Bitcoin on the Brink? 'Rare Death Cross' Signals $100K Price Plunge

The cryptocurrency market has recently presented a mix of significant technical signals and dramatic price movements across various assets, from major players like Bitcoin to popular meme coins such as Shiba Inu. Market dynamics have seen both bearish indicators for established cryptocurrencies and extreme volatility in derivatives markets, alongside community-driven efforts to influence token supply.

Bitcoin, the leading cryptocurrency by market capitalization, is currently facing a formidable technical indicator known as a “death cross.” This signal emerges when the 23-day moving average (typically depicted in green) descends and crosses below the 50-day moving average (often in blue), indicating a potential loss of control by buyers and a likely drag on the price towards a lower anchor. If this bearish cross is confirmed, the price is generally expected to gravitate towards its next major support level, identified as the 200-day moving average, which is presently situated at $100,483. Bitcoin is currently trading around $114,106, following an intraday dip below $113,000. Just two weeks prior, Bitcoin was pressing $124,000 before collapsing through its $118,000 support, establishing $119,991 as a significant overhead resistance level. Subsequent rally attempts have shown diminishing strength, effectively transforming the moving average curves into a challenging trap for traders. The primary danger associated with this setup is not merely another price dip, but the market's historical tendency to gravitate towards the 200-day line whenever shorter averages begin to roll over. A decline to the $100,000 mark would not be an unprecedented event, but rather the natural progression dictated by chart mathematics, and would also effectively erase almost the entire gains from the summer run, bringing the broader bullish narrative under intense scrutiny. However, Bitcoin has a history of making the death cross appear alarming only to reverse course at the last minute. Should the critical $112,000-$114,000 price pocket manage to hold firm in the coming days, the bearish pattern might be invalidated, allowing the chart to reverse course before significant damage occurs.

In a separate and equally dramatic event, XRP experienced an “extreme long wipeout,” characterized by a record liquidation imbalance that brutally crushed bullish positions. CoinGlass data revealed an unprecedented 101,445% liquidation skew between long and short positions within a single hour – a figure the market has rarely, if ever, witnessed. Unsurprisingly, almost the entirety of this impact landed on the bullish side of the market. The mathematics behind this wipeout were severe: $4.21 million worth of long positions received margin calls, while short liquidations barely registered at $4,150. This staggering disproportion created the unprecedented skew, indicating not necessarily the largest wipeout in dollar terms, but rather the extent to which the long trade around XRP had become crowded. In terms of price action, XRP struggled to maintain above the $2.88 resistance level, failing multiple times, and subsequently headed towards $2.83 as selling pressure mounted throughout the afternoon session. Across the broader cryptocurrency market, liquidations over the last 24 hours cleared more than $475 million. Long positions accounted for a significant $403 million of this total, with short positions representing only $72 million. Specific large-cap cryptocurrencies also saw substantial liquidations: Ethereum erased $10.81 million, Bitcoin lost $5.81 million, and Solana experienced $1.82 million flushed out in the latest wave.

Meanwhile, the Shiba Inu (SHIB) community demonstrated a massive surge in its token burn rate, as a significant volume of these meme coins was permanently removed from circulation. Blockchain wallet tracker Shibburn reported a remarkable 2,196.63% increase in SHIB burns within a 24-hour period, driven by recent community activity. Within this single day, the community of the second-most-popular meme coin managed to transfer 1,606,561 Shiba Inu tokens to unspendable blockchain addresses. The largest single burn recorded amounted to 1,192,392 SHIB. Despite this impressive daily spike, weekly burn statistics presented a contrasting picture, showing a 29% decline in overall burns, with 72,264,101 SHIB torched over the longer seven-day period. This highlights the volatile nature of the community's burning efforts and their impact on the token's circulating supply.

You may also like...

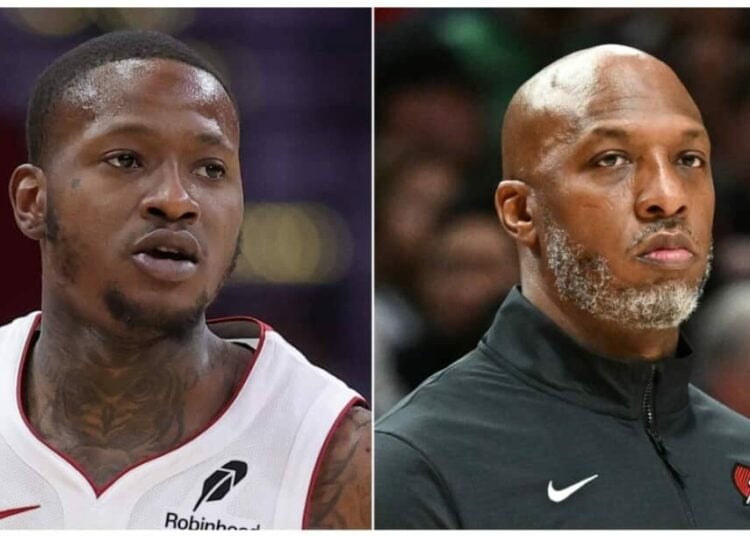

NBA Scandal Rocks League: Billups, Rozier Face Charges in Explosive Sports Betting Probe

Two major federal investigations have rocked the NBA, leading to the indictment and arrest of Portland Trail Blazers coa...

Streaming Wars Intensify: Netflix Exposes Paramount's Role in Industry's 'Brutal Crisis'

Netflix co-CEO Greg Peters has strongly criticized Hollywood's reliance on mergers, arguing they fail to address fundame...

DCU's Epic Future: James Gunn Taps George R. R. Martin's Lore for Major Storylines

James Gunn's DC Universe is heavily influenced by George R.R. Martin's "A Song of Ice and Fire," shaping its structure, ...

K-Pop Firestorm: LE SSERAFIM & J-Hope Unleash 'Spaghetti' Collaboration

LE SSERAFIM has released their new EP, “Spaghetti,” featuring a significant collaboration with BTS’ j-hope, marking his ...

South Africa's Legal Earthquake: Black Coffee Ruling Redefines Marriage Equality

South African actress Enhle Mbali Mlotshwa has won a landmark legal battle, with the Johannesburg High Court validating ...

Groundbreaking! Nigeria Unveils First-Ever Afrobeats Reality Show!

XL Creative Hub introduces "Battle of the Beats Season 1," Nigeria's inaugural Afrobeats production reality show, runnin...

Davido's Diplomatic Daze: Superstar Meets French President Macron!

Nigerian afrobeat superstar Davido recently met with French President Emmanuel Macron in Paris, an event he shared on hi...

Botswana Confronts Wildlife Conflict: Bold New Strategy to Protect Eco-Tourism

Botswana's Minister of Environment and Tourism, Mr Wynter Mmolotsi, announced that addressing human-wildlife conflict is...