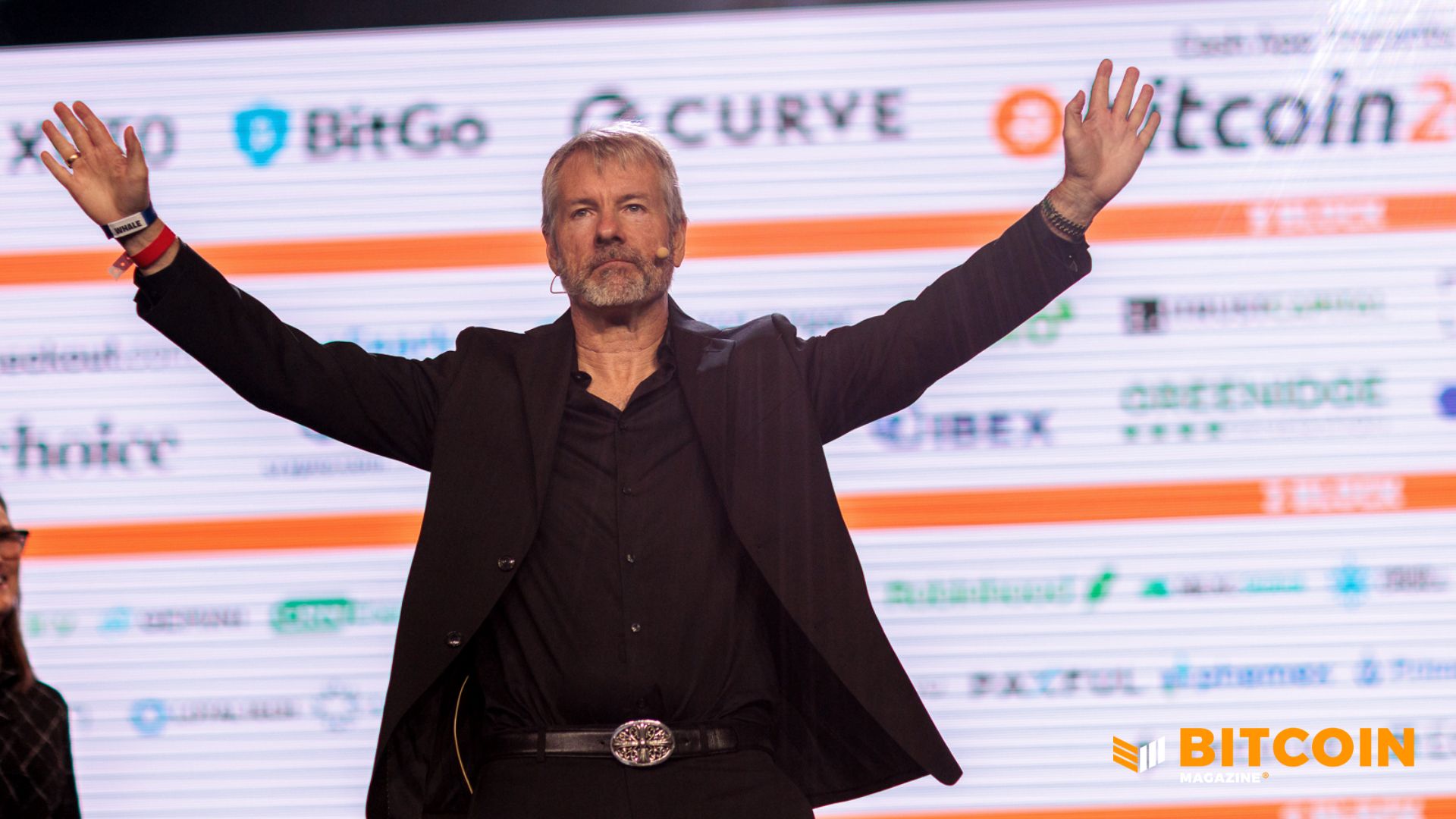

MicroStrategy's $261 Million Bitcoin Shopping Spree Fuels Crypto Hopes

Strategy, formerly known as MicroStrategy, has reaffirmed its steadfast commitment to its Bitcoin standard through a recent significant acquisition. The company announced the purchase of an additional 2,932 BTC for approximately $264.1 million, executed at an average price of $90,061 per Bitcoin. This move demonstrates Strategy's dedication to accumulating Bitcoin, even as the asset has struggled to reclaim the $100,000 level.

