14 Things to Stop Buying If You’re Serious About Your Financial Goals This Year

Money rarely disappears in dramatic ways. It leaks slowly. In amounts small enough to justify and frequent enough to sabotage progress.

Most people who feel stuck financially are not reckless spenders. They are tired spenders, emotional spenders, or habit spenders. The kind who look at their bank balance and genuinely wonder how things went sideways again.

This is not a call to extreme frugality or aesthetic suffering. It is about identifying purchases that quietly delay your goals and deciding, with intention, to step off autopilot.

If you want your financial plans to feel achievable this year, these are some things worth reconsidering.

1. Clothes for a Lifestyle You Rarely Live

Many wardrobes are stocked for imaginary versions of real people. Weekend trips that never happen. Events that come once a year. A social calendar that exists mostly in theory.

Buying clothes for occasions you do not regularly attend locks money into items that sit unused while essentials wear out. The goal is not to dress boringly. It is to dress realistically.

Buy for your actual week, not your aspirational highlight reel.

2. Trend-Driven Purchases You Would Ignore Without Social Media

Trends create urgency without usefulness. A product feels essential because everyone is talking about it, not because it solves a real problem in your life.

If interest disappears the moment the trend fades, the purchase was never about value. It was about belonging. That is expensive.

Your financial goals require longer attention spans than internet cycles.

3. Cheap Alternatives You Do Not Actually Like

Buying something simply because it is cheaper often leads to buying it again. And again.

Low-quality substitutes that disappoint quickly end up costing more over time, especially when they need frequent replacement. Spending less is not the same as spending wisely.

If you do not enjoy using it, it is not a bargain.

4. Backup Beauty and Skincare Products You Haven’t Finished

Sales create the illusion of urgency. Suddenly, products you use slowly feel like they need to be stocked in bulk.

Most beauty and skincare items expire before they are fully used. Others lose relevance as routines change. Buying backups often benefits retailers more than consumers.

Finish what you own first. There will always be another discount.

5. Takeout as a Default Response to Fatigue

Convenience spending is one of the most underestimated budget drains. Delivery fees, service charges, and tips add up quickly when food ordering becomes automatic.

This is not an argument against takeout. It is an argument against unplanned takeout.

Having a few low-effort meals available can save significant money without demanding extra energy.

6. Subscriptions You Barely Remember Signing Up For

Recurring payments are dangerous because they fade into the background. Small monthly charges feel harmless until they are added up over a year.

If you would not actively subscribe to it again today, it should not still be charging you.

Your budget deserves regular audits, not passive acceptance.

7. Home Organisation Items Bought Before Decluttering

Storage solutions are often purchased to manage clutter rather than reduce it.

Buying baskets, boxes, and shelves without first eliminating excess simply rearranges the problem. It also turns the organisation into an aesthetic expense instead of a functional one.

Declutter first. Then organise intentionally.

8. Books You Buy Faster Than You Read

Buying books feels productive. Reading them actually is.

When unread books pile up, they become visual reminders of unfinished intentions. They also tie up money that could be allocated elsewhere.

One book at a time builds a habit. Hoarding books builds pressure.

9. Guilt Purchases, Especially for Children

Spending driven by guilt is rarely planned and often repeated. Small “just this once” purchases quickly become expectations.

While generosity matters, consistency matters more. Not every difficult moment needs to be softened with money.

Time and attention are often more valuable and far less expensive.

10. Sale Items That Were Never Part of Your Plan

A discount does not create necessity. It only reduces resistance.

If you would not buy an item at full price, the sale price is not saving you money. It is simply making spending feel smarter than it is.

Sales should serve your plan, not override it.

11. Productivity Tools You Abandon After a Week

New planners, apps, and notebooks promise transformation. Most are abandoned once the novelty fades.

Productivity improves through consistent systems, not constant replacements. One tool used well is more effective than several used briefly.

Finish what you start before buying what is new.

12. Groceries You Buy With No Clear Plan

Food waste is one of the most common and least discussed money drains.

Buying groceries based on mood, discounts, or aesthetics rather than actual meals leads to spoilage and repeat shopping. Money is spent twice: once at purchase and again when replacing unused items.

