Nigeria's SEC Just Made It Way Harder to Start a Fintech — Here's What That Means for You

So, Nigeria's SEC just dropped aregulatory bombon fintech.

If you have been keeping up with Nigerian tech news or if you are just now tuning in because this affects your favorite crypto app, here is the gist: Nigeria's Securities and Exchange Commission just made it significantly harder and way more expensive to operate certain types of fintech businesses in the country.

And no, this is not one of those boring regulatory updates you can scroll past. This one actually matters, especially if you have ever thought about starting a fintech, work in the industry, or just use digital financial services regularly.

Let's Break Down What Actually Changed

On January 16, 2026, the SEC basically said, "If you want to play in Nigeria's capital market, you need to bring a lot more money to the table." And when I say "a lot more," I mean they increased some requirements by 1000%.

Robo-advisers (those AI-powered investment platforms) went from needing ₦10 million to ₦100 million. That is a 10x jump. Imagine if your school fees suddenly became ten times higher. Exactly, it is that kind of increase.

Crowdfunding platforms doubled from ₦100 million to ₦200 million. Not as dramatic, but still a hefty bump. Digital asset exchanges and custodians (basically, crypto platforms) now need ₦2 billion each just to get started.

Even the smaller players in the crypto space need ₦300 million now. Private equity folks need ₦500 million, while venture capital managers need ₦200 million.

Why Should You Actually Care?

I know "regulatory requirements" sounds like the kind of thing only people in suits care about. But hear me out, because this affects you more than you think.

If you are an aspiring founder: That fintech idea you have been sketching out just got a whole lot harder to launch. The barrier to entry just went from "challenging" to "you better have some serious investors lined up." This is not your typical "start in your room and scale" situation anymore.

If you use fintech apps: The platforms you love might be scrambling right now. Some might merge, some might shut down, and others might change how they operate. That robo-adviser helping you invest your side hustle money is probably now figuring out how to raise ₦100 million or risk being shut down by mid-2027.

If you work in tech: The industry is about to go through some changes. We might see more consolidation (big companies buying smaller ones), which could mean fewer options but potentially more stable services.

The Official Reason: "Market Stability"

According to the SEC, this is not them being difficult for the sake of it. They are saying these new standards are meant to make sure companies have enough financial muscle to weather storms, protect investors and bring Nigeria's regulations up to global standards.

Think of it like this: they want to make sure that if you put your money in a platform, that platform is not running on fumes and prayers. They want companies with actual financial backing that can survive market crashes and keep your money safe.

The SEC is basically saying, "We've seen what happens when undercapitalized companies fail, and we're not about to let that happen here."

But Here's the Other Side

Not everyone is celebrating. Some people are super concerned and their reasons are valid.

When you make it super expensive to start something new, you automatically cut out a lot of potential innovators. That brilliant 23-year-old with the next game-changing idea will be out of luck unless they have access to hundreds of millions in funding.

Higher barriers to entry usually mean established players with deep pockets dominate. Less competition can mean fewer choices, higher fees, and slower innovation.

Also, there will be a potential forbrain drain. If Nigeria becomes too expensive or difficult to operate in, founders might just set up shop elsewhere in Africa like Ghana, Kenya, or even completely outside Africa. We have already seen this happen in other industries.

Some argue that while Nigeria's fintech ecosystem is still relatively young and finding its footing, this might be too much too soon. It is like trying to make a teenager follow adult rules before they have figured out how to be a teenager.

The Countdown is On

Companies have until June 30, 2027, to get their finances in order. That might sound like a long time, but in the world of raising capital and restructuring businesses, it is actually not that much time.

Here is what could happen:

Scenario 1: Smaller companies might merge to pool resources and meet requirements. Your favorite app might become part of a bigger platform.

Scenario 2: We could see a wave of funding rounds as companies scramble to raise capital. Expect a lot of "we just raised X million" announcements.

Scenario 3: Some companies might just pack up and either shut down or move to friendlier regulatory environments.

Scenario 4: Companies might change their business models entirely to avoid these requirements. That crypto exchange might become something else entirely.

What This Means for the Bigger Picture

Nigeria has been positioning itself as Africa's fintech hub. This move signals that they are willing to prioritize regulation and stability over rapid, unchecked growth. Whether that is the right call depends on who you ask.

On one hand, we could end up with a more mature, stable financial ecosystem where consumers feel safer. On the other hand, we might lose the wild, innovative energy that made Nigerian fintech exciting in the first place.

It is also worth noting that this could set a precedent for other African countries. If Nigeria goes this route, don't be surprised if other regulators across the continent follow suit.

This is a fundamental shift in how fintech operates in Nigeria. Whether you are building, investing, or just using these services, things are about to change.

The Nigerian fintech story is still being written, but this chapter just took an interesting turn. Whether it is a plot twist that makes the story better or one that derails the narrative entirely? We will have to wait and see.

But one thing that is for sure is the "move fast and break things" era of Nigerian fintech might be coming to an end. Welcome to the "move carefully with substantial capital backing" era.

Stay tuned, stay informed, and maybe start saving that ₦100 million just in case.

You may also like...

NBA Shocker: Stephen Curry Sidelined with Knee Injury, Warriors Face Uphill Battle

Golden State Warriors star Stephen Curry is slated to miss at least five additional games due to a lingering right knee ...

