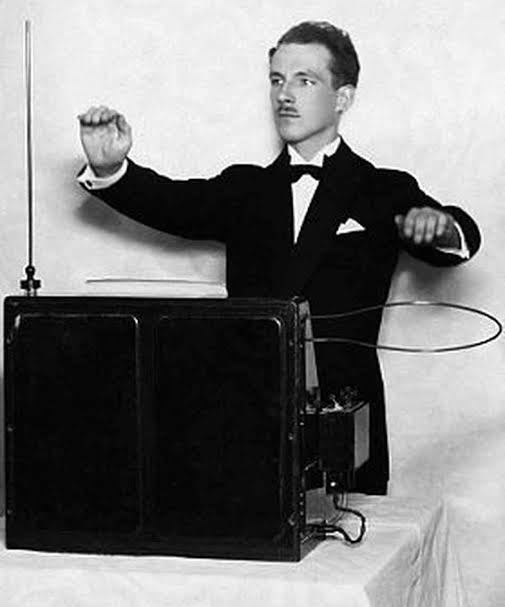

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...

Recommended Articles

Oil Prices Dip on Anticipation of OPEC+ Output Increase

Global oil prices experienced a slight dip on Friday, July 5, 2025, as markets anticipated an expected output increase f...

Oil Prices Dip on Anticipation of OPEC+ Output Increase

Oil prices saw a slight decline on Friday as markets anticipated an OPEC+ meeting expected to announce increased output....

Indian Rupee Plummets to 86.08 Against USD Amid Regional Tensions

The Indian rupee sharply declined against the US dollar on Friday, influenced by surging global oil prices and escalatin...

Oil Prices React as OPEC+ Maintains Output Hike Schedule for July

Oil prices surged over $1 a barrel on Monday after OPEC+ announced a July output increase of 411,000 barrels per day, a ...

Markets React to Trump Tariff Ruling: Oil, Dollar Surge, Sensex Climbs

A U.S. court's decision to block President Trump's import tariffs sparked a rally in the U.S. dollar and boosted oil pri...