Urgent Warning: Bitcoin Plummets to $108K, Sub-$100K Crash Feared

Bitcoin experienced a significant price fluctuation, initially retreating to approximately $108,300 today after a brief surge to $114,000 on Tuesday. This movement occurred against a backdrop of declining traditional safe-haven assets, with spot gold falling to $4,034 per ounce and silver remaining down by nearly 8%, extending earlier losses in the week.

These market shifts followed key announcements from Federal Reserve Governor Christopher Waller. Speaking at the Federal Reserve’s inaugural Payments Innovation Conference in Washington, Waller unveiled plans for a “skinny master account” program. This initiative is designed to grant eligible fintech and cryptocurrency firms limited access to the Fed’s established payment system, a strategic move interpreted as a direct effort to integrate digital assets more deeply into the traditional financial landscape. Bitcoin initially reacted positively to these remarks, jumping over 5% to $114,000 during the conference, though it subsequently pulled back.

Observations from social media and market analysts suggest a potential rotation of investor capital from precious metals into Bitcoin. This sentiment aligns with findings from Bitwise Asset Management’s latest Crypto Market Compass report, which posited that even a modest 3–4% reallocation of capital from gold to crypto markets could theoretically lead to a doubling of Bitcoin’s price, underscoring the significant size disparity between these asset classes.

Despite the recent volatility, expert opinions vary on Bitcoin's immediate future. Geoff Kendrick of Standard Chartered notably projected a brief dip for Bitcoin below the $100,000 mark, attributing this potential decline to escalating trade war concerns. However, Kendrick also indicated that such a downturn would likely be short-lived, pointing to historical trends where weakness in gold prices has often preceded swift rebounds for Bitcoin.

Further insights into market sentiment are being provided by Bitcoin prediction markets, such as Polymarket and Kalshi, which are gaining traction as real-time indicators for traders. These platforms aggregate probabilistic outcomes based on participants' bets on Bitcoin's year-end price. In early October, the consensus prediction for Bitcoin’s year-end price was $144,000, but this figure has since adjusted downwards to approximately $129,000, reflecting an increase in market volatility and investor fear.

When the spot price of Bitcoin trades significantly below these forecasted values, it typically signals a pervasive sense of fear and potential undervaluation in the market. Conversely, when the spot price trades near or above these predictions, it often indicates market euphoria and could suggest the formation of local price tops. After adjusting for prediction volatility, data reveals that substantial divergences between the spot price and prediction market forecasts frequently coincide with market lows, suggesting that these markets are currently flashing a contrarian "fear" signal.

While Polymarket asserts a high accuracy rate of 91% for its predictions, this figure drops to a more conservative 71% when outlier bets are excluded. Interestingly, the accuracy ratio of these prediction markets tends to move inversely to the widely recognized Fear and Greed Index. This inverse relationship further highlights periods of potential undervaluation during widespread fear and signals overconfidence during phases of market greed, offering a unique perspective on investor psychology and market positioning.

You may also like...

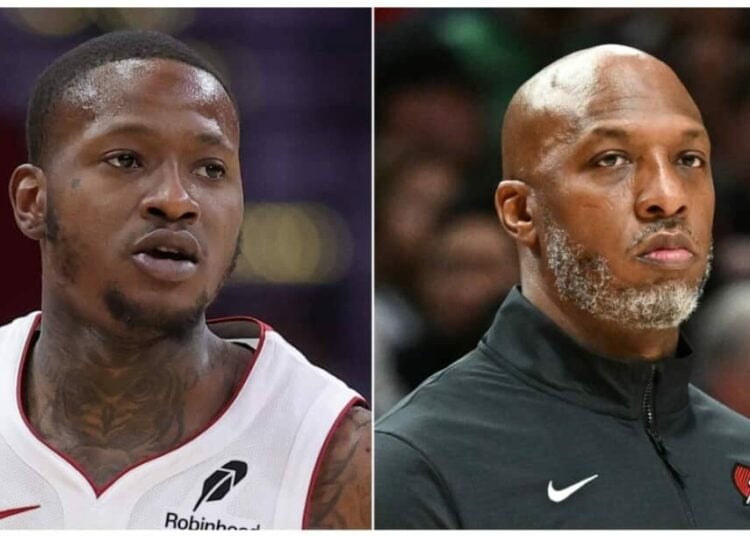

NBA Scandal Rocks League: Billups, Rozier Face Charges in Explosive Sports Betting Probe

Two major federal investigations have rocked the NBA, leading to the indictment and arrest of Portland Trail Blazers coa...

Streaming Wars Intensify: Netflix Exposes Paramount's Role in Industry's 'Brutal Crisis'

Netflix co-CEO Greg Peters has strongly criticized Hollywood's reliance on mergers, arguing they fail to address fundame...

DCU's Epic Future: James Gunn Taps George R. R. Martin's Lore for Major Storylines

James Gunn's DC Universe is heavily influenced by George R.R. Martin's "A Song of Ice and Fire," shaping its structure, ...

K-Pop Firestorm: LE SSERAFIM & J-Hope Unleash 'Spaghetti' Collaboration

LE SSERAFIM has released their new EP, “Spaghetti,” featuring a significant collaboration with BTS’ j-hope, marking his ...

South Africa's Legal Earthquake: Black Coffee Ruling Redefines Marriage Equality

South African actress Enhle Mbali Mlotshwa has won a landmark legal battle, with the Johannesburg High Court validating ...

Groundbreaking! Nigeria Unveils First-Ever Afrobeats Reality Show!

XL Creative Hub introduces "Battle of the Beats Season 1," Nigeria's inaugural Afrobeats production reality show, runnin...

Davido's Diplomatic Daze: Superstar Meets French President Macron!

Nigerian afrobeat superstar Davido recently met with French President Emmanuel Macron in Paris, an event he shared on hi...

Botswana Confronts Wildlife Conflict: Bold New Strategy to Protect Eco-Tourism

Botswana's Minister of Environment and Tourism, Mr Wynter Mmolotsi, announced that addressing human-wildlife conflict is...