Bitcoin Mining Stocks Skyrocket: BTDR, CIFR, IREN, CLSK Lead the Pack

The Bitcoin mining sector has recently experienced a significant surge, with mining stocks rallying and pushing the combined market capitalization of major miners to over $90 billion, more than double its level just two months ago. This sector-wide momentum underscores growing investor confidence and strategic shifts within the industry.

Leading the charge is Bitdeer Technologies (BTDR), whose shares soared by as much as 30% on a recent Wednesday, reaching $27.31 and marking their highest level in over a year. The Singapore-based company, now the world’s fifth-largest public Bitcoin miner, reported a substantial 32.9% increase in its realized hashrate in September. This growth was largely driven by the successful deployment of its proprietary mining rigs. Bitdeer also mined 452 BTC in September, a 20.5% rise from the previous month, and aims to increase its self-mining hashrate from 35 exahashes per second (EH/s) to 40 EH/s by the end of the month.

The positive momentum extends across nearly the entire Bitcoin mining sector. Companies such as Iren (IREN) saw sharp increases following a $1 billion convertible note offering and multiple price-target hikes. Cipher Mining (CIFR), CleanSpark (CLSK), and Bitfarms (BITF) all reported double-digit weekly gains, with many firms testing or setting new 52-week highs. Over the past year, Applied Digital ($APLD) and Cipher Mining have notably surged three to four times in value, underscoring the broad-based success.

Industry analysts highlight growing investor interest in vertically integrated miners that combine ASIC design, self-mining operations, and advanced capabilities such as Artificial Intelligence (AI) and High-Performance Computing (HPC). Bitdeer Technologies exemplifies this trend, actively expanding its AI and HPC footprint. The company is converting several of its North American mining facilities into hybrid data centers designed to host AI workloads. Its Clarington, Ohio site is slated to eventually manage both Bitcoin mining and AI compute tasks, while its Tydal Phase 2 site is targeted for conversion into a dedicated AI data center by Q4 2026. Looking ahead, Bitdeer plans to operate over 200 MW of AI computing load in Southeast Asia by next year, projecting potentially over $2 billion in annualized revenue from these initiatives.

Other notable developments include Canaan, whose stock jumped more than 50% in the last week after securing a 50,000-unit miner order and expanding its pilot gas-to-power mining project in Canada. Applied Digital and Hut 8 also posted solid gains, reflecting widespread enthusiasm across the industry. Overall, this climate signals a major rotation within the Bitcoin mining sector, with investors increasingly favoring miners that can strategically leverage AI, HPC, and highly efficient fleets to enhance both operations and profitability.

You may also like...

Super Eagles Soar to World Cup Playoff, Friendly Games Canceled Amidst Continental Praise

)

The Nigerian Super Eagles have secured a place in the 2026 FIFA World Cup playoffs after a decisive 4-0 victory over Ben...

Liverpool's Form in Question: Can Reds Rebound Against Arch-Rivals Manchester United?

Liverpool, grappling with three straight losses, faces old rivals Manchester United in a crucial Premier League fixture....

Netflix's All-Time Box Office King Makes Shocking Theatrical Comeback!

"KPop Demon Hunters," the wildly successful animated fantasy, is set to return to theaters for a limited sing-along even...

