Oil Prices Dip on Anticipation of OPEC+ Output Increase

Oil prices experienced a slight dip on Friday, July 5, 2025, as market participants keenly awaited the weekend's OPEC+ meeting, which was widely expected to result in an increase in oil output. This modest decline occurred amidst thin holiday trading due to the U.S. Independence Day. Brent crude futures saw a decrease of 50 cents, settling at $68.30 a barrel, while U.S. West Texas Intermediate (WTI) crude also fell by 50 cents to $66.50. Despite Friday's slight dip, both Brent and WTI closed the week higher than the previous Friday's levels, indicating underlying market resilience.

Eight OPEC+ countries were anticipated to approve another oil output increase for August at their meeting on Saturday, a day earlier than initially planned. This move is part of their broader strategy to boost market share. Analysts such as PVM's Tamas Varga suggested that if the group proceeds with the expected 411,000 barrels per day (bpd) output increase for the fourth consecutive month, it would necessitate a reassessment of oil balance estimates for the second half of the year, potentially leading to an accelerated swelling of global oil reserves. Phil Flynn, a senior analyst with the Price Futures Group, noted that some profit-taking was evident due to concerns that OPEC might increase production by more than anticipated, leading investors into a "wait-and-see" mode.

Beyond OPEC+ decisions, global oil markets were also influenced by several geopolitical and economic factors. Investors were closely monitoring the implications of a massive package of tax and spending cuts from U.S. President Donald Trump's administration, which was slated to be signed into law on Friday. Furthermore, crude prices faced pressure from reports indicating that the United States was planning to resume nuclear talks with Iran next week. This news came as Iranian foreign minister Abbas Araqchi reaffirmed Tehran's commitment to the nuclear Non-Proliferation Treaty.

Uncertainty surrounding U.S. tariff policy also played a role, as the 90-day pause on higher levies was nearing its end. European Union negotiators had reportedly failed to achieve a breakthrough in trade discussions with the Trump administration, potentially leading them to seek an extension of the status quo to prevent tariff hikes, according to EU diplomats. In a separate development reflecting an improved demand outlook, Barclays announced it had raised its Brent oil price forecast to $72 a barrel for 2025 (an increase of $6) and to $70 a barrel for 2026 (an increase of $10). All these intertwined factors contributed to the complex dynamics observed in the global oil market.

You may also like...

