AI Anxiety Hits Wall Street: Goldman Sachs Prepares for Major Staffing Shift!

Goldman Sachs has reportedly informed its employees of potential job cuts and a hiring slowdown for the remainder of the year. This strategic move, outlined in an internal memo cited by Reuters, signals the Wall Street giant's intent to significantly boost internal productivity through the application of artificial intelligence (AI).

The internal memorandum, co-signed by CEO David Solomon, President John Waldron, and CFO Denis Coleman, detailed the firm's ambitious AI initiative, branded as "OneGS 3.0". This program targets several critical areas for AI enhancement, including client management and operations. The leadership team expressed strong confidence in this technological shift, emphasizing that "The rapidly accelerating advancements in AI can unlock significant productivity gains for us, and we are confident we can re-invest those gains to continue delivering world-class solutions for our clients."

These anticipated job reductions follow a period of substantial internal restructuring at Goldman Sachs. The firm accelerated its annual staffing reductions to the second quarter this year, a departure from its typical September schedule. This exercise traditionally aims for a headcount reduction of 3% to 5% based on performance. Furthermore, the firm implemented significant leadership changes, appointing co-heads across its major divisions, adding six new members to its management committee, and establishing a new financing division. This consolidation, coupled with the intensified focus on AI, underscores Goldman Sachs' strategic drive to streamline operations and allocate resources towards technology-driven efficiency.

Despite these internal shifts and the ongoing AI integration, Goldman Sachs delivered strong third-quarter results, surpassing Wall Street's profit expectations on Tuesday. This impressive performance was primarily propelled by a significant surge in its investment banking division and increased revenue from managing client assets amidst rallying markets. The firm's advisory business was particularly robust, contributing substantially to these results.

Specifically, investment banking fees experienced a notable 42% year-on-year increase, reaching $2.66 billion for the quarter ended September 30th. This growth was largely attributed to a 60% surge in advisory fees, complemented by increases in both debt and equity underwriting fees. Goldman Sachs reported an overall quarterly profit of $4.1 billion, translating to $12.25 per share, comfortably exceeding Wall Street's consensus expectation of $11 per share.

A Goldman executive disclosed that the firm has advised on $1 trillion in announced mergers and acquisitions (M&A) year-to-date, outperforming its nearest competitor by $220 billion. Notable deals for the year include advising Electronic Arts on its $55 billion sale to a consortium, advising Holcim on the $26 billion spin-off of its North American business, Amrize, and advising Fifth Third Bancorp on its $10.9 billion agreement to acquire regional lender Comerica. CEO David Solomon affirmed that "This quarter's results reflect the strength of our client franchise and focus on executing our strategic priorities in an improved market environment." He also added a note of caution, stating, "We know that conditions can change quickly and so we remain focused on strong risk management." Chief Financial Officer Denis Coleman further highlighted the firm’s robust position, noting that the quarter-end deals backlog is currently at its highest level in three years.

You may also like...

Super Eagles Soar to World Cup Playoff, Friendly Games Canceled Amidst Continental Praise

)

The Nigerian Super Eagles have secured a place in the 2026 FIFA World Cup playoffs after a decisive 4-0 victory over Ben...

Liverpool's Form in Question: Can Reds Rebound Against Arch-Rivals Manchester United?

Liverpool, grappling with three straight losses, faces old rivals Manchester United in a crucial Premier League fixture....

Netflix's All-Time Box Office King Makes Shocking Theatrical Comeback!

"KPop Demon Hunters," the wildly successful animated fantasy, is set to return to theaters for a limited sing-along even...

Pentagon Rages: New Netflix "Woke" Military Drama Under Fire, Ignites Streaming War

Netflix's new military series "Boots," depicting gay relationships in a 1990s boot camp, has topped streaming charts but...

Rock Legend Ace Frehley, KISS Co-Founder, Passes Away at 74

Ace Frehley, the iconic founding guitarist of KISS and the legendary "Spaceman," has died at 74. His family confirmed hi...

Inspiring Achievement: Antony Martin Named Nation's Top Disability Coach

Antony Martin of Hamilton Judo Club's Inclusion class has been honored as Disability Coach of the Year at the JudoScotla...

Victoria's Secret Stunner: Jude Law's Daughter's Bold Fashion Statement

The Victoria's Secret Fashion Show triumphantly returned, aiming to revive its global buzz. The iconic event featured gr...

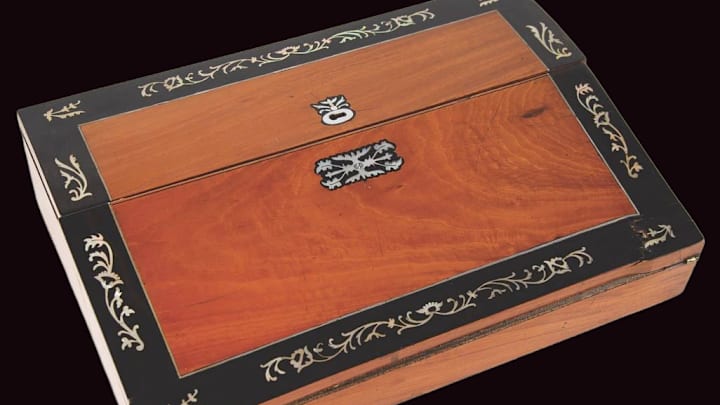

Own a Piece of Literary History: Charles Dickens's Ornate Travel Desk Hits Auction Block

Personal items belonging to the renowned 19th-century English writer Charles Dickens, including his travel writing desk ...