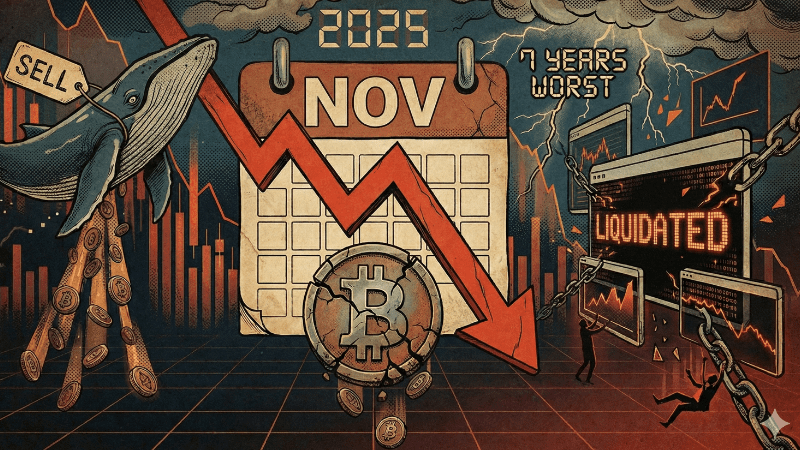

Crypto Carnage: Bitcoin Plummets 17%, Marking Worst Month in Seven Years!

Bitcoin experienced a severe downturn in November 2025, recording a 17.49% plummet, marking its worst monthly performance since the 2018 bear market and the second-worst of the year, just surpassing February’s 17.39% slide. The cryptocurrency, which began the month near $110,000, dipped to a seven-month low near $80,000 before a brief recovery and subsequent collapse to approximately $86,000 by month-end, including a 5% drop within three hours on a Sunday.

Initially, November saw cautious optimism for Bitcoin, fueled by post-halving momentum and anticipated institutional inflows. However, this sentiment quickly dissolved as U.S. spot Bitcoin ETFs faced a surge in redemptions, with outflows reaching $3.48 billion, making it the second-heaviest monthly drain since the ETFs’ launch in 2024. Notably, BlackRock’s iShares Bitcoin Trust alone witnessed billions in withdrawals, as risk-averse funds pulled back, leading to significant losses for short-term holders, with over 10,200 BTC wiped out in a single event.

Adding to the pressure were several macroeconomic headwinds. Donald Trump’s expanded tariffs on China, implemented on October 10, triggered a global risk reassessment that negatively impacted both equities and crypto markets. The record U.S. government shutdown further squeezed liquidity from traditional markets, leaving Bitcoin starved. Federal Reserve Chair Jerome Powell’s unenthusiastic comments on rate cuts, coupled with ongoing quantitative tightening, leaving the Fed’s balance sheet at $6.6 trillion, diverted dollars from high-risk assets like Bitcoin. In contrast, gold demonstrated stronger performance, highlighting Bitcoin’s vulnerability during periods of flight to safety.

A major factor in November’s carnage was aggressive selling by Bitcoin whales, defined as mega-holders with over 10,000 BTC. These long-term holders, including those from Bitcoin’s early Satoshi era, began cashing in significant gains. On-chain data revealed an exodus of over 50,000 BTC, equivalent to $4.6 billion, in a single week, the largest whale sell-off of 2025. Long-term holders collectively offloaded $43 billion since July, including a notable instance where Owen Gunden moved 2,400 BTC ($237 million) to Kraken, and another Satoshi-era whale liquidated a 15-year stash worth $1.5 billion. This whale frenzy intensified market instability, leading to $870 million in ETF redemptions in one day due to margin calls on leveraged positions. Technically, the 50-day moving average neared a “death cross” below the 200-day, a historically bearish indicator.

Market sentiment, as reflected by the Fear & Greed Index, plummeted to 28, firmly in “fear” territory. Despite the widespread sell-off, figures such as Michael Saylor maintained their accumulation strategy, adding thousands of BTC, underscoring the divergence in investor conviction. November’s rout also defied historical seasonal trends; while history showed a 42% average November gain (skewed by 2013’s 449% surge) and an 8.8% median, 2025 joined the ranks of losing Novembers, echoing 2018’s 36% drop. Altcoins suffered even more, with Ethereum down 22% and the total crypto market cap shedding $1 trillion, indicating Bitcoin’s deep scars exposed underlying fragilities masked by ETF hype.

Looking ahead, December presents a mixed outlook. Historically, red Novembers often precede red Decembers, with a median decline of -3.2%. Key support levels to watch are $85,000, with a break potentially leading to $80,000. Conversely, resistance between $90,000 and $95,000 could trigger a “Santa rally” towards or above $100,000. While whale sales have been brutal, they often signal the capping of corrections. Despite the November slump, Bitcoin’s year-to-date performance remains positive at 7%. The market continues to observe whether November’s bearish trends will persist or if Bitcoin will find new momentum in 2026.

Recommended Articles

Crypto Carnage Strikes: Bitcoin Price Crashes to $75K Amid Market-Wide Sell-Off

Bitcoin's price plummeted to nearly $75,000 today in a high-volume sell-off, erasing over 10% from recent highs and trig...

Ancient Bitcoin Whale Awakens: $500M Dump After 12 Years Yields Jaw-Dropping 31,250% Profit!

A dormant Bitcoin whale, known as "5K BTC OG," has re-emerged after 12 years to sell half of its 5,000 BTC stash, earnin...

Bitcoin Bloodbath: $200 Million Liquidated as Price Plummets Below $87K

Bitcoin faces an extremely bearish outlook this week, struggling to hold the $84,000 support level after a significant w...

Fed Shakes Crypto: Interest Rate Cut Triggers Bitcoin Volatility

The Federal Reserve cut its benchmark interest rate by 25 basis points, marking its third reduction this year. This deci...

Crypto Crash: Bitcoin Tumbles to $88K, Yet JPMorgan Holds Firm on $170K Target!

Bitcoin recently plunged to $88,000s, but JPMorgan remains bullish with a $170,000 target, heavily influenced by corpora...

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...