Report Highlights Three TSX Penny Stocks with Market Caps Under CA$200M

As the Canadian market enters the second half of 2025, it is characterized by an intricate economic environment, marked by ongoing trade negotiations and the potential for tariff adjustments. Within this dynamic landscape, investors are increasingly exploring opportunities in smaller or emerging companies, particularly through what are colloquially known as "penny stocks." While the term itself is an older designation, these stocks continue to present a compelling avenue for investment due to their potential for significant growth at relatively lower price points. The key to unlocking this potential lies in identifying companies that are underpinned by robust financial health and solid fundamental performance.

A recent screener of TSX Penny Stocks identified a comprehensive list of 889 companies, from which a select subset of preferred stocks has been highlighted. These selections are notable for their strong financial health ratings. Among these, PetroTal (TSX:TAL) is trading at CA$0.70 with a market capitalization of CA$640.27 million and a financial health rating of ★★★★★☆. Orezone Gold (TSX:ORE) stands at CA$1.26, boasting a market cap of CA$692.02 million and a ★★★★★☆ rating. Dynacor Group (TSX:DNG) is priced at CA$4.49, with a market cap of CA$190.13 million and an exceptional ★★★★★★ rating. Further down the list, Findev (TSXV:FDI) trades at CA$0.44 (CA$12.46 million market cap, ★★★★★★ rating), Thor Explorations (TSXV:THX) at CA$0.78 (CA$532.24 million market cap, ★★★★★★ rating), Automotive Finco (TSXV:AFCC.H) at CA$0.88 (CA$20.61 million market cap, ★★★★★★ rating), and NTG Clarity Networks (TSXV:NCI) at CA$2.29 (CA$96.08 million market cap, ★★★★★★ rating). Completing this highlighted group are Intermap Technologies (TSX:IMP) at CA$2.19 (CA$119.51 million market cap, ★★★★★☆ rating), Hemisphere Energy (TSXV:HME) at CA$1.94 (CA$184.07 million market cap, ★★★★★★ rating), and McChip Resources (TSXV:MCS) at CA$0.99 (CA$5.02 million market cap, ★★★★★★ rating).

Diving deeper into specific companies, PharmaTher Holdings Ltd. (CNSX:PHRM), with a market capitalization of CA$20.80 million, is a specialty pharmaceutical company dedicated to developing and commercializing pharmaceuticals through novel delivery methods aimed at improving patient outcomes. Despite being pre-revenue, PharmaTher Holdings is strategically positioned within the burgeoning ketamine space. The company recently launched KetaVault, an innovative portal designed to provide comprehensive ketamine data to its partners, a move anticipated to significantly accelerate clinical trials and streamline regulatory submissions. This strategic initiative aligns with the expected FDA approval for its ketamine product, projected by August 9, 2025. Financially, PharmaTher Holdings appears stable with no reported debt and sufficient short-term assets to cover current liabilities. However, a closer look at its cash flow trends reveals a potential challenge: if cash flow continues its historical decline, the company may have less than a year of cash runway. Despite recent operational losses, these strategic advancements and its strong market positioning could significantly enhance its future prospects.

Another company of interest is Progressive Planet Solutions Inc., which, alongside its subsidiaries, focuses on the acquisition and exploration of mineral properties across Canada and the United States. This company operates with a market capitalization of CA$18.66 million. While specific revenue segments for Progressive Planet Solutions were not detailed, its focus on mineral exploration positions it within a sector with long-term growth potential tied to resource demand and discovery. The financial health rating for Progressive Planet Solutions Inc. stands at ★★★★☆☆, indicating a generally sound financial position.

You may also like...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

Beyond Fast Fashion: How Africa’s Designers Are Weaving a Sustainable and Culturally Rich Future for

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...

