JPMorgan’s Bold Crypto Shift: Bitcoin to Be Used as Collateral

JPMorgan Chase is reportedly planning to allow its institutional clients to use major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) as collateral for loans by the end of 2025. This new initiative, expected to be rolled out globally, will leverage a third-party custodian to securely hold pledged digital assets. While the bank already accepts crypto-linked exchange-traded funds (ETFs) as collateral, this expansion marks a significant shift, enabling clients to borrow directly against their personal cryptocurrency holdings.

This development is poised to offer greater liquidity to institutions, allowing them to access capital without selling their long-term digital asset positions, a feature that has grown increasingly attractive to hedge funds and family offices. The move by JPMorgan Chase underscores a broader trend of rising acceptance for digital assets within the traditional financial sector. Other major banks, including Morgan Stanley, BNY Mellon, State Street, and Fidelity, have also been expanding their crypto custody and trading services, driven by greater regulatory clarity in the United States and abroad. JPMorgan’s exploration into lending against Bitcoin dates back to 2022, though the project faced earlier delays.

Notably, this strategic embrace of digital assets comes amidst a remarkable shift in tone from JPMorgan CEO Jamie Dimon, who has historically been one of cryptocurrency’s most vocal critics. Dimon once famously labeled Bitcoin a “fraud” and a “pet rock”, and in 2023, he said he was “deeply opposed” to it, claiming its primary use was for illicit activities. However, his recent comments indicate a more pragmatic stance. Earlier this year, Dimon remarked, “I don’t think we should smoke, but I defend your right to smoke. I defend your right to buy Bitcoin, go at it,” signaling a shift toward accepting individual choice in crypto investment.

Despite Dimon’s personal reservations, JPMorgan has steadily deepened its involvement in the crypto ecosystem. The bank launched the J.P. Morgan Deposit Token (JPMD), a blockchain-based alternative to stablecoins, reaffirming its commitment to distributed ledger innovation. Additionally, JPMorgan’s Kinexys blockchain network now facilitates over $2 billion in daily transactions across sectors such as carbon markets, supply chain finance, and cross-border payments, showcasing the practical impact of its blockchain infrastructure.

The announcement of JPMorgan’s collateral program sparked a positive reaction in the cryptocurrency markets. Following the news, Bitcoin’s price surged, trading above $111,000, while Ethereum gained 2%, hovering just below $4,000, according to Bitcoin Magazine Pro. This momentum builds upon previous collaborations, including JPMorgan Chase’s strategic partnership with Coinbase, announced in July. That alliance aims to simplify Bitcoin and crypto access for customers through features like direct bank-to-wallet connections, redeeming Chase Ultimate Rewards points for crypto, and credit card funding for Coinbase accounts, with these integrations slated for launch in 2026.

Recommended Articles

Bitcoin Rises Above Politics: A New Era for Human Rights

Often perceived as a capitalistic tool, Bitcoin's crucial role in human rights is frequently overlooked. This article ex...

Urgent Warning: Bitcoin Plummets to $108K, Sub-$100K Crash Feared

Bitcoin's price saw recent fluctuations, retreating after touching $114,000, while traditional safe-haven assets decline...

Prediction Markets Signal Major Bitcoin Price Shift

Bitcoin prediction markets are emerging as a powerful tool to gauge real-time sentiment and price expectations, offering...

Crypto Tide Turns: Bitcoin Whales Move Billions Into Wall Street via BlackRock’s IBIT

Wealthy Bitcoin holders are shifting their assets from cold storage to financial custodians via new U.S. exchange-traded...

Elon Musk's SpaceX Shakes Crypto Market with Massive Bitcoin Transfer!

The crypto market faces turbulence as Bitcoin drops to $108,097 amidst significant ETF outflows and overleveraged liquid...

You may also like...

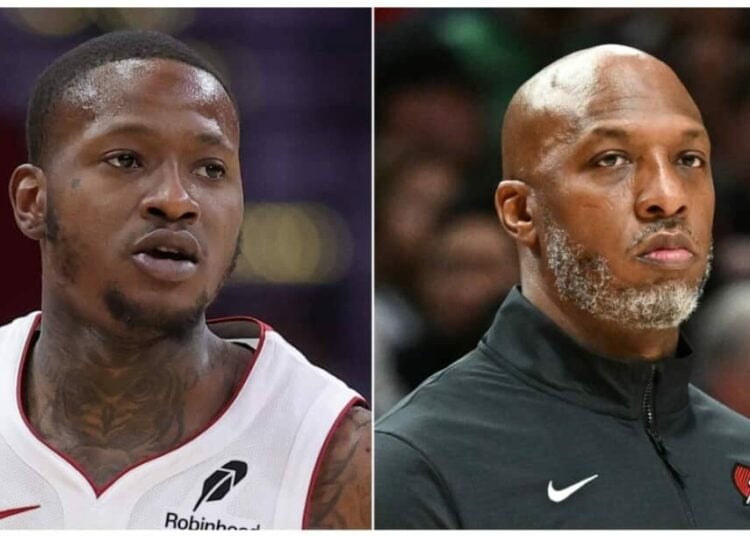

NBA Scandal Rocks League: Billups, Rozier Face Charges in Explosive Sports Betting Probe

Two major federal investigations have rocked the NBA, leading to the indictment and arrest of Portland Trail Blazers coa...

Streaming Wars Intensify: Netflix Exposes Paramount's Role in Industry's 'Brutal Crisis'

Netflix co-CEO Greg Peters has strongly criticized Hollywood's reliance on mergers, arguing they fail to address fundame...

DCU's Epic Future: James Gunn Taps George R. R. Martin's Lore for Major Storylines

James Gunn's DC Universe is heavily influenced by George R.R. Martin's "A Song of Ice and Fire," shaping its structure, ...

K-Pop Firestorm: LE SSERAFIM & J-Hope Unleash 'Spaghetti' Collaboration

LE SSERAFIM has released their new EP, “Spaghetti,” featuring a significant collaboration with BTS’ j-hope, marking his ...

South Africa's Legal Earthquake: Black Coffee Ruling Redefines Marriage Equality

South African actress Enhle Mbali Mlotshwa has won a landmark legal battle, with the Johannesburg High Court validating ...

Groundbreaking! Nigeria Unveils First-Ever Afrobeats Reality Show!

XL Creative Hub introduces "Battle of the Beats Season 1," Nigeria's inaugural Afrobeats production reality show, runnin...

Davido's Diplomatic Daze: Superstar Meets French President Macron!

Nigerian afrobeat superstar Davido recently met with French President Emmanuel Macron in Paris, an event he shared on hi...

Botswana Confronts Wildlife Conflict: Bold New Strategy to Protect Eco-Tourism

Botswana's Minister of Environment and Tourism, Mr Wynter Mmolotsi, announced that addressing human-wildlife conflict is...