Everyone’s Talking About Flutterwave Acquiring Mono, But What Does Mono Actually Do?

When the news broke that Flutterwave had acquired Mono, tech circles lit up. Group chats buzzed. Headlines flashed with big numbers: an all-stock deal reportedly valued between $25 million and $50 million. At first glance, it seemed like another fintech acquisition. But beneath the price tag lies something far more consequential: a quiet reshaping of Africa’s financial infrastructure.

If you’ve been wondering what Mono actually does, and why everyone is suddenly obsessed, you’re not alone. The truth is simpler than the hype, but the implications are enormous.

Flutterwave’s New Achievement: Data Meets Payments

Flutterwave is already a household name in African fintech. Founded in 2016, it powers transactions for businesses across more than 30 countries, from global giants like Uber and Netflix to small Nigerian merchants selling on Instagram. In short, Flutterwave moves money. Fast, seamless, and invisible.

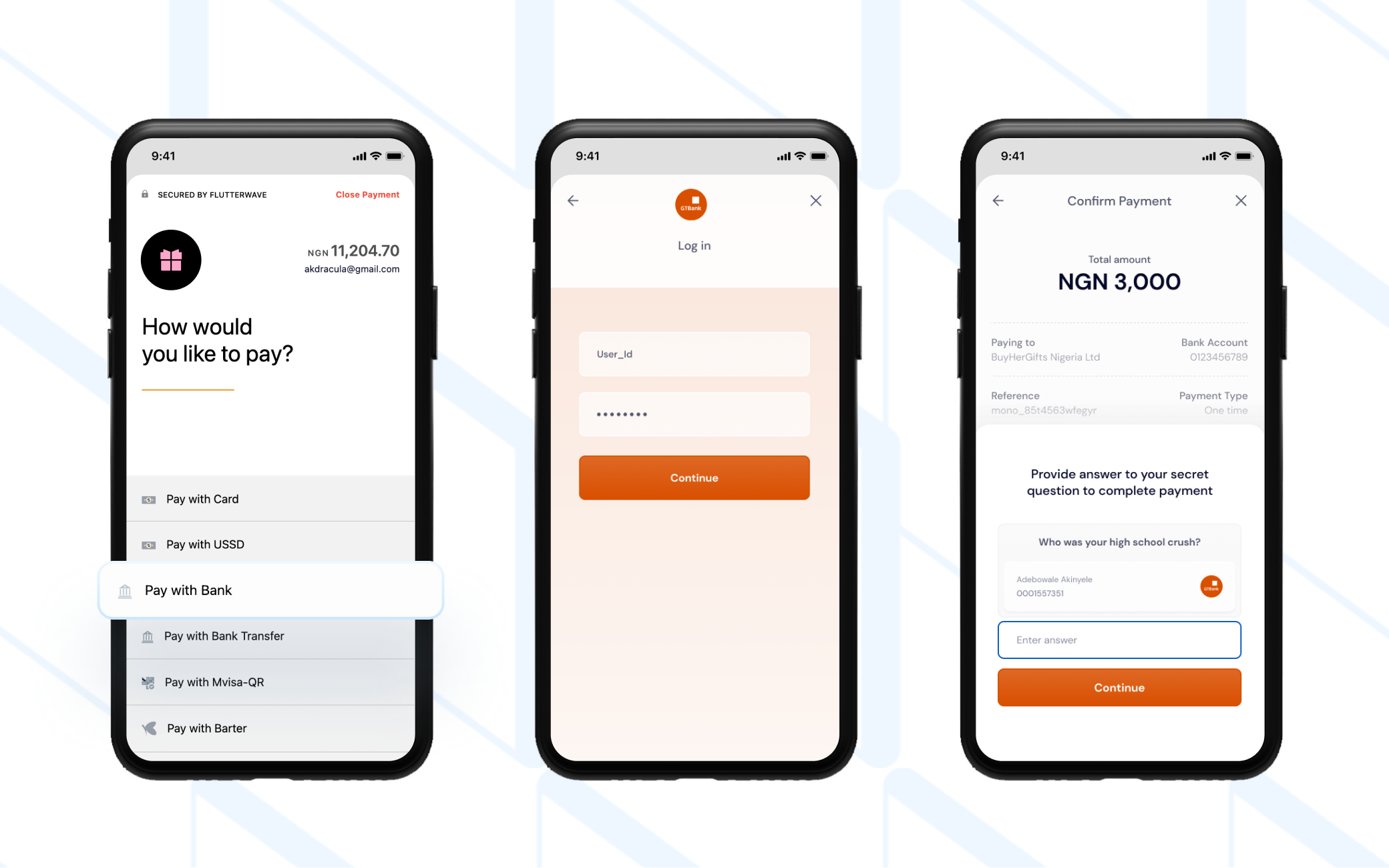

Mono, on the other hand, operates in a less obvious but even more critical layer: financial visibility. Mono’s open-banking platform allows companies, with user consent, to access bank statements, transaction histories, income patterns, and spending behaviour across multiple banks.

