Crypto Powerhouse BitGo Aims for $1.96 Billion Valuation in Blockbuster US IPO!

BitGo, a prominent cryptocurrency custody startup, announced its intentions on Monday to pursue a US initial public offering (IPO) with a target valuation of up to $1.96 billion. This strategic move aims to leverage the escalating investor interest in crypto companies, particularly as demand for digital asset firms has surged due to improving market sentiment, increased institutional involvement, and clearer regulatory frameworks.

According to a Reuters report and regulatory filings, BitGo, alongside certain existing shareholders, plans to raise as much as $201 million through the IPO. This will involve offering 11.8 million shares, with an anticipated price range of $15 to $17 per share. The company is set to list its shares on the New York Stock Exchange (NYSE) under the ticker symbol "BTGO". Goldman Sachs and Citigroup have been appointed as the lead underwriters for the offering.

The broader IPO market is projected to sustain its recovery trajectory throughout the current year, building on momentum established in 2025. This comes despite various economic headwinds, including market volatility spurred by tariffs, the potential impact of a prolonged government shutdown, and a late-year selloff in Artificial Intelligence stocks, all of which have contributed to investor uncertainty.

Beyond BitGo, the cryptocurrency sector is expected to see more companies go public. Notable examples include crypto exchange Kraken, following the successful market debuts of stablecoin issuer Circle and crypto exchange Bullish last year, as reported by Reuters.

However, the crypto sector also contends with significant challenges. Heightened turbulence, particularly after a sharp selloff in October, has led to increased investor caution. This caution is further exacerbated by recent pressure on AI and tech valuations, pushing investors towards a "flight to quality" that prioritizes regulated entities over more speculative crypto ventures. IPOX research analyst Lukas Muehlbauer noted to Reuters that this environment places BitGo, as a regulated custody firm, in a relatively defensive and advantageous position within the sector. BitGo intends to capitalize on the early 2026 market momentum, characterized by outperformance in small and mid-cap indices, creating a favorable window for mid-sized offerings.

Founded in 2013, the Palo Alto, California-based BitGo has established itself as one of the largest crypto custody firms in the United States. Its core service involves storing and protecting digital assets for clients, a role that has gained increasing importance with the growing institutional interest in the cryptocurrency space.

You may also like...

Splitting Bills at Birthday Parties Should Be Outlawed

Birthday dinners are meant to celebrate love and friendship, so why do they end with calculators and awkward money trans...

Smarter AI, Weaker Grid: The Energy Crisis Behind the Data Center Boom

The race to build smarter AI is colliding with a harsh reality: data centers are consuming electricity faster than power...

"Intelligence Tools Have Changed What It Means to Run a Company" — Dorsey Is Right, and That Should Terrify Us

After Jack Dorsey laid off 4,000 employees at Block Inc., his blunt admission about AI replacing roles exposes a deeper ...

Jazz Star Markkanen Sidelined with Hip Injury, Out for Weeks!

Utah Jazz forward Lauri Markkanen is set for a two-week reevaluation after an MRI confirmed hip impingement, inflammatio...

Thunder's SGA Cleared for Return, Playoff Hopes Surge!

Reigning NBA MVP Shai Gilgeous-Alexander is cleared to return for the Oklahoma City Thunder after missing nine games due...

