Crypto Giant MicroStrategy Splurges $1.25 Billion on Bitcoin, Amassing a Staggering Horde

Strategy, a leading entity in the digital asset domain, significantly bolstered its Bitcoin (BTC) treasury for the third consecutive week, completing a substantial acquisition of 13,627 BTC. These purchases, made between January 5 and January 11, amounted to approximately $1.25 billion, with an average price of $91,519 per coin, as detailed in an SEC filing dated January 12. The funding for these acquisitions was primarily sourced through the company’s at-the-market offering program, which encompassed sales of its Class A common stock (MSTR) and 10.00% Series A perpetual preferred stock (STRC). These sales collectively generated around $1.2 billion in net proceeds, with common stock contributing $1.1 billion and preferred equity adding $119 million.

These latest acquisitions elevate Strategy's total Bitcoin holdings to an impressive 687,410 BTC. The aggregate cost for these holdings stands at $51.8 billion, reflecting an average purchase price of $75,353 per bitcoin. At current market valuations, this substantial Bitcoin stash is estimated to be worth approximately $62 billion. Preceding this, Strategy had also disclosed another notable Bitcoin purchase in late December and early January, acquiring 1,286 BTC for about $116 million, which at the time brought its total holdings to 673,783 BTC, also funded through Class A share sales.

Alongside its Bitcoin strategy, Strategy also reinforced its U.S. dollar reserves last week, increasing them to $2.25 billion to ensure adequate support for preferred dividends and debt obligations. The company reported an average Bitcoin cost basis of approximately $75,000 per coin. Despite Bitcoin's rebound above the $90,000 mark at the start of 2026, the firm recorded a considerable $17.44 billion unrealized loss in the fourth quarter of 2025, following a sharp decline in Bitcoin prices from their October highs.

Over recent months, Strategy has been at the epicenter of attention due to its substantial Bitcoin treasury strategy and its inclusion in MSCI’s global equity indexes. MSCI, one of the world's most influential index providers, initiated a review in late 2025 to evaluate whether companies holding more than 50% of their assets in digital assets—termed Digital Asset Treasury Companies (DATCOs)—should retain their positions in major benchmarks like the MSCI World and MSCI USA indexes. The potential exclusion from these indexes posed a significant threat, as passive funds tracking them could be compelled to divest billions of dollars in MSTR shares. Estimates suggested outflows of up to ~$2.8 billion from MSCI-linked funds alone, with potentially greater market repercussions if other index providers followed suit. Analysts from JPMorgan and TD Cowen further estimated that such an exclusion could jeopardize billions in additional market value.

