Streaming Wars Intensify: Netflix Exposes Paramount's Role in Industry's 'Brutal Crisis'

As the entertainment industry grapples with evolving consumption habits, Netflix co-CEO Greg Peters has sharply critiqued Hollywood's ongoing reliance on mergers as a solution for its streaming woes. His comments came after Paramount Skydance's second bid to acquire Warner Bros. Discovery (WBD) failed, highlighting a perceived coping mechanism where studios attempt to buy their way out of problems rather than innovate. Peters argued that acquiring another company with similar developmental capabilities does not fundamentally alter the competitive landscape or solve the underlying strategic challenges facing legacy media.

For the past decade, the so-called streaming wars have often been defined by sheer size, who boasts the most subscribers, the largest content library, or the deepest intellectual property (IP). However, Netflix contends that these metrics, and the mergers pursued to achieve them, are not the panacea they once seemed. Peters cited examples such as Disney-Fox, Amazon-MGM, and Warner’s numerous rebrands as evidence that adding more assets through acquisition does not automatically create a stronger or more sustainable business model. The core issue, according to Netflix, is Hollywood’s “streaming identity crisis,” where traditional studios continue to treat streaming primarily as a content pipeline rather than a distinct product with its own culture and logic.

In stark contrast to the acquisition-driven strategies of its competitors, Netflix is focusing on what Peters describes as the “hard work” of internal iteration and innovation. This includes significant investments in developing advanced technology, continuously improving customer experience, and building a robust global infrastructure capable of adapting to audience behaviors. Specific areas of focus range from AI integration and payment optimization to the development of interactive content and live programming. The company has also shifted its focus toward advertising innovation, with its ad tier now a cornerstone of growth and plans to roll out interactive ad formats and real-time voting features in future programming, starting with an upcoming “Star Search” revival.

Beyond digital platforms, Netflix is expanding its ecosystem with real-world brand extensions, including Netflix House venues, gaming expansions, live events, and even a Las Vegas restaurant. This multifaceted approach aims to position Netflix as a unique entity that functions simultaneously as a studio and a Silicon Valley product. While cautiously embracing AI, co-CEO Ted Sarandos affirmed the company’s excitement about empowering creators with generative AI tools, yet emphasized that the pursuit is not for novelty’s sake. His sentiment, “It takes a great artist to make something great” underscores a deliberate attempt to balance technological efficiency with creative artistry, navigating the inherent tension between computation and soul in content creation.

Netflix’s distinct stance is particularly striking as it both critiques and embodies the entertainment era’s growing pains. Sarandos and Peters are banking on innovation, rather than sheer ownership, to define the next phase of Hollywood. While competitors like Paramount-Skydance, Comcast, and Warner remain seemingly trapped in a cycle of merging, restructuring, and rebranding, each move promising synergy but often delivering only short-term boosts, Netflix implies that this relentless consolidation reflects a kind of “creative bankruptcy.” The core problem, as Netflix sees it, is not merely that these companies are too small, but that they have lost a clear sense of identity and strategy in the streaming landscape.

With the streaming boom of 2020 long past, subscriber growth flattening, and 2025 potentially marking a year where the industry runs out of ideas, Netflix’s global scale, now serving “nearly a billion viewers” stands out. Its critique resonates deeply because it addresses a fundamental mindset difference: legacy studios still treat streaming as a delivery method for IP, not as the primary business with its own distinct culture.

Netflix, despite its flaws, has fully embraced streaming as the business, not a mere side venture. This unwavering commitment and strategic clarity make its recent observations about competitors’ merger tactics particularly incisive and true.

You may also like...

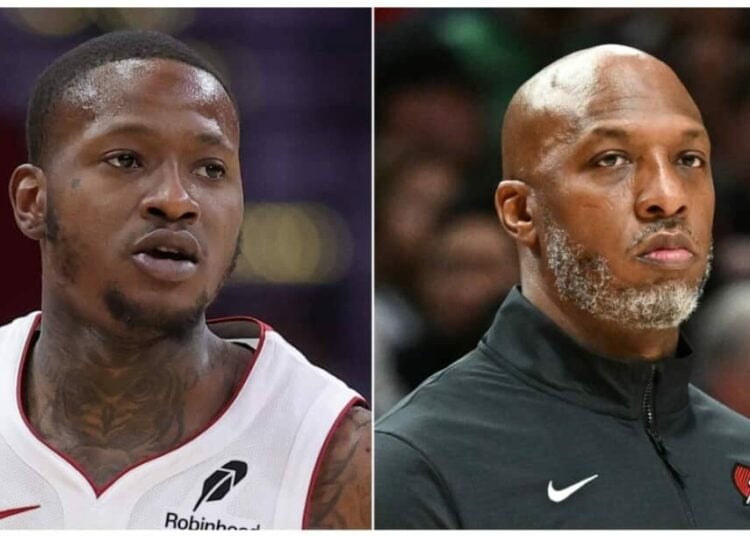

NBA Scandal Rocks League: Billups, Rozier Face Charges in Explosive Sports Betting Probe

Two major federal investigations have rocked the NBA, leading to the indictment and arrest of Portland Trail Blazers coa...

Streaming Wars Intensify: Netflix Exposes Paramount's Role in Industry's 'Brutal Crisis'

Netflix co-CEO Greg Peters has strongly criticized Hollywood's reliance on mergers, arguing they fail to address fundame...

DCU's Epic Future: James Gunn Taps George R. R. Martin's Lore for Major Storylines

James Gunn's DC Universe is heavily influenced by George R.R. Martin's "A Song of Ice and Fire," shaping its structure, ...

K-Pop Firestorm: LE SSERAFIM & J-Hope Unleash 'Spaghetti' Collaboration

LE SSERAFIM has released their new EP, “Spaghetti,” featuring a significant collaboration with BTS’ j-hope, marking his ...

South Africa's Legal Earthquake: Black Coffee Ruling Redefines Marriage Equality

South African actress Enhle Mbali Mlotshwa has won a landmark legal battle, with the Johannesburg High Court validating ...

Groundbreaking! Nigeria Unveils First-Ever Afrobeats Reality Show!

XL Creative Hub introduces "Battle of the Beats Season 1," Nigeria's inaugural Afrobeats production reality show, runnin...

Davido's Diplomatic Daze: Superstar Meets French President Macron!

Nigerian afrobeat superstar Davido recently met with French President Emmanuel Macron in Paris, an event he shared on hi...

Botswana Confronts Wildlife Conflict: Bold New Strategy to Protect Eco-Tourism

Botswana's Minister of Environment and Tourism, Mr Wynter Mmolotsi, announced that addressing human-wildlife conflict is...