Plan meals before shopping, buy with intention, and waste less.

13. Small Daily Purchases That Feel Harmless Individually

Coffee stops, snacks, and quick add-ons. These expenses feel too minor to matter until they become routines.

Daily spending habits shape monthly outcomes. What feels insignificant in the moment often determines whether goals are reached or postponed.

Awareness changes outcomes.

14. Emotional Spending Disguised as Self-Care

Self-care that consistently strains finances stops being care.

Spending as a response to stress, boredom, or exhaustion provides temporary relief but long-term pressure. True financial self-care involves rest, boundaries, and planning, not just transactions.

Not every feeling needs a purchase attached to it.

This is not about eliminating joy or living restrictively. It is about directing money toward what actually moves your life forward.

Financial progress is built by small decisions repeated consistently. Choose one thing to stop buying for now. That single pause can create momentum you did not know you were missing.

More Articles from this Publisher

14 Things to Stop Buying If You’re Serious About Your Financial Goals This Year

Most financial goals fail quietly, not through big mistakes but small daily purchases. These are the everyday things dra...

4 African Countries Where Debt Recovery Is Brutal

Doing business in Africa comes with high rewards and high risks. These are the African countries where debt recovery is ...

Ghana Suspends Citizenship Applications for Africans in the Diaspora Abroad

Ghana has paused citizenship applications for African descendants abroad, raising hard questions about Pan-Africanism, a...

Patience Ozokwor: The Nollywood Legend Who Turned Into a Meme Queen

Patience Ozokwor didn’t just act in Nollywood, she became Nigerian pop culture. From her “Mama G” roles to the memes tha...

Why Is the Keyboard Not Arranged in Alphabetical Order?

Why isn’t your keyboard alphabetical? The surprising history of QWERTY reveals how broken machines, clever hacks, and 19...

Plastics and Priviledge: How Two Videos Reveal the Country’s Hidden Fault Lines

Two viral videos, one young man carrying plastics to survive, and a billionaire’s son shocked by fuel prices. This is wh...

You may also like...

Beyond GDP: What Africa’s Most Socially Progressive Countries Tell Us About Real Development

Have you heard of the Global Social Progress Index? This is a deep dive and insight into the 2026 Global Social Progress...

Why More Women Are Choosing Single Motherhood Over Marriage

More women are choosing single motherhood for independence and freedom. Marriage can bring love but also stress, while r...

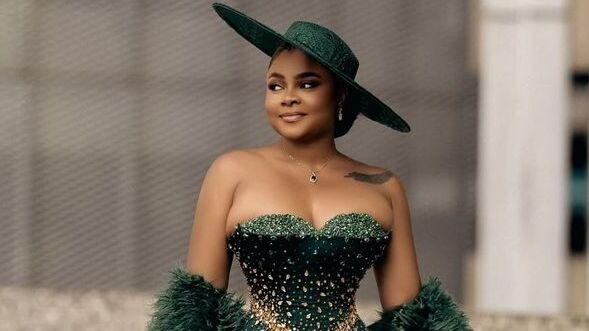

Bimbo Ademoye: The New Face of Nigerian Nollywood Comedy

From Ebute-Meta to the AMVCA stage, Bimbo Ademoye has redefined Nollywood comedy with authenticity, impeccable timing, a...

14 Things to Stop Buying If You’re Serious About Your Financial Goals This Year

Most financial goals fail quietly, not through big mistakes but small daily purchases. These are the everyday things dra...

The value of internships and summer jobs in shaping career paths

Internships and summer jobs are more than temporary roles, they shape careers. Learn how early experience builds skills,...

How AI Leadership Forums Are Shaping Fintech's Future Across Africa

As African leaders, fintech founders, and AI pioneers convene in Addis Ababa during AU Summit Week, AI leadership forums...

Health Inequities and Why ZIP Code Can Matter More Than Genetics

Your neighborhood affects your health more than your genes. Learn how ZIP codes shape access to food, care, safety, and ...

4 African Countries Where Debt Recovery Is Brutal

Doing business in Africa comes with high rewards and high risks. These are the African countries where debt recovery is ...