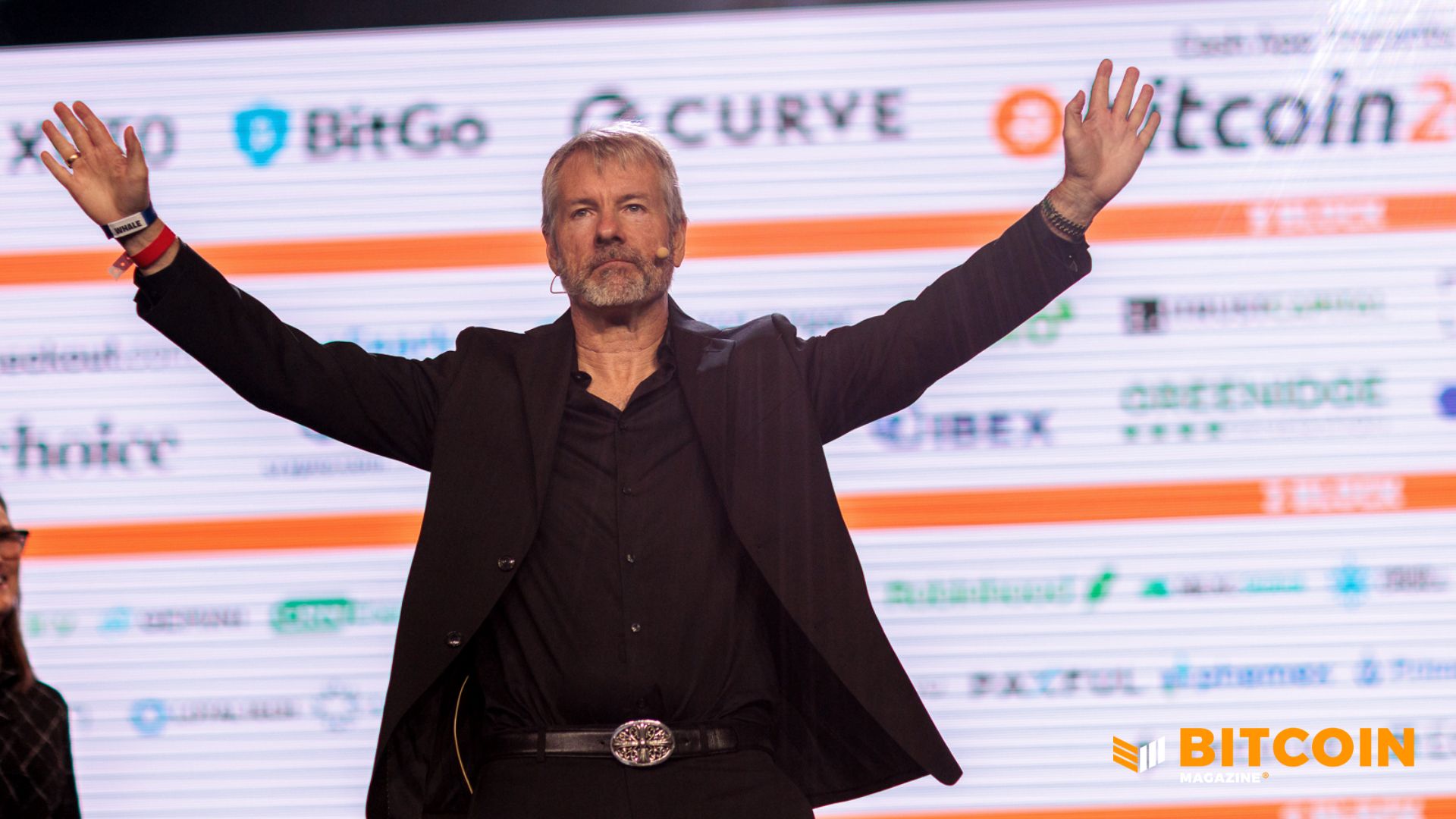

As markets began to price in the risk of index exclusion, Strategy’s stock experienced declines and heightened risk-off sentiment, with its share price dropping sharply in late 2025. In response, company leadership, including Michael Saylor, actively defended Strategy's operational model. Saylor publicly asserted that the company is a legitimate operating entity, not a passive fund, trust, or holding company, highlighting its $500 million software business and a unique treasury strategy that leverages Bitcoin as productive capital. Strategy engaged directly with MSCI during the consultation period to stress its enterprise operations alongside its Bitcoin holdings.

In a pivotal announcement in early January 2026, MSCI declared its decision not to implement the proposed exclusions of DATCOs from its indexes at that time. This effectively postponed any removal for the upcoming February 2026 review, providing immediate relief for Strategy. The decision was widely interpreted as a positive short-term development, alleviating some selling pressure and leading to a 4%-6% rise in MSTR stock as investors welcomed the reprieve. However, MSCI also indicated a forthcoming broader consultation on the classification of non-operating companies, suggesting that similar debates regarding Strategy's index inclusion could re-emerge later in 2026. Despite all these corporate maneuvers and significant Bitcoin acquisitions, the price of Bitcoin itself has remained relatively stable over the last couple of months, fluctuating around the $90,000 range and currently trading at $90,555.

You may also like...

Splitting Bills at Birthday Parties Should Be Outlawed

Birthday dinners are meant to celebrate love and friendship, so why do they end with calculators and awkward money trans...

Smarter AI, Weaker Grid: The Energy Crisis Behind the Data Center Boom

The race to build smarter AI is colliding with a harsh reality: data centers are consuming electricity faster than power...

"Intelligence Tools Have Changed What It Means to Run a Company" — Dorsey Is Right, and That Should Terrify Us

After Jack Dorsey laid off 4,000 employees at Block Inc., his blunt admission about AI replacing roles exposes a deeper ...

Jazz Star Markkanen Sidelined with Hip Injury, Out for Weeks!

Utah Jazz forward Lauri Markkanen is set for a two-week reevaluation after an MRI confirmed hip impingement, inflammatio...

Thunder's SGA Cleared for Return, Playoff Hopes Surge!

Reigning NBA MVP Shai Gilgeous-Alexander is cleared to return for the Oklahoma City Thunder after missing nine games due...

Horror Franchise in Peril: 'Scream 7' Reviews Slammed Despite Neve Campbell's Return to Basics

After a tumultuous production and cast exits, "Scream 7" arrives with Kevin Williamson directing and Neve Campbell retur...

Media Giant Merger: Paramount Skydance Poised to Acquire Warner Bros. Discovery, Netflix Stock Surges After Exiting Bidding War

Netflix has abruptly exited its $83 billion deal to acquire Warner Bros. Discovery, allowing Paramount Skydance to proce...

BLACKPINK Unleashes 'Deadline' Mini-Album, Lights Up South Korea’s Most-Visited Museum

Global K-pop sensation BLACKPINK has returned with their new five-track mini-album, "DEADLINE," released on Friday, Feb....