This latest acquisition underscores Strategy's willingness to "average up," with the purchase price of $90,061 per Bitcoin being notably higher than their aggregate cost basis of $76,037. This indicates the firm perceives the current consolidation around the $90,000 mark not as a market peak, but rather as a discount relative to its long-term market outlook for Bitcoin. With this recent purchase, Strategy's total Bitcoin holdings now stand at 712,647 BTC, positioning it as the world's largest publicly traded corporate holder of the asset. These holdings effectively grant Strategy control over nearly 3.4% of Bitcoin's entire circulating supply, which is capped at 21 million.

The acquisition, which occurred between January 20 and January 25, was funded through proceeds generated under Strategy’s at-the-market (ATM) offering program. During this five-day period, the company sold 1,569,770 shares of its Class A common stock (MSTR) for approximately $257 million in net proceeds. Additionally, it sold 70,201 shares of its perpetual preferred stock (STRC), raising an extra $7 million, bringing the total ATM proceeds used for the purchase to roughly $264 million.

As of January 25, Strategy maintains substantial capacity within its ATM programs, including approximately $8.17 billion available for future issuance under its common stock offering. The company also manages multiple preferred stock programs, such as STRK, STRF, STRC, and STRD, which collectively represent tens of billions of dollars in potential future capital raises. At current market prices, Strategy’s Bitcoin treasury is valued at roughly $62.5 billion, and the company is sitting on an estimated $8.3 billion in unrealized gains.

Further bolstering its market position, Strategy experienced a significant relief earlier this month when MSCI concluded its review of digital asset treasury companies. MSCI decided against excluding such firms from its major global equity indexes, allowing Bitcoin-heavy companies to remain eligible under existing rules. This decision came after months of market anxiety, as MSCI had proposed reclassifying companies with over 50% of their assets in digital assets as fund-like, which would have rendered them ineligible for inclusion and potentially triggered billions of dollars in forced passive selling. Strategy, along with industry groups, had strongly pushed back against this proposal. At the time of this report, Bitcoin is trading near the $88,000 to $89,000 level.

You may also like...

Tottenham's Champions League Success Contrasts With Troubled Premier League Form Under Thomas Frank

Tottenham's Premier League form poses problems for boss Thomas Frank despite their Champions League success. BBC Sport e...

The Pitt Unleashed: Exclusive Sneak Peeks, Star Secrets, and a Shocking 'Simpsons' Crossover!

The Indian SUV market sees compact SUVs leading sales in FY2025, with Tata Punch topping the charts. Maruti Brezza </div...

Neil Young Unleashes Fury: Slams Apple, Verizon, T-Mobile Over Trump Regime Support!

Neil Young has intensified his political activism, publicly condemning the Trump administration and companies like Veriz...

Grammy Gala Shakes Up 2026: Chappell Roan, Teyana Taylor, Karol G Join Presenter Ranks!

The 68th annual Grammy Awards are slated for February 1, 2026, with Trevor Noah hosting his final consecutive show. Chap...

