Data Now Drives 60% of Telkom’s Revenue as Mobile Subscribers Hit 25 Million

There was a time when telecom companies lived and died by voice calls. Minutes mattered and airtime was the king of telecom conversation.

But that era is quietly fading, across Africa and globally, the real currency of telecommunications is no longer voice, it is data.

In its third-quarter 2025 results, Telkom— a South African telecom operator— delivered clear proof of that transition.

Data services now account for 60% of the company’s total earnings, marking a decisive shift in business strategy and consumer behaviour.

As South Africans stream more, scroll longer, and rely increasingly on digital services, Telkom is repositioning itself at the centre of that digital economy.

The numbers underline the shift as the company reported Q3 revenue of $701 million, up 1.3% year-over-year.

For the first nine months of 2025, revenue reached $2.09 billion, a 2.7% increase.

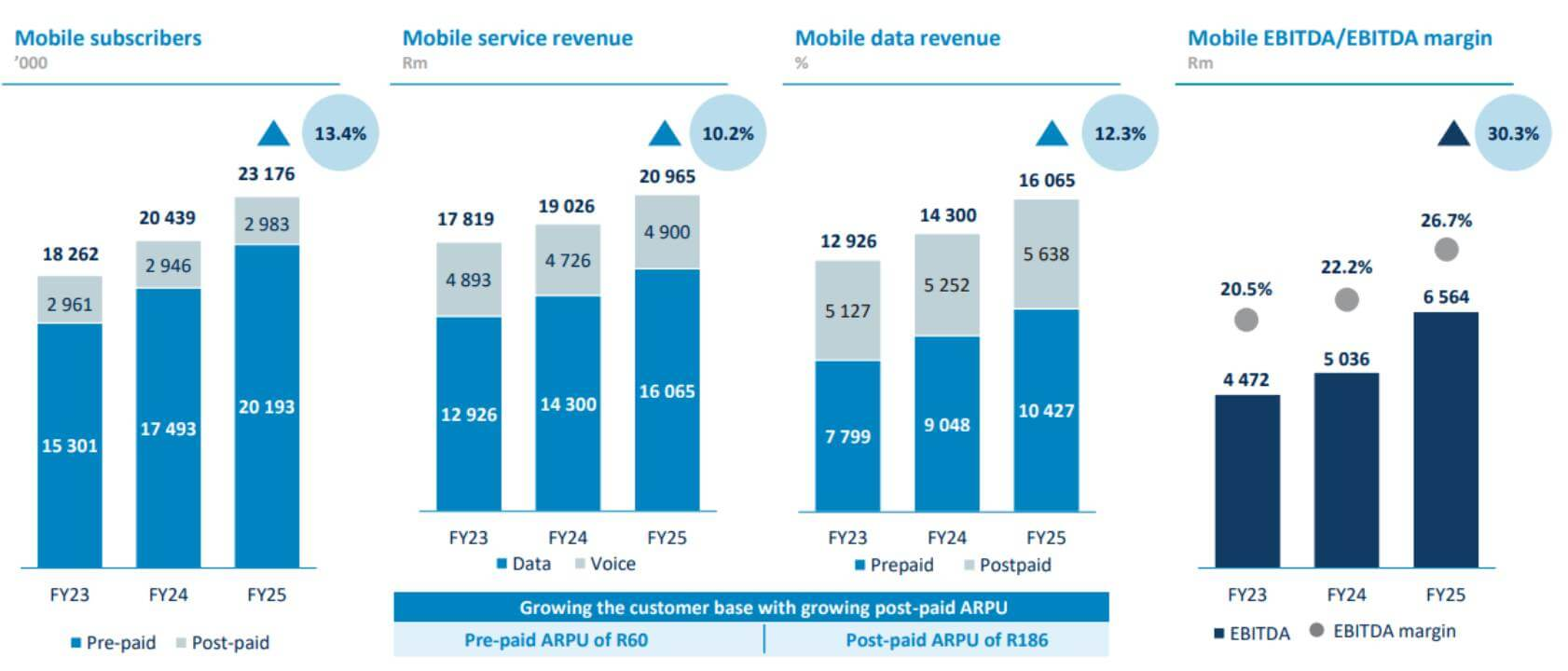

More notably, its mobile subscriber base has surpassed 25 million, with the majority actively consuming mobile data.

This is no longer a telecom company defined by calls. It is increasingly defined by connectivity.

Data Is the New Voice: Inside Telkom’s Growth Engine

The structural change inside Telkom’s earnings is unmistakable. Data revenue grew 9.6% during the quarter, with mobile data rising even faster at 12.9%. Fibre revenue, powering home broadband, increased by 8.9%.

At the centre of this growth is Telkom’s mobile division, now the strongest performing segment of the business.

Mobile service revenue rose 7.2% in Q3. Prepaid customers, a dominant segment in South Africa’s telecom market, spent 11.6% more compared to last year, reflecting stronger data bundle purchases rather than traditional airtime use.

Out of 25 million mobile users, 19.3 million are actively using mobile data.

Even more telling is the 29.3% year-on-year increase in data users.

Latest Tech News

Decode Africa's Digital Transformation

From Startups to Fintech Hubs - We Cover It All.

That surge reflects broader behavioural changes ranging from more streaming platforms, heavier social media usage, digital banking apps, remote work tools, to online education platforms.

