The $2 Trillion AI Bet: Three Tech Giants Are About to Show Us Their Cards

Okay, so imagine this: Three companies, just three, are about to go public with a combined value of almost $2 trillion dollars. Yes, you read right! That is a trillion. To put that in perspective, that is more than the entire GDP of most African countries combined.

We are talking about SpaceX, OpenAI, and Anthropic, and they are all planning to list on stock exchanges in 2026.

If you are thinking "why should I care about some Silicon Valley tech bros getting richer?"valid question. Now, this is actually the moment when we finally get to see if the AI hype is real or if we have all been played. And trust me, the answer affects all of us, wherever you are trying to figure out your future in this AI-dominated world.

The Numbers Are Actually Insane

Let's break that down for you. SpaceX, Elon's rocket company, is valued at $800 billion after its December share sale. OpenAI, the company behind ChatGPT that has probably helped you write at least one essay or email, is sitting at $500 billion from its October valuation.

And Anthropic, the company making Claude, hit up to $350 billion in November with backing from Microsoft and Nvidia.

For context, if all three successfully go public, they would be worth more than theentire U.S. IPO marketwas in 2025. SpaceX alone is targeting over $25 billion in its offering, which would eclipse Saudi Aramco's massive 2019 IPO. These are not just big numbers, they are potentially reshaping how we think about what makes a company valuable in the first place.

And, if these IPOs succeed, they could create over 16,000 millionaires overnight. That is a whole lot of wealth being generated, but the question is who is actually getting a piece of that wealth?

But Why Should You Actually Care?

I understand that rich tech companies getting richer is not exactly groundbreaking news. But here is why this matters to you specifically:

First, AI is already changing the job market globally, and these are the companies leading that charge. As a person in this modern society, the tools these companies build are either going to be your biggest asset or your biggest competitor. Understanding who controls AI and where they are headed helps you figure out where you fit in.

Second, there is an opportunity angle here. When these companies go public, everyday people can actually invest in them for the first time. Before, only venture capitalists and ultra-wealthy investors could buy in.

Now, if you have a brokerage account, you could potentially own a piece of the AI future. Of course, that is if you think the valuations make sense which brings us to the plot twist.

Things Aren't As Solid As They Look

It, however, gets interesting. When ChatGPT first dropped and had everyone shook, OpenAI controlled 50% of the entire enterprise AI market. Literally half. But today that share has crashed to just 25%. They have been overtaken by Anthropic, one of the other companies trying to go public.

Latest Tech News

Decode Africa's Digital Transformation

From Startups to Fintech Hubs - We Cover It All.

Think about that for a second. In less than two years, the supposed king of AI lost half its market dominance. That is not exactly the kind of stability you want to see in a company valued at half a trillion dollars.

Nobody knows if these companies are actually profitable yet. They are burning through cash like it is going out of style. Of course, training AI models costs millions, sometimes billions of dollars.

The data centers alone require so much electricity that these companies are literally making deals for nuclear power plants. So when they finally release their financial details as public companies, we will get our first real look at whether this is a sustainable business or the most expensive experiment in tech history.

What Happens Next?

2026 is shaping up to be the year that separates the real from the hype in AI. When these companies go public, they will have to show their full financial cards: their revenue, expenses, growth projections, the whole thing. No more hiding behind "we are a private company" when people ask tough questions.

For investors, it is a massive opportunity but also a serious risk. Are you betting on the future of technology, or are you buying into a bubble right before it pops? The truth is, nobody really knows yet.

For the rest of us just trying to navigate this AI-powered world, it means something different. It means we will finally understand the business model behind these tools we use every day. We will see if AI companies can actually make money or if they're just good at convincing venture capitalists to keep funding them.

The Bottom Line

Whether you are planning to invest, or you are worried about your job security in an AI world, or maybe you are just trying to stay informed about the forces shaping our future, these IPOs are worth watching. They represent the biggest test yet of whether artificial intelligence is the transformative technology everyone claims it is, or whether we are witnessing the most overhyped moment in tech history.

2026 is going to answer a lot of questions. The stage is set, the valuations are wild, and soon enough, the public markets will decide if these companies are worth what they claim.

And I will be grabbing my popcorn because this is about to be one expensive show.

Keep your eyes open. This is history in the making, for better or worse.

You may also like...

NBA Shocker: Stephen Curry Sidelined with Knee Injury, Warriors Face Uphill Battle

Golden State Warriors star Stephen Curry is slated to miss at least five additional games due to a lingering right knee ...

Geopolitical Turmoil Snags Super Eagles: Troost-Ekong Stranded Amid Middle East Crisis

Former Super Eagles captain William Troost-Ekong and other international football stars are stranded in Qatar due to a m...

Victory! 'Sinners' Sweeps Actor Awards with Michael B. Jordan's Dual Performance Stealing the Spotlight

Ryan Coogler's film "Sinners" has taken home the Outstanding Performance by a Cast award, with star Michael B. Jordan al...