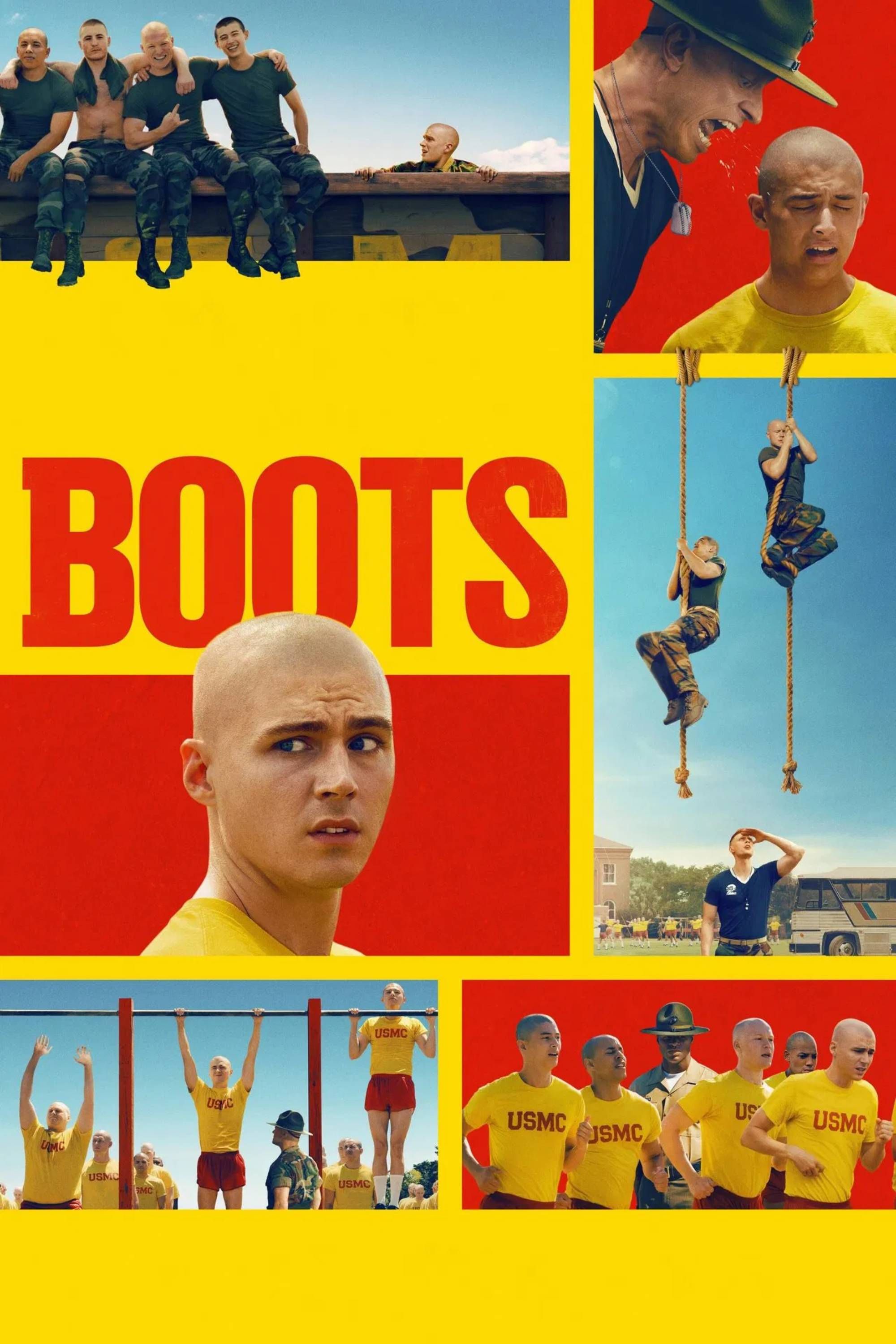

Pentagon Rages: New Netflix "Woke" Military Drama Under Fire, Ignites Streaming War

Netflix's new military series "Boots," depicting gay relationships in a 1990s boot camp, has topped streaming charts but...

Rock Legend Ace Frehley, KISS Co-Founder, Passes Away at 74

Ace Frehley, the iconic founding guitarist of KISS and the legendary "Spaceman," has died at 74. His family confirmed hi...

Inspiring Achievement: Antony Martin Named Nation's Top Disability Coach

Antony Martin of Hamilton Judo Club's Inclusion class has been honored as Disability Coach of the Year at the JudoScotla...

Victoria's Secret Stunner: Jude Law's Daughter's Bold Fashion Statement

The Victoria's Secret Fashion Show triumphantly returned, aiming to revive its global buzz. The iconic event featured gr...

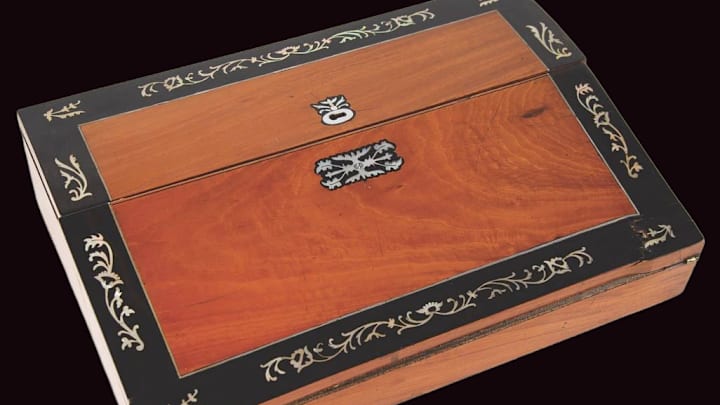

Own a Piece of Literary History: Charles Dickens's Ornate Travel Desk Hits Auction Block

Personal items belonging to the renowned 19th-century English writer Charles Dickens, including his travel writing desk ...