Elon Musk's SpaceX Shakes Crypto Market with Massive Bitcoin Transfer!

The cryptocurrency market faced significant turbulence this Tuesday morning, marked by notable price declines, substantial fund outflows, and intriguing corporate movements. Bitcoin, a bellwether for the crypto space, traded at $108,097, having endured a 2.4% drop over 24 hours following a harsh rejection at the $110,500 mark. The digital asset's price structure appears fragile, with immediate support hovering just above $107,000, and $104,000 eyed as the next critical target if selling pressure intensifies. A clear breakthrough above $115,400 is deemed necessary to reset its chart positively.

Compounding Bitcoin's woes are persistent outflows from Spot Bitcoin Exchange-Traded Funds (ETFs), which yesterday alone saw $40.5 million in redemptions, reducing total net assets to $149.7 billion. This trend, a stark contrast to earlier strong inflows that propelled Bitcoin to its local high near $115,000, suggests institutions are trimming their exposure, thereby jeopardizing short-term market confidence. The derivatives market further amplified this weakness, with $88.9 million in Bitcoin longs liquidated in a single day, contributing to a staggering $321.3 million in liquidations across the broader market. This reinforces the current sentiment that market caution is being rewarded, while impatience is being penalized.

Amidst this downturn, a significant on-chain event captured attention: Elon Musk’s SpaceX executed a massive Bitcoin transfer valued at approximately $268 million. About 2,495 Bitcoin were moved into two previously inactive addresses, `bc1qq` and `bc1qj7`, marking the first substantial transfer linked to SpaceX in three months. This action echoes a similar movement in July 2025, which Arkham Intelligence later identified as funds moving into Coinbase Prime Custody, suggesting it might be a routine internal treasury optimization or a liquidity adjustment plan rather than a sale. However, the sheer scale and timing of the transfer during a period of market instability have fueled considerable speculation regarding SpaceX’s cryptocurrency holdings and potential institutional custody preparations. Despite market trepidation, on-chain data currently indicates no immediate selling activity from these destination addresses, though traders are closely monitoring for any further transfers to exchange-linked platforms. This move underscores the growing integration of corporate players in the crypto ecosystem and their continued market influence.

In a notable counter-trend, XRP staged a violent reversal, jumping from below $1.90 to $2.50 and currently trading between $2.41 and $2.53. This rebound occurred despite retail sentiment plummeting to a nine-month low, a phenomenon often described by on-chain analysts as a textbook capitulation. The psychology behind this was clear: weaker holders sold in fear, enabling stronger hands to absorb the supply. Technically, XRP faces support between $2.35 and $2.40, with resistance at $2.76, a break above which could propel it towards $3.00. Conversely, a failure to hold $1.98 risks another collapse. This bounce is particularly significant because it is rooted in market exhaustion rather than euphoria.

Meanwhile, Binance Founder Changpeng Zhao (CZ) offered a long-term bullish perspective, boldly declaring that Bitcoin would eventually overtake gold’s substantial $30.1 trillion market capitalization. While Bitcoin’s current market cap sits at approximately $2.2 trillion, requiring over a 1000% growth to reach CZ's target and pushing its price beyond $1,000,000 per coin, Zhao remains steadfast. His

You may also like...

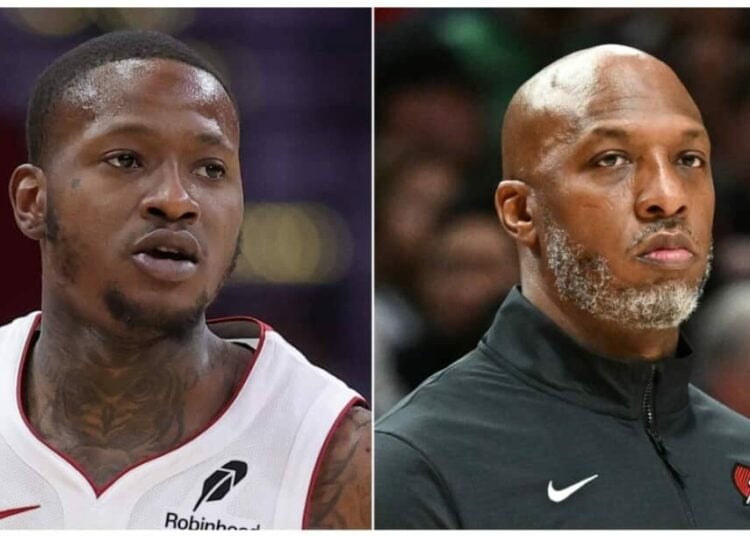

NBA Scandal Rocks League: Billups, Rozier Face Charges in Explosive Sports Betting Probe

Two major federal investigations have rocked the NBA, leading to the indictment and arrest of Portland Trail Blazers coa...

Streaming Wars Intensify: Netflix Exposes Paramount's Role in Industry's 'Brutal Crisis'

Netflix co-CEO Greg Peters has strongly criticized Hollywood's reliance on mergers, arguing they fail to address fundame...

DCU's Epic Future: James Gunn Taps George R. R. Martin's Lore for Major Storylines

James Gunn's DC Universe is heavily influenced by George R.R. Martin's "A Song of Ice and Fire," shaping its structure, ...

K-Pop Firestorm: LE SSERAFIM & J-Hope Unleash 'Spaghetti' Collaboration

LE SSERAFIM has released their new EP, “Spaghetti,” featuring a significant collaboration with BTS’ j-hope, marking his ...

South Africa's Legal Earthquake: Black Coffee Ruling Redefines Marriage Equality

South African actress Enhle Mbali Mlotshwa has won a landmark legal battle, with the Johannesburg High Court validating ...

Groundbreaking! Nigeria Unveils First-Ever Afrobeats Reality Show!

XL Creative Hub introduces "Battle of the Beats Season 1," Nigeria's inaugural Afrobeats production reality show, runnin...

Davido's Diplomatic Daze: Superstar Meets French President Macron!

Nigerian afrobeat superstar Davido recently met with French President Emmanuel Macron in Paris, an event he shared on hi...

Botswana Confronts Wildlife Conflict: Bold New Strategy to Protect Eco-Tourism

Botswana's Minister of Environment and Tourism, Mr Wynter Mmolotsi, announced that addressing human-wildlife conflict is...