Michael Saylor's MicroStrategy Strikes Again: Second $1 Billion Bitcoin Buy Confirmed!

Strategy, the world's largest publicly traded bitcoin holder, has significantly expanded its digital asset reserves with another substantial acquisition. The company recently added 10,645 bitcoin (BTC) for approximately $980.3 million, marking its second consecutive mega-purchase. This acquisition occurred as bitcoin prices experienced a pullback, nearing the $90,000 level. The average price paid for this latest batch of BTC was $92,098 per coin, according to a filing released on Monday.

Following this purchase, Strategy's total bitcoin holdings now stand at an impressive 671,268 BTC, acquired for a cumulative sum of $50.33 billion. This gives the company an average acquisition cost of $74,972 per coin. The latest acquisition, consistent with recent purchasing trends, was primarily funded through equity issuance. Specifically, Strategy raised $888.2 million through sales of its common stock, with the remaining capital sourced from sales of its STRD preferred shares. Despite persistent concerns regarding shareholder dilution, the company has consistently leveraged equity markets to bolster its bitcoin exposure.

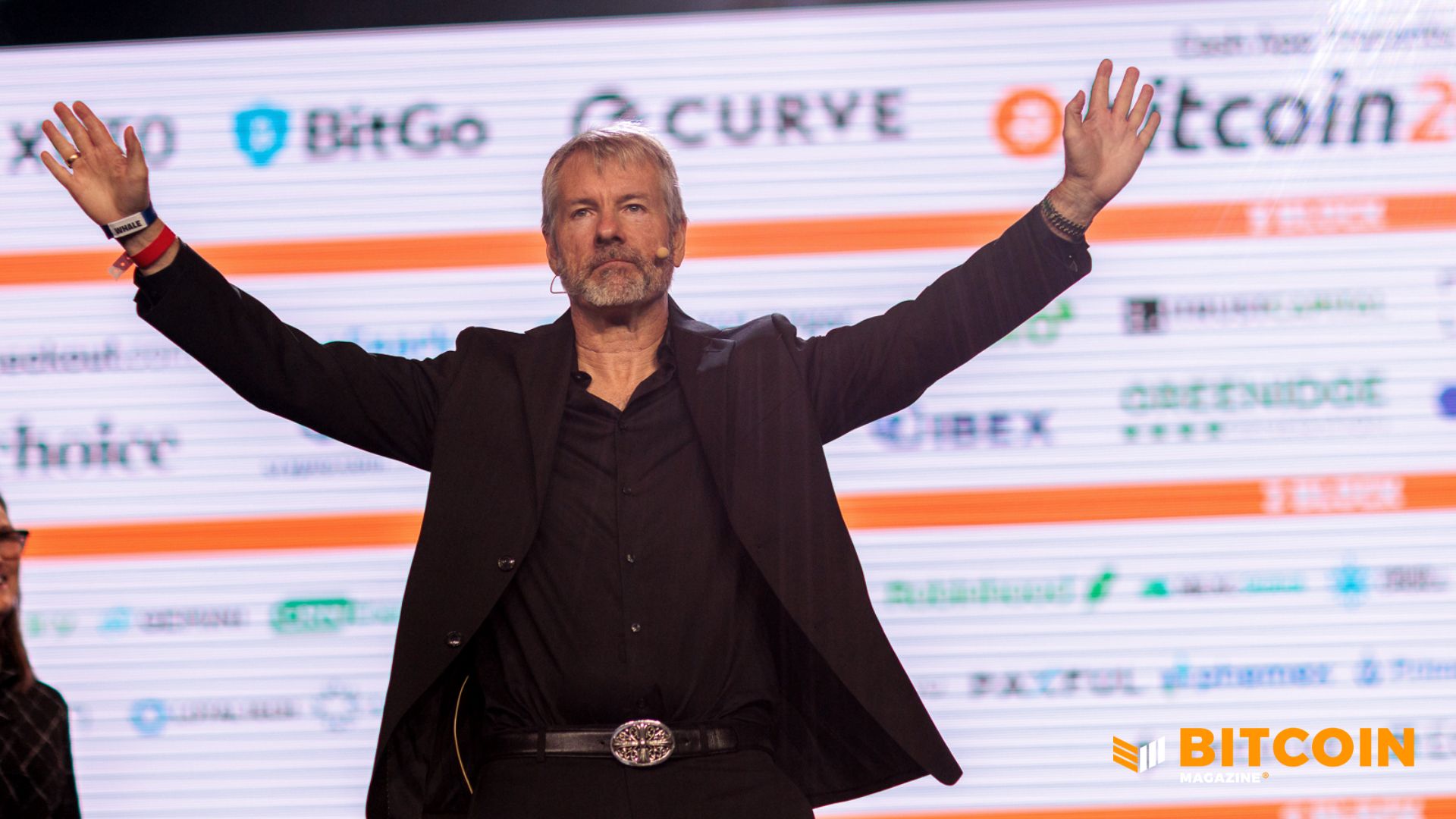

The timing of this significant purchase is notable, occurring amidst a broader market correction for bitcoin, which briefly dipped below $90,000 over the weekend before stabilizing around $89,600. While Strategy has maintained a steady purchasing pattern throughout 2025, most weekly acquisitions in recent months had been relatively modest due to fundraising constraints. However, over the past two weeks, Executive Chairman Michael Saylor has ramped up purchases, signaling a renewed conviction in bitcoin despite ongoing volatility in both the cryptocurrency and Strategy’s own stock.

