Markets React to Trump Tariff Ruling: Oil, Dollar Surge, Sensex Climbs

A significant U.S. court decision on Thursday to block President Donald Trump from imposing his widespread import tariffs sent ripples across global financial markets, triggering a notable rally in the U.S. dollar and an uptick in oil prices. The Manhattan-based Court of International Trade ruled that the U.S. Constitution grants Congress exclusive authority to regulate commerce with other nations, a power not overridden by presidential emergency powers. The Trump administration promptly filed an appeal, signaling potential for a protracted legal battle.

In an immediate response to the ruling, the U.S. dollar strengthened. It rose 0.72% against the yen to 145.86 and gained 0.63% against the Swiss franc, reaching 0.8326. Concurrently, the euro declined by 0.42% to $1.1245, and sterling fell 0.30% to $1.3432. This surge pushed the dollar index, which measures the U.S. currency against six major peers, back above the 100 mark for the first time in a week. However, analysts noted that the index remains down approximately 8% for the year.

Market analysts attributed the dollar's appreciation to the perception that a reversal of Trump's tariffs could alleviate stagflationary pressures on the U.S. economy. Yunosuke Ikeda, head of macro research at Nomura, commented, "Trump's tariffs will lead to stagflation pressure on the U.S. economy, so reversing those tariffs would be a positive for the dollar." This development offered some respite for U.S. assets, including the dollar, equities, and longer-dated Treasury bonds, which had seen sharp declines in recent months amid investor concerns over erratic trade and tax policies.

Despite the initial positive reaction, skepticism remains regarding a sustained dollar rally. Hirofumi Suzuki, chief FX strategist at SMBC, cautioned, "There's an initial reaction of a stronger dollar and weaker yen. However, considering judicial processes like appeals, I don't expect a continuous rise in the dollar." Since Trump imposed harsh levies on global economies on April 2, the greenback had weakened significantly, by about 2% against the Japanese yen, nearly 6% against the Swiss franc, and 4% against the euro, with the broader dollar index falling more than 3%. Tohru Sasaki, chief strategist at Fukuoka Financial Group, observed that "The markets are buying back the dollar on the news, rather than selling the yen," adding a note of caution that a further rise above 148 yen could trigger an unwinding of speculative short yen positions.

The court's decision also positively impacted oil markets. Brent crude futures climbed 78 cents, or 1.2%, to $65.68 a barrel, while U.S. West Texas Intermediate (WTI) crude advanced by 78 cents, or 1.3%, to $62.62 a barrel as of 0405 GMT on Thursday. The ruling buoyed risk appetite across global markets, which had been on edge about the potential impact of the tariffs on economic growth. However, similar to the currency market outlook, analysts suggest this relief might be temporary given the administration's intention to appeal.

Matt Simpson, an analyst at City Index in Brisbane, remarked on the oil market's reaction, stating, "But for now, investors get a breather from the economic uncertainty they love to loathe." Beyond the tariff news, the oil market is also navigating several other critical factors. There are ongoing concerns about potential new U.S. sanctions that could curb Russian crude flows. Additionally, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) are expected to decide on Saturday whether to accelerate oil production hikes in July. ING analysts anticipate the group will agree on "another large supply increase of 411,000 barrels per day," with similar increases expected through the end of the third quarter as OPEC+ focuses on defending market share.

Supply dynamics are further complicated by recent developments in Venezuela and Canada. Chevron has terminated its oil production and other activities in Venezuela after its key license was revoked by the Trump administration in March. Prior to this, Chevron was exporting approximately 290,000 barrels per day (bpd) of Venezuelan oil, accounting for over a third of the country's total exports. This follows Venezuela's cancellation of Chevron-scheduled cargoes in April due to payment uncertainties linked to U.S. sanctions. Separately, a wildfire in Alberta, Canada, has prompted the temporary shutdown of some oil and gas production, potentially reducing supply further.

Despite these supply-side uncertainties, some analysts maintain a constructive outlook for oil demand. Mukesh Sahdev, Global Head of Commodity Markets at Rystad Energy, noted, "From May through August, the data points to a constructive, bullish bias with liquids demand set to outpace supply," projecting demand growth to outpace supply growth by 600,000 to 700,000 bpd. Investors are also keenly awaiting weekly inventory reports from the American Petroleum Institute (API) and the Energy Information Administration (EIA). Preliminary market sources familiar with API data indicated that U.S. crude and gasoline stocks fell last week, while distillate inventories rose.