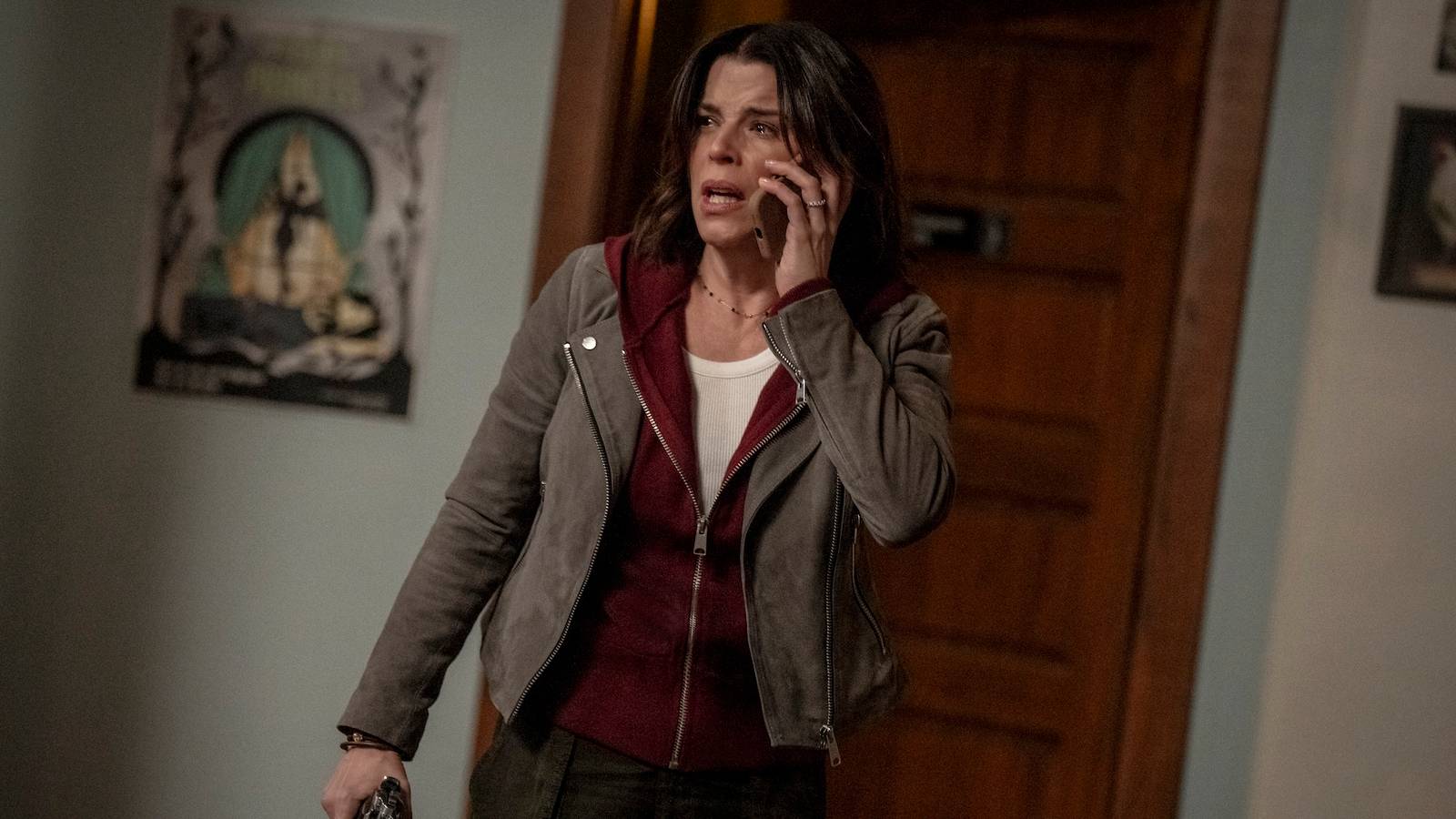

Horror Franchise in Peril: 'Scream 7' Reviews Slammed Despite Neve Campbell's Return to Basics

After a tumultuous production and cast exits, "Scream 7" arrives with Kevin Williamson directing and Neve Campbell retur...

Media Giant Merger: Paramount Skydance Poised to Acquire Warner Bros. Discovery, Netflix Stock Surges After Exiting Bidding War

Netflix has abruptly exited its $83 billion deal to acquire Warner Bros. Discovery, allowing Paramount Skydance to proce...

BLACKPINK Unleashes 'Deadline' Mini-Album, Lights Up South Korea’s Most-Visited Museum

Global K-pop sensation BLACKPINK has returned with their new five-track mini-album, "DEADLINE," released on Friday, Feb....