In other corporate developments, Strategy ($MSTR) has confirmed its continued inclusion as a constituent of the Nasdaq 100 index, maintaining its classification within the technology category. Furthermore, the company has actively challenged proposals from the index provider MSCI, which is currently reviewing whether to exclude companies with significant bitcoin treasury holdings from its benchmarks. In a formal letter, Strategy argued that MSCI’s proposed digital asset threshold is 'misguided' and would result in 'profoundly harmful consequences.' MSCI is anticipated to announce its final decision on this matter in January.

Strategy, formerly known as MicroStrategy, made a strategic pivot from enterprise software to a bitcoin-focused treasury strategy in 2020. This innovative model has since been emulated by numerous other firms, though some critics contend that these companies are increasingly functioning more as bitcoin investment vehicles than as traditional operating businesses. Despite these criticisms, Michael Saylor has remained resolute and unapologetic in his bold purchasing decisions. As of December 14, 2025, Strategy reported a year-to-date BTC yield of 24.9%, underscoring its unwavering commitment to accumulating bitcoin irrespective of short-term market fluctuations or equity price pressures. At the time of writing, bitcoin was trading near $89,650.

Recommended Articles

MicroStrategy's Bitcoin Frenzy: $168M Haul Boosts Holdings to Staggering 717,131 BTC!

Strategy, the bitcoin treasury company led by Executive Chairman Michael Saylor, recently acquired an additional $168.4 ...

MicroStrategy's $261 Million Bitcoin Shopping Spree Fuels Crypto Hopes

Strategy, formerly MicroStrategy, has acquired an additional 2,932 Bitcoin for $264.1 million, bringing its total holdin...

BREAKING: Mystery 'Strategy' Amasses Staggering 700,000 BTC, Shaking Crypto Markets!

Strategy Inc. (MSTR) has significantly boosted its Bitcoin holdings, surpassing 700,000 BTC after acquiring an additiona...

Crypto Giant MicroStrategy Splurges $1.25 Billion on Bitcoin, Amassing a Staggering Horde

Strategy recently made significant Bitcoin acquisitions, raising its total holdings to over 687,000 BTC, while also succ...

Japan's Metaplanet Kicks Off 2026 with Massive 4,279 BTC Accumulation!

Japanese public company Metaplanet has started 2025 with a major Bitcoin acquisition, adding 4,279 BTC to its treasury. ...

You may also like...

Telecom Giants Strike Gold: MTN and IHS Towers Seal $6.2 Billion Merger!

IHS Towers and MTN Group have announced a proposed $6.2 billion merger agreement, which will result in MTN taking full c...

OPPO A93: Nigeria Gears Up for the Much-Anticipated Device Launch!

OPPO is set to introduce its new A93 smartphone in Nigeria, an upgraded model also known as F17 Pro in other markets. Th...

Al Warda Unleashes 8.2 Million IBIT Shares: Abu Dhabi's Q4 Crypto Power Play

Al Warda Investments, an Abu Dhabi-based firm under Mubadala, significantly increased its bitcoin exposure through Black...

Mubadala's $630 Million Bitcoin Bet: Abu Dhabi Giant's Crypto Dive

Institutional investment in BlackRock's iShares Bitcoin Trust (IBIT) is surging, led by Abu Dhabi's Mubadala Investment ...

French Far-Right Activist Murder: Four Arrested Amidst Misinformation Chaos

The fatal beating of French far-right activist Quentin Deranque in Lyon has escalated political tensions between the far...

Ghana's Thirsty Future: Mounting Debt, Ageing Pipes, and a 130 Million Gallon Daily Deficit Unleash Water Crisis

Ghana's urban water system is facing severe financial and operational challenges, with over half of treated water lost a...

Cocoa Farmers' Fury: Ghana's Gold Faces Privatization Pushback and Price Cut Protests Amidst Deepening Crisis

Ghana's cocoa sector faces a crisis as the government implements a controversial farmgate price reduction, significantly...

El-Rufai Under Fire: From EFCC Detention to Phone Tapping Allegations, Political Storm Brews

Former Kaduna State Governor Nasir El-Rufai faces extensive legal and ethical challenges, including federal charges for ...