Crypto Tide Turns: Bitcoin Whales Move Billions Into Wall Street via BlackRock’s IBIT

A significant shift is underway among Bitcoin’s wealthiest holders, who are increasingly moving their assets from traditional cold storage methods to institutional custodians. This trend is largely driven by the rise of new U.S. exchange-traded funds (ETFs) that allow long-term Bitcoin investors to integrate their digital assets into the conventional financial system, without having to sell their holdings. The catalyst for this migration was the regulatory approval of “in-kind” transactions for spot Bitcoin ETFs earlier this summer, a mechanism that enables investors to directly deposit Bitcoin into a fund in exchange for shares, according to Bloomberg.

The “in-kind” transaction structure is a standard, tax-neutral mechanism commonly used in equities and commodities ETFs. Its implementation for Bitcoin now allows volatile digital assets to be converted into regulated, reportable holdings on brokerage statements. This development offers immediate advantages, making Bitcoin easier to borrow against, use as collateral, or include in estate plans, effectively bridging a long-standing gap between decentralized digital assets and traditional financial tools.

Major financial institutions are already capitalizing on this momentum. BlackRock, the world’s largest asset manager, has processed more than $3 billion worth of these conversions, according to Robbie Mitchnick, the firm’s Head of Digital Assets. Similarly, Bitwise Asset Management reports daily inquiries from investors seeking to transfer their private Bitcoin holdings into managed portfolios. Liquidity provider Galaxy has also facilitated numerous such transactions, further underscoring the growing demand for institutional integration.

This shift marks an ironic evolution for Bitcoin, an asset originally designed to exist outside traditional banking structures. As ETFs now embed Bitcoin within Wall Street’s brokerage ecosystem, even investors with anti-establishment leanings are acknowledging the practical advantages of traditional finance (TradFi). These include professional custody, leverage opportunities, and estate management, benefits not easily replicated on-chain. While some investors are transferring only portions of their Bitcoin, others are consolidating their entire holdings into ETFs for greater simplicity and management efficiency.

The integration of Bitcoin into Wall Street’s infrastructure is expected to deepen, solidifying the connection between digital assets and established finance. BlackRock’s iShares Bitcoin Trust ETF (IBIT), launched just 22 months ago, exemplifies this transformation. The fund recently surpassed $100 billion in assets under management, making it the firm’s most profitable product. IBIT now generates roughly $244.5 million in annual revenue, outpacing older funds such as the 25-year-old iShares Russell 1000 Growth ETF in both speed of growth and profitability. In the most recent quarter, IBIT even overtook Coinbase Global’s Deribit platform to become the world’s largest venue for Bitcoin options.

Beyond IBIT’s success, BlackRock is pursuing a broader initiative to tokenize a wide array of assets, including equities, bonds, and real estate. The firm’s long-term goal is to link the estimated $4.5 trillion global digital wallet market with U.S.-based investment products, further advancing the convergence between traditional and digital finance.

You may also like...

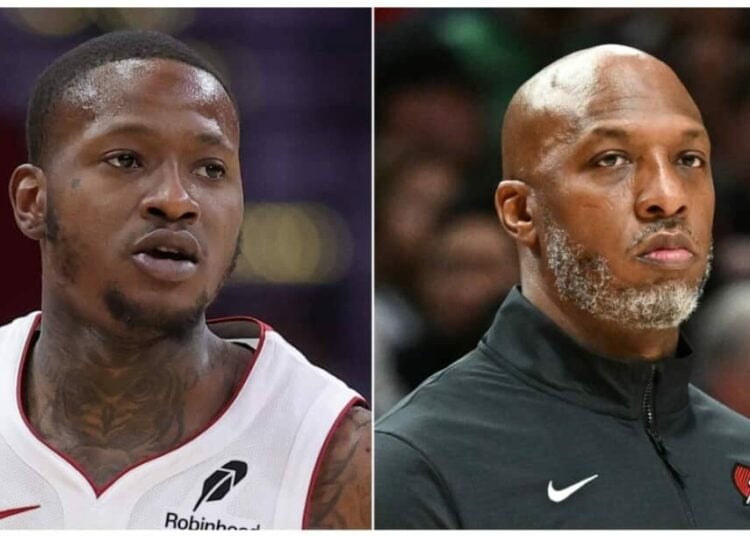

NBA Scandal Rocks League: Billups, Rozier Face Charges in Explosive Sports Betting Probe

Two major federal investigations have rocked the NBA, leading to the indictment and arrest of Portland Trail Blazers coa...

Streaming Wars Intensify: Netflix Exposes Paramount's Role in Industry's 'Brutal Crisis'

Netflix co-CEO Greg Peters has strongly criticized Hollywood's reliance on mergers, arguing they fail to address fundame...

DCU's Epic Future: James Gunn Taps George R. R. Martin's Lore for Major Storylines

James Gunn's DC Universe is heavily influenced by George R.R. Martin's "A Song of Ice and Fire," shaping its structure, ...

K-Pop Firestorm: LE SSERAFIM & J-Hope Unleash 'Spaghetti' Collaboration

LE SSERAFIM has released their new EP, “Spaghetti,” featuring a significant collaboration with BTS’ j-hope, marking his ...

South Africa's Legal Earthquake: Black Coffee Ruling Redefines Marriage Equality

South African actress Enhle Mbali Mlotshwa has won a landmark legal battle, with the Johannesburg High Court validating ...

Groundbreaking! Nigeria Unveils First-Ever Afrobeats Reality Show!

XL Creative Hub introduces "Battle of the Beats Season 1," Nigeria's inaugural Afrobeats production reality show, runnin...

Davido's Diplomatic Daze: Superstar Meets French President Macron!

Nigerian afrobeat superstar Davido recently met with French President Emmanuel Macron in Paris, an event he shared on hi...

Botswana Confronts Wildlife Conflict: Bold New Strategy to Protect Eco-Tourism

Botswana's Minister of Environment and Tourism, Mr Wynter Mmolotsi, announced that addressing human-wildlife conflict is...