Panic! 'Scary Movie 6' Trailer Unleashed After 13-Year Hiatus, Ready to Invade Your Safe Space

The iconic Wayans Bros. are reuniting after 18 years for "Scary Movie 6," bringing back original stars Anna Faris and Re...

Tragic Loss: Beloved Gospel Singer Taiwo Adegbodu Passes Away

The gospel music community is in mourning following the death of Taiwo Adegbodu, one half of the celebrated Adegbodu Twi...

Pop Icon Pink Silences Separation Rumors with 20-Year Husband

Pop star Pink has publicly refuted claims of a second separation from her husband, Carey Hart, labeling the reports as "...

HBO Hit 'Industry' Creators Spill on Season 5's Grand Finale Vision

Discover the intricate dynamics of <i>Industry</i> Season 4, as creators Mickey Down and Konrad Kay discuss the show's e...

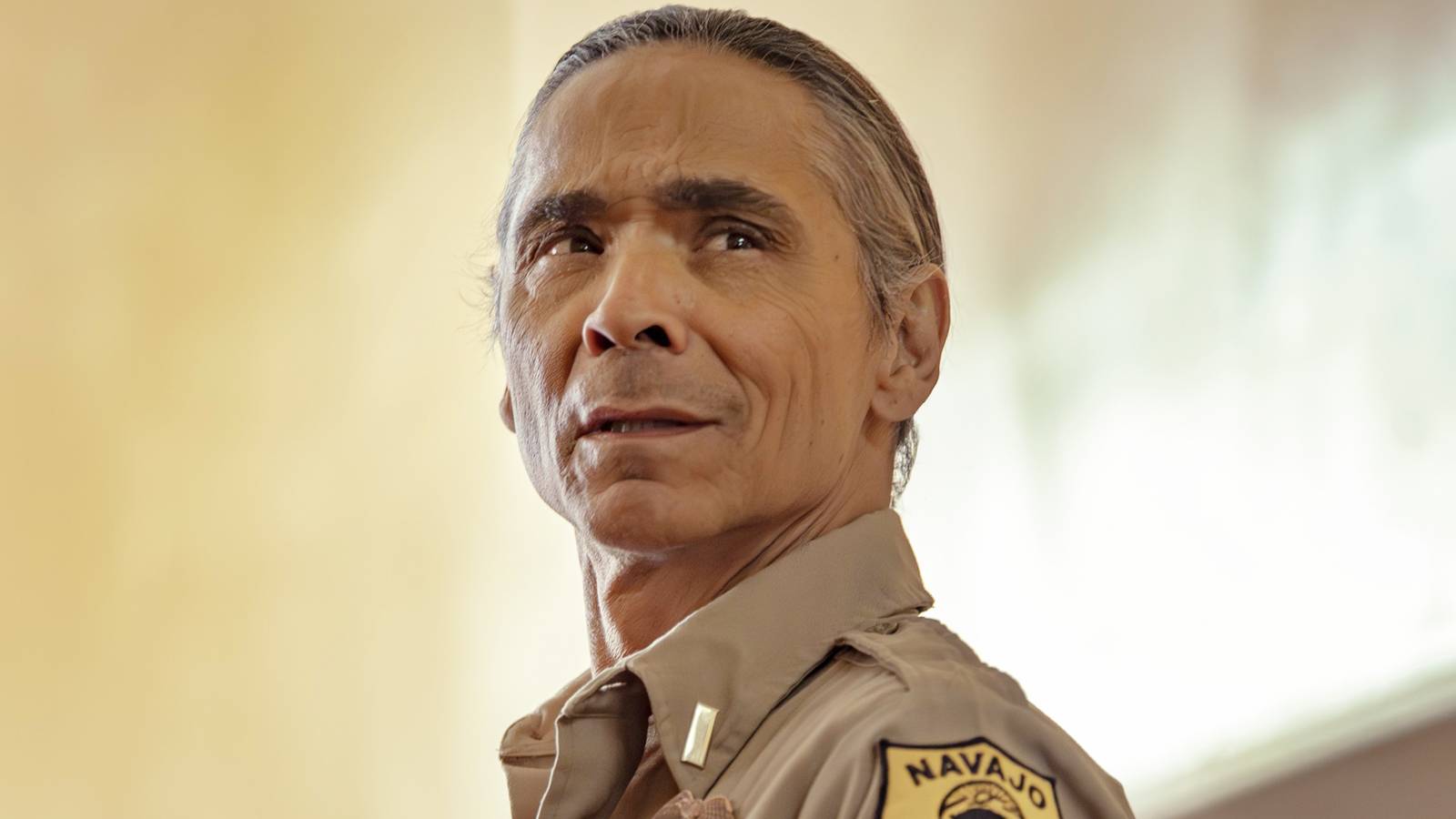

'Dark Winds' Star Zahn McClarnon Teases Joe's Perilous Future After Shocking Showdown

In <i>Dark Winds</i> Season 4, Zahn McClarnon discusses the compelling dynamic between Lt. Joe Leaphorn and new antagoni...