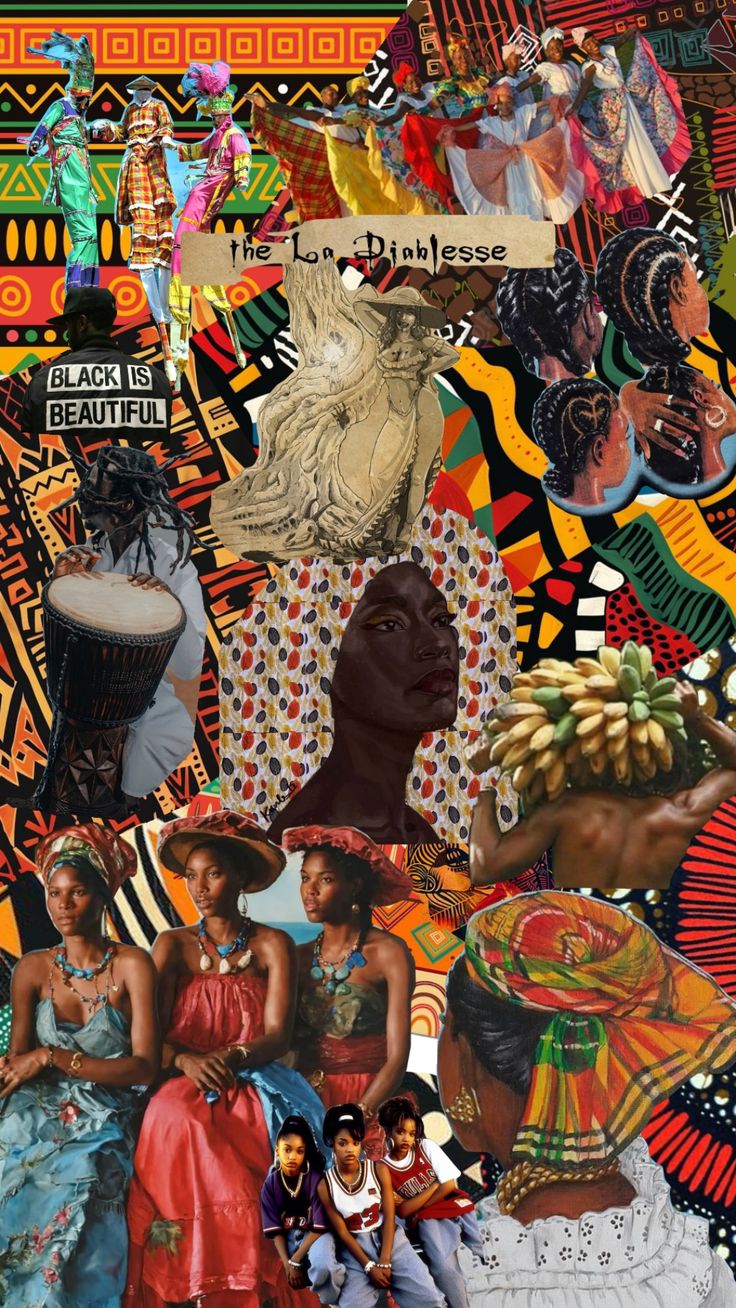

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

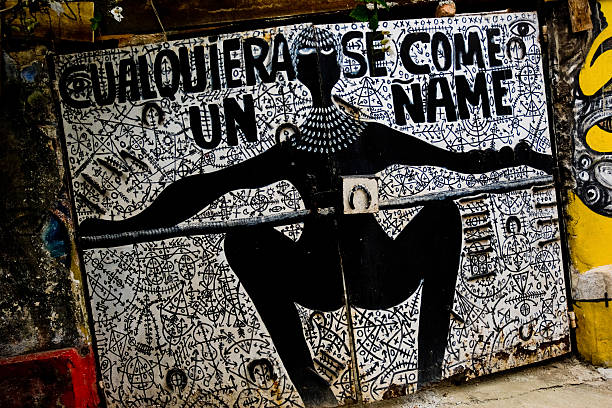

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

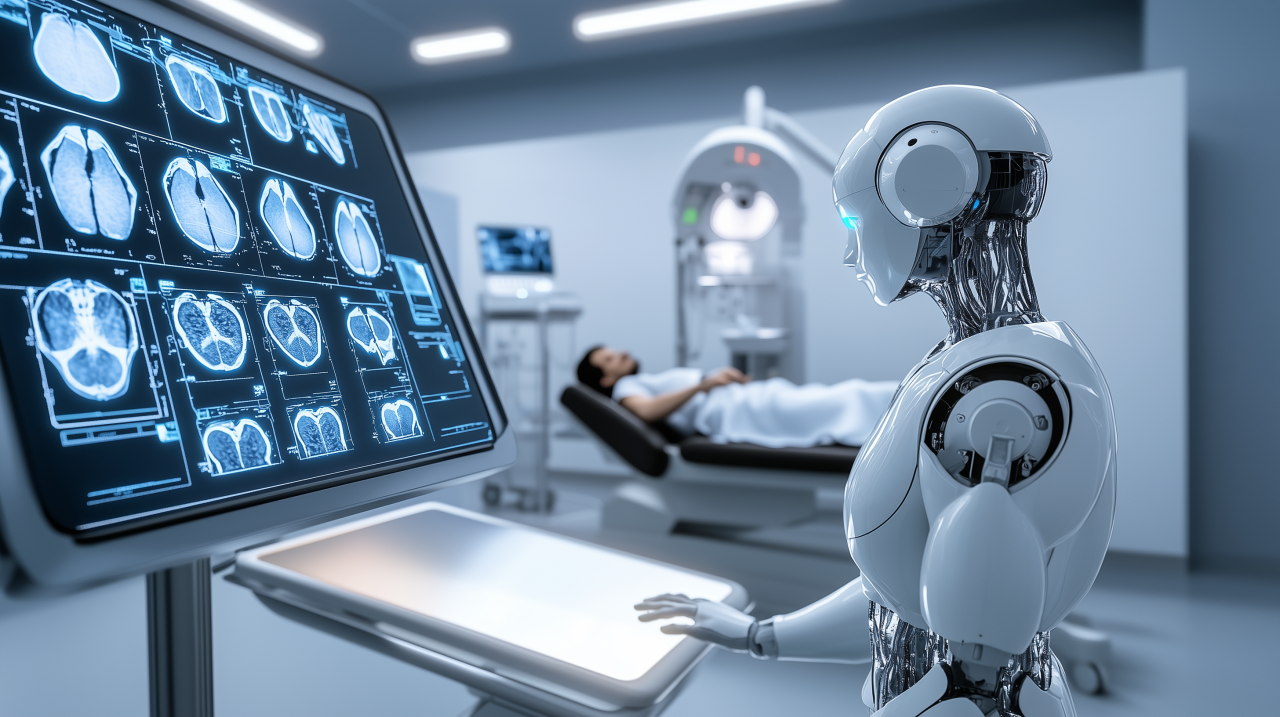

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

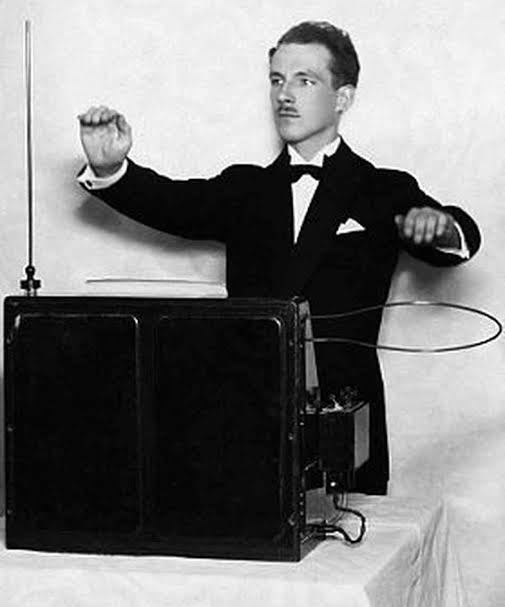

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...