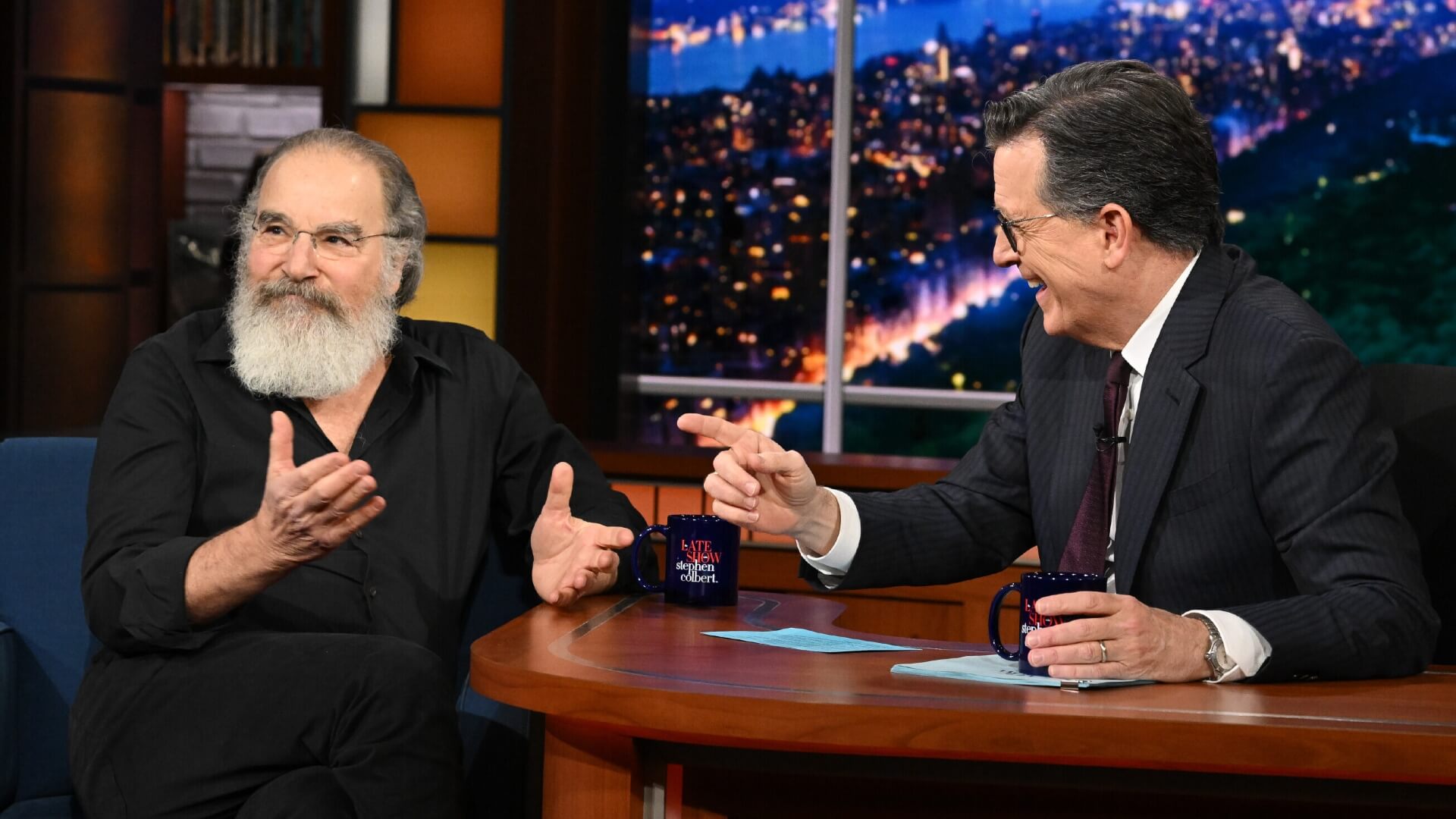

Divine Casting Revelation: Mandy Patinkin Ascends as Odin in Amazon's God Of War Series!

Mandy Patinkin has officially joined Amazon's live-action 'God of War' series, taking on the role of Odin, the Allfather...

Gaming Glory: Beth Mead, Cunha Dominate EA FC 26 Team of the Week 20!

Arsenal's Beth Mead earned a spot in the Team of the Week after a stellar performance against Chelsea, scoring and assis...

Crypto Bloodbath: Bitcoin Plummets to $84K, Triggering MicroStrategy Stock's 52-Week Low

Bitcoin's price plummeted sharply this morning, falling to the $84,000 range due to macro uncertainty and Federal Reserv...

Billion-Dollar Scandal: First Brands Founder Faces Charges for Massive Fraud

The founder and a former executive of First Brands Group, Patrick and Edward James, have been indicted in New York on ch...