Indian Rupee Plummets to 86.08 Against USD Amid Regional Tensions

The Indian rupee experienced a significant decline against the US dollar in early trade on Friday, June 13, 2025, falling 56 paise to 86.08. This depreciation was primarily driven by a sharp increase in global oil prices, a strengthening dollar, and escalating tensions in the Middle East following an Israeli attack on Iran's nuclear sites. Concurrently, domestic equity markets saw a weak opening, and heavy outflows from Foreign Institutional Investors (FIIs) further exacerbated the pressure on the local currency.

At the interbank foreign exchange market, the rupee opened at 86.25 against the greenback before slightly recovering to 86.08, marking a 56 paise drop from its previous close of 85.52 on Thursday, June 12, 2025. Anil Kumar Bhansali, Head of Treasury and Executive Director at Finrex Treasury Advisors LLP, commented on the situation, stating, "The rupee opened weak as hostility in the Middle East kept tensions boiling and risk appetite taking a hit with Gift Nifty down 285 points." He further added, "As Israel struck Iran, explosions were heard in Tehran with tensions mounting over U.S. efforts to win Iran’s agreement to halt production of material for Nuclear bombs."

The broader global economic environment also played a role in the rupee's downturn. The dollar index, which measures the greenback's strength against a basket of six major currencies, climbed 0.31 percent to 98.22. Brent crude, the international benchmark for oil prices, surged by a notable 8.59 percent to $75.32 per barrel in futures trade, reflecting the heightened geopolitical risks. Data from exchanges indicated that Foreign Institutional Investors offloaded equities worth ₹3,831.42 crore on a net basis on Thursday.

In the domestic equity market, both key indices registered substantial losses. The 30-share BSE Sensex plummeted by 1,337.39 points to reach 80,354.59 in early trade on Friday, while the Nifty tumbled 415.2 points, settling at 24,473. These market reactions underscored the prevailing risk-off sentiment among investors.

Adding to the somber news on Thursday, June 12, 2025, a tragic air disaster occurred when a London-bound Air India plane, carrying 242 passengers and crew, crashed into a medical college complex in Ahmedabad less than a minute after takeoff. The incident resulted in the deaths of at least 265 people, including several individuals on the ground, marking one of the country's worst air tragedies in recent times.

Despite the prevailing market volatility, there was a positive economic indicator as retail inflation in the country dipped to an over six-year low of 2.82 percent in May. This was attributed to subdued food prices, and it marked the fourth consecutive month that inflation remained below the Reserve Bank of India's (RBI’s) median target of 4 percent, according to government data released on Thursday.

Looking ahead, Anil Kumar Bhansali projected the rupee's expected range for Friday, June 13, 2025, to be between 85.70 and 86.25. He advised that this could present an "opportunity for exporters to sell their receivables as the RBI will surely step in to curb the volatility," while urging "importers to wait and watch the situation as it develops."

You may also like...

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

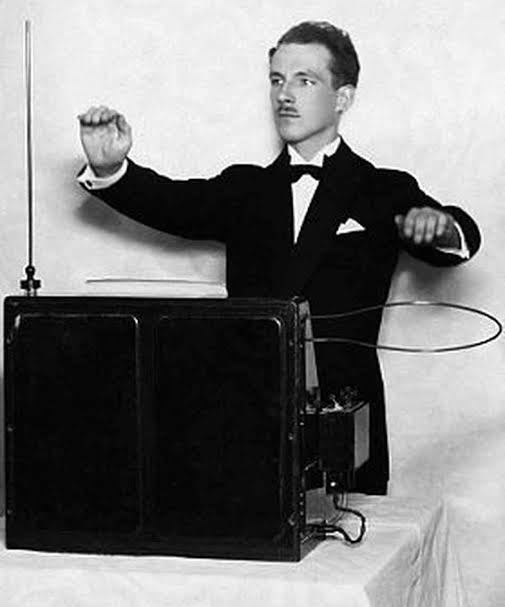

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...