Overall, the court ruling provided a temporary boost to market sentiment, reflected in jumps in U.S. stock futures and Asian bourses. Traders also adjusted their expectations for interest rate cuts by the Federal Reserve, reducing anticipated easing to 42 basis points from 50 basis points earlier in the week. Nevertheless, investor focus remains on the bond market, worsening government deficits, and the progress of a U.S. budget and spending bill expected to add trillions to national debt. Recent positive signals included Trump's delay of a plan to impose 50% tariffs on European Union imports, improving sentiment slightly regarding U.S. trade relations.

You may also like...

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

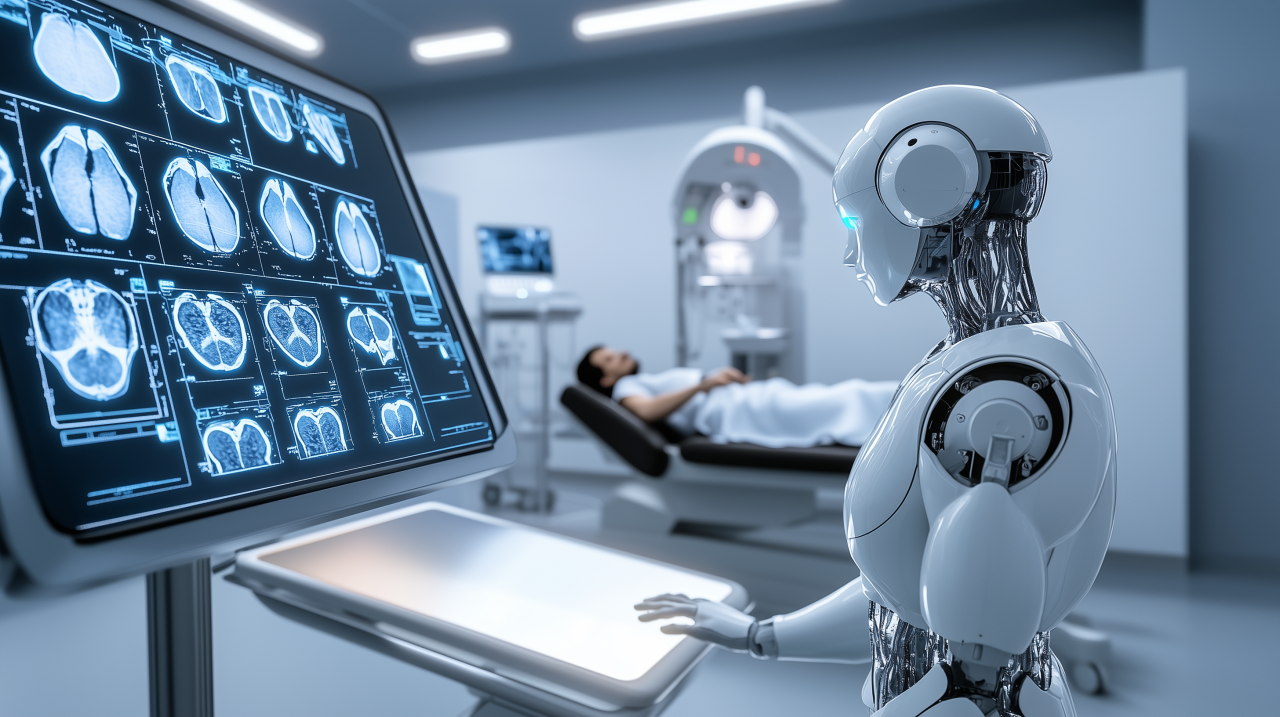

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

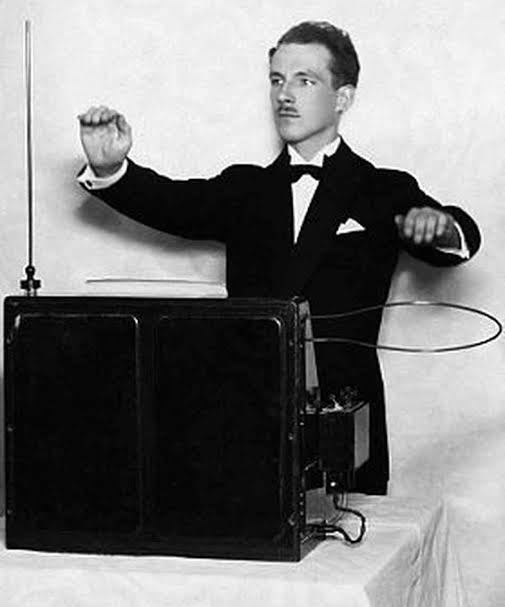

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...