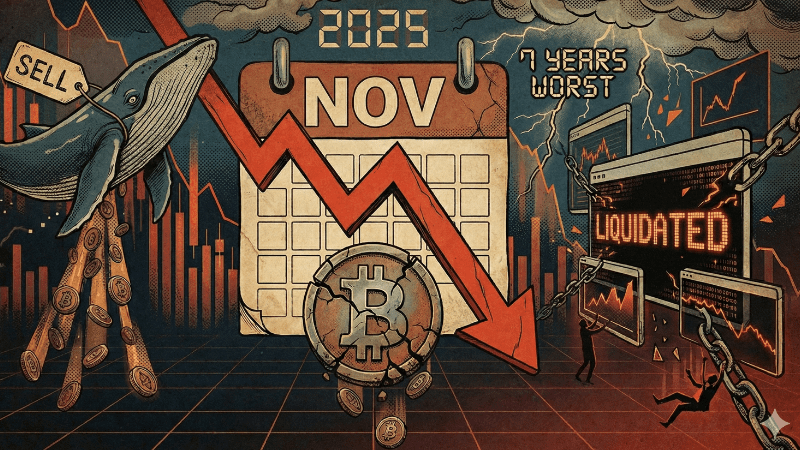

Bitcoin Bloodbath: $200 Million Liquidated as Price Plummets Below $87K

Bitcoin extended its weekend slide, dropping below $87,000, following a rejection from the $94,000 resistance level last week and closing at $88,170. This decline was accompanied by approximately $200 million in leveraged liquidations across the crypto market. At the time of writing, Bitcoin traded around $86,751-$86,770, down about 2% over the past 24 hours, indicative of thin liquidity and persistent sell pressure.

The market sentiment is "extremely bearish," with Bitcoin's price outlook described as "lethargic." The bulls failed to gain any momentum, leading to a significant weekly red candle close. Bears are now poised to challenge the critical $84,000 support level this week, aiming to drive the price further down.

The $84,000 support level is currently under intense pressure. While a slight defense around $85,000 is possible, it's unlikely to hold without a substantial influx of buying volume. Should the $84,000 level break, an accelerated descent towards $75,000 and potentially into the low $70,000 range is anticipated. Below this, the 0.618 Fibonacci retracement support at $57,000 represents a further downside target.

A more robust support zone lies between $72,000 and $68,000. This area is expected to act as a solid floor upon initial tests, likely requiring several weeks to breach if reached. If this zone is touched, a strong bounce is expected, potentially retesting the $84,000 level or even initiating a stronger reversal out of the current bear market.

On the upside, Bitcoin faces a formidable "blanket of resistance" extending from $94,000 all the way to $118,000. Conquering $94,000 would set the next target at $101,000, although strong selling pressure is expected above $97,000. Further progression towards $107,000 and eventually $118,000 would necessitate even greater buying pressure, but these levels appear largely unattainable under current market conditions.

In a counter-trend move amidst the bearish sentiment, Strategy, recognized as the world's largest publicly traded Bitcoin holder, recently acquired an additional 10,645 BTC for nearly $1 billion, at an average price of $92,098 per coin. This marks their second consecutive mega-purchase, increasing their total holdings to 671,268 BTC, acquired for an aggregate of $50.33 billion at an average cost of $74,972 each.

The acquisition was primarily funded through equity issuance, including $888.2 million from common stock sales. Executive Chairman Michael Saylor has demonstrated renewed conviction by accelerating buying despite ongoing shareholder concerns about dilution and market volatility. Strategy maintains a year-to-date BTC yield of 24.9% and continues its commitment to accumulating Bitcoin, increasingly operating like a dedicated Bitcoin investment vehicle rather than just a software company.

To comprehend the market dynamics, several terms are crucial. "Bulls" (Bullish) refer to buyers expecting prices to rise, while "Bears" (Bearish) denote sellers expecting prices to fall. A "Support level" is where prices are expected to hold, at least initially, becoming weaker with more tests. Conversely, a "Resistance level" is where prices are likely to be rejected, also weakening with repeated touches. "Fibonacci Retracements" are ratios based on the golden ratio (Phi 1.618 and phi 0.618), used to identify potential support and resistance levels in growth and decay cycles.

Recommended Articles

Crypto Carnage Strikes: Bitcoin Price Crashes to $75K Amid Market-Wide Sell-Off

Bitcoin's price plummeted to nearly $75,000 today in a high-volume sell-off, erasing over 10% from recent highs and trig...

Ancient Bitcoin Whale Awakens: $500M Dump After 12 Years Yields Jaw-Dropping 31,250% Profit!

A dormant Bitcoin whale, known as "5K BTC OG," has re-emerged after 12 years to sell half of its 5,000 BTC stash, earnin...

Fed Shakes Crypto: Interest Rate Cut Triggers Bitcoin Volatility

The Federal Reserve cut its benchmark interest rate by 25 basis points, marking its third reduction this year. This deci...

Crypto Crash: Bitcoin Tumbles to $88K, Yet JPMorgan Holds Firm on $170K Target!

Bitcoin recently plunged to $88,000s, but JPMorgan remains bullish with a $170,000 target, heavily influenced by corpora...

Crypto Carnage: Bitcoin Plummets 17%, Marking Worst Month in Seven Years!

Bitcoin endured a harsh November 2025, plunging 17.49% in its worst monthly drop since 2018, driven by massive ETF redem...

You may also like...

Bundesliga's New Nigerian Star Shines: Ogundu's Explosive Augsburg Debut!

Nigerian players experienced a weekend of mixed results in the German Bundesliga's 23rd match day. Uchenna Ogundu enjoye...

Capello Unleashes Juventus' Secret Weapon Against Osimhen in UCL Showdown!

Juventus faces an uphill battle against Galatasaray in the UEFA Champions League Round of 16 second leg, needing to over...

Berlinale Shocker: 'Yellow Letters' Takes Golden Bear, 'AnyMart' Director Debuts!

The Berlin Film Festival honored

Shocking Trend: Sudan's 'Lion Cubs' – Child Soldiers Going Viral on TikTok

A joint investigation reveals that child soldiers, dubbed 'lion cubs,' have become viral sensations on TikTok and other ...

Gregory Maqoma's 'Genesis': A Powerful Artistic Call for Healing in South Africa

Gregory Maqoma's new dance-opera, "Genesis: The Beginning and End of Time," has premiered in Cape Town, offering a capti...

Massive Rivian 2026.03 Update Boosts R1 Performance and Utility!

Rivian's latest software update, 2026.03, brings substantial enhancements to its R1S SUV and R1T pickup, broadening perf...

Bitcoin's Dire 29% Drop: VanEck Signals Seller Exhaustion Amid Market Carnage!

Bitcoin has suffered a sharp 29% price drop, but a VanEck report suggests seller exhaustion and a potential market botto...

Crypto Titans Shake-Up: Ripple & Deutsche Bank Partner, XRP Dips, CZ's UAE Bitcoin Mining Role Revealed!

Deutsche Bank is set to adopt Ripple's technology for faster, cheaper cross-border payments, marking a significant insti...