Geopolitical Turmoil Snags Super Eagles: Troost-Ekong Stranded Amid Middle East Crisis

Former Super Eagles captain William Troost-Ekong and other international football stars are stranded in Qatar due to a m...

Victory! 'Sinners' Sweeps Actor Awards with Michael B. Jordan's Dual Performance Stealing the Spotlight

Ryan Coogler's film "Sinners" has taken home the Outstanding Performance by a Cast award, with star Michael B. Jordan al...

Panic! 'Scary Movie 6' Trailer Unleashed After 13-Year Hiatus, Ready to Invade Your Safe Space

The iconic Wayans Bros. are reuniting after 18 years for "Scary Movie 6," bringing back original stars Anna Faris and Re...

Tragic Loss: Beloved Gospel Singer Taiwo Adegbodu Passes Away

The gospel music community is in mourning following the death of Taiwo Adegbodu, one half of the celebrated Adegbodu Twi...

Pop Icon Pink Silences Separation Rumors with 20-Year Husband

Pop star Pink has publicly refuted claims of a second separation from her husband, Carey Hart, labeling the reports as "...

HBO Hit 'Industry' Creators Spill on Season 5's Grand Finale Vision

Discover the intricate dynamics of <i>Industry</i> Season 4, as creators Mickey Down and Konrad Kay discuss the show's e...

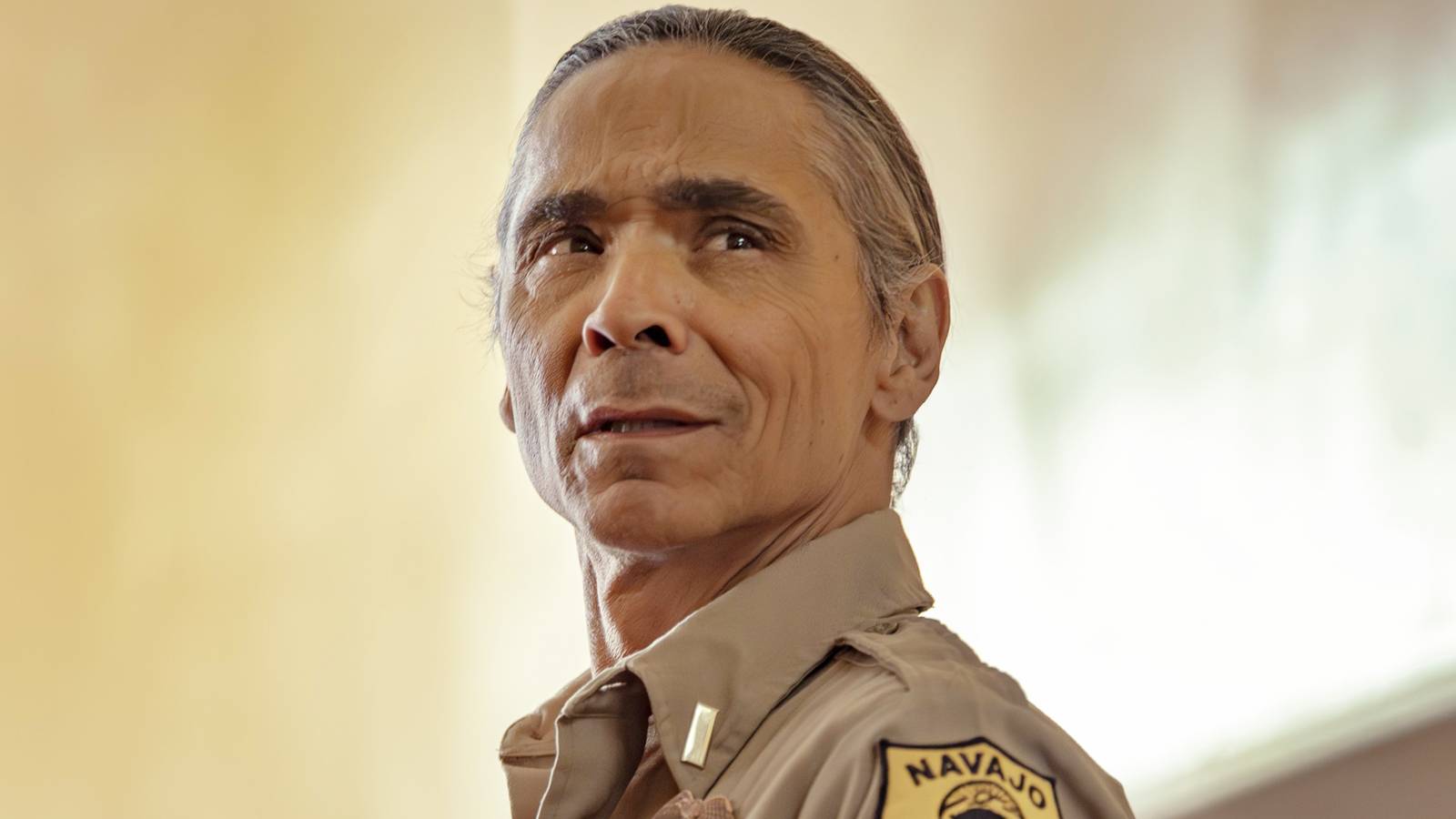

'Dark Winds' Star Zahn McClarnon Teases Joe's Perilous Future After Shocking Showdown

In <i>Dark Winds</i> Season 4, Zahn McClarnon discusses the compelling dynamic between Lt. Joe Leaphorn and new antagoni...