In markets where formal credit histories are limited or non-existent, this is nothing short of revolutionary.

By acquiring Mono, Flutterwave isn’t just moving money anymore. It now understands money, giving businesses insight into how people earn, spend, save, and manage their finances. The combination of payment rails and data rails positions Flutterwave as more than a payments company, it’s becoming Africa’s financial operating system.

Why Mono Is a Game-Changer

Mono’s impact is rooted in solving a problem many Africans face daily: financial opacity. Millions earn irregular income, operate partly in cash, and lack formal credit records.

Traditional lending systems struggle to capture this reality, making access to loans, insurance, and other financial services a guessing game.

Mono changes that. Lending apps can now see patterns in income and spending, assess repayment reliability, and reduce risk, all without invasive processes.

Subscriptions, savings platforms, and payroll solutions can now link accounts directly, enabling smoother operations and reducing fraud.

This is the essence of what fintech calls “full-stack infrastructure”. For businesses, it’s about making smarter decisions. For consumers, it’s about services that reflect how they live and earn.

And for Flutterwave, it means moving from being a transaction facilitator to a trusted infrastructure provider that connects money, data, and trust.

What This Deal Means for Mono, and Africa

Mono remains operationally independent, but this acquisition is a major accelerator. Expanding fintech infrastructure in Africa is notoriously difficult because of regulatory diversity, licensing hurdles, and fragmented markets.

Flutterwave brings the scale, compliance frameworks, licenses, and enterprise networks that Mono alone would have struggled to access.

This isn’t just about growth. It’s about continental reach, creating an infrastructure layer that could set the standard for how African financial systems operate.

Faster onboarding, smarter lending decisions, reduced fraud, and better digital financial products are the outcomes for everyday users.

At the ecosystem level, this deal signals a shift: the era of fragmented fintech solutions is giving way to strategic consolidation around infrastructure, a move that benefits both businesses and consumers.

Investors notice this too; early Mono backers reportedly saw returns up to 20x, proving that African infrastructure startups can deliver serious value when they solve real problems.

Why Everyone Should Pay Attention

This acquisition is quietly transformative. It shows that data is power and that unlocking financial context is just as valuable, if not more so, than moving money. For businesses, it reduces friction and risk. For consumers, it enables better financial products.

And for African fintech, it sets a precedent for future integrations that prioritize efficiency, trust, and scalability.

Flutterwave didn’t just acquire a company. It acquired context, intelligence, and the key to building Africa’s next-generation financial system.

In a continent where access to reliable financial data has long been the missing piece, this move quietly changes the game. Not flashy. Not loud. But foundational. And sometimes, the most important revolutions happen not in headlines, but in the infrastructure that powers everyday life.

You may also like...

Unveiling the Fascinating Science of How Airplanes Defy Gravity

Ever wondered how airplanes stay in the air? Understand the science of lift, thrust, drag, and weight that makes flight ...

You Are Not the Target Audience: How Nigerian RTW Brands Use Exclusion as a Business Model

Explore how Nigerian ready-to-wear (RTW) brands use exclusion and high pricing as a business strategy, turning fashion i...

Grey Business and the Future of Cross-Border Payments for African SMEs

Grey has launched Grey Business, a multi-currency payments platform designed to simplify cross-border transactions for A...

Legendary Lakers Coach Pat Riley Honored with Bronze Statue at Crypto.com Arena

Pat Riley is immortalized with an 8-foot bronze statue outside Crypto.com Arena, celebrating his Lakers legacy, champion...

Former WNBA Star and Two-Time Champion Kara Braxton Passes Away at 43

Two-time WNBA champion Kara Braxton has died at 43, the league announced Sunday. Braxton, a former Georgia Bulldog and D...

Ridley Scott's $400M+ Sci-Fi Blockbuster Conquers Netflix Worldwide!

Ridley Scott's visually majestic and intellectually ambitious sci-fi epic "Prometheus" has remarkably returned to global...

A Knight of the Seven Kingdoms” Finale Ignites Fan Debates and Creator Insights

The finale of “A Knight of the Seven Kingdoms” Season 1 leaves fans debating Targaryen tragedies, Dunk’s journey, and ...

Nigerian Author Sarah Eniola Inspires with Faith-Based Book “Faces of Trial”

Sarah Eniola’s Faces of Trial inspires readers with a faith-based guide to resilience, emotional healing, and spiritua...