South Africa’s telecom landscape remains highly competitive, with players like MTN and Vodacom also expanding aggressively into data services.

Telkom’s differentiation appears to lie in its balanced focus on both mobile data and fixed fibre infrastructure.

Through its Openserve division, Telkom has connected nearly 787,000 homes to fibre.

Fibre infrastructure now passes more than 1.5 million homes, with approximately 30,000 new connections added every quarter.

Fibre connectivity supports simultaneous streaming, gaming, video conferencing, and cloud-based work, a necessity in an economy increasingly shaped by hybrid work and digital entrepreneurship.

The strategic pivot is deliberate, CEO Serame Taukobong has indicated that the company is prioritising data-heavy services while gradually reducing exposure to older, less profitable voice-based systems.

In practical terms, that means investing capital into mobile towers, fibre lines, and digital infrastructure, while allowing legacy voice services to decline organically.

The broader industry trend supports this direction. Globally, telecom operators are under pressure to monetise rising data traffic while managing shrinking margins on voice and SMS.

In emerging markets, especially, data consumption has become a primary growth lever.

Profitability While Investing: How Telkom Is Managing the Transition

Transformation often comes with financial strain. Network upgrades, fibre expansion, and mobile infrastructure development are capital-intensive.

Yet Telkom’s latest results suggest that growth and profitability are not mutually exclusive.

In Q3, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) grew 8.4% to $204 million.

The EBITDA margin improved to 29.1%, meaning Telkom retains roughly 29 cents as operating profit for every dollar earned.

Latest Tech News

Decode Africa's Digital Transformation

From Startups to Fintech Hubs - We Cover It All.

Cost discipline appears central to this outcome and the company has reduced bad debt exposure, cut non-essential operational expenses, and migrated customers from costly legacy systems to more efficient digital platforms.

Modernising infrastructure lowers maintenance costs while improving service reliability, a key factor in customer retention.

Capital expenditure remains significant. Telkom invested $82 million in Q3 alone, bringing nine-month total investment to $263 million.

Crucially, this spending is concentrated almost entirely on mobile and fibre expansion rather than maintaining outdated systems.

The strategy is straightforward and calculated, ensuring scaling of mobile data aggressively, expanding fibre footprint, optimizing operational efficiency, and allowing the traditional voice business to taper naturally.

In an environment where consumers are buying more data bundles and making fewer calls, that alignment appears commercially sound.

The telecom industry in Africa is entering a maturity phase where subscriber growth is no longer the only metric that matters.

Average revenue per user (ARPU), data monetisation efficiency, and infrastructure resilience are becoming more critical.

Telkom’s 25 million subscribers are valuable not just as numbers, but as active data consumers driving recurring digital revenue streams.

Conclusion: A Clear Signal of Telecom’s Future

Telkom’s Q3 performance is more than a quarterly earnings story, it is a reflection of a structural transformation in African telecommunications.

With data contributing 60% of total earnings and mobile subscribers surpassing 25 million, the company has effectively repositioned itself from a traditional voice operator to a digital infrastructure provider.

Its ability to grow revenue modestly, expand margins, and invest heavily in network upgrades simultaneously suggests strategic clarity.

The question now is sustainability; can Telkom continue scaling mobile data and fibre while managing competitive pressure and regulatory dynamics?

If current trends persist, the company’s future will be defined not by how many calls are made, but by how deeply integrated it becomes in South Africa’s digital economy.

For now, the numbers indicate that betting on data is paying off and that is worth applauding.

You may also like...

Shockwave in Transfers: Manchester United Reportedly Eyeing Liverpool Midfield Maestro Mac Allister!

Football's summer transfer window is heating up with major European clubs eyeing key players. Manchester United is repor...

Klopp's Agent Drops Bombshell: Two Premier League Giants Vied for Jurgen Post-Liverpool Exit!

)

Jürgen Klopp's agent, Marc Kosicke, revealed that Chelsea and Manchester United pursued the German manager after his Liv...

Tom Hardy's Crime Saga Hits New Heights: Fans Rave Over Season 2 and Stellar Performance

Emmett J. Scanlan teases an "insane" Season 2 for Guy Ritchie's 'MobLand', promising heightened drama and the return of ...

Game of Thrones Spinoff 'A Knight of the Seven Kingdoms' Stirs Controversy and Celebration

<i>A Knight of the Seven Kingdoms</i> Episode 5, "In the Name of the Mother," earns accolades as the franchise's highest...

'The Rookie' Star Eric Winter on Why He Loves Chenford's Unpredictable Journey

The Rookie Season 8 sees Tim Bradford embrace his new watch commander role, facing managerial challenges while his roman...

Sarah Ferguson's Business Empire Collapses Amid New Epstein Scandal Revelations

Six businesses associated with Sarah Ferguson, the former Duchess of York, are being dissolved amid heightened scrutiny ...

Chaos at JKIA: Aviation Workers' Strike Grounds Flights, Stranding Thousands

Jomo Kenyatta International Airport in Nairobi faced widespread chaos, delays, and flight cancellations as aviation work...

Outrage Erupts After Tragic Kitengela Rally Shooting, Family Demands Justice

Tragedy struck an ODM 'Linda Mwananchi' rally in Kitengela as 28-year-old Vincent Ayomo Otieno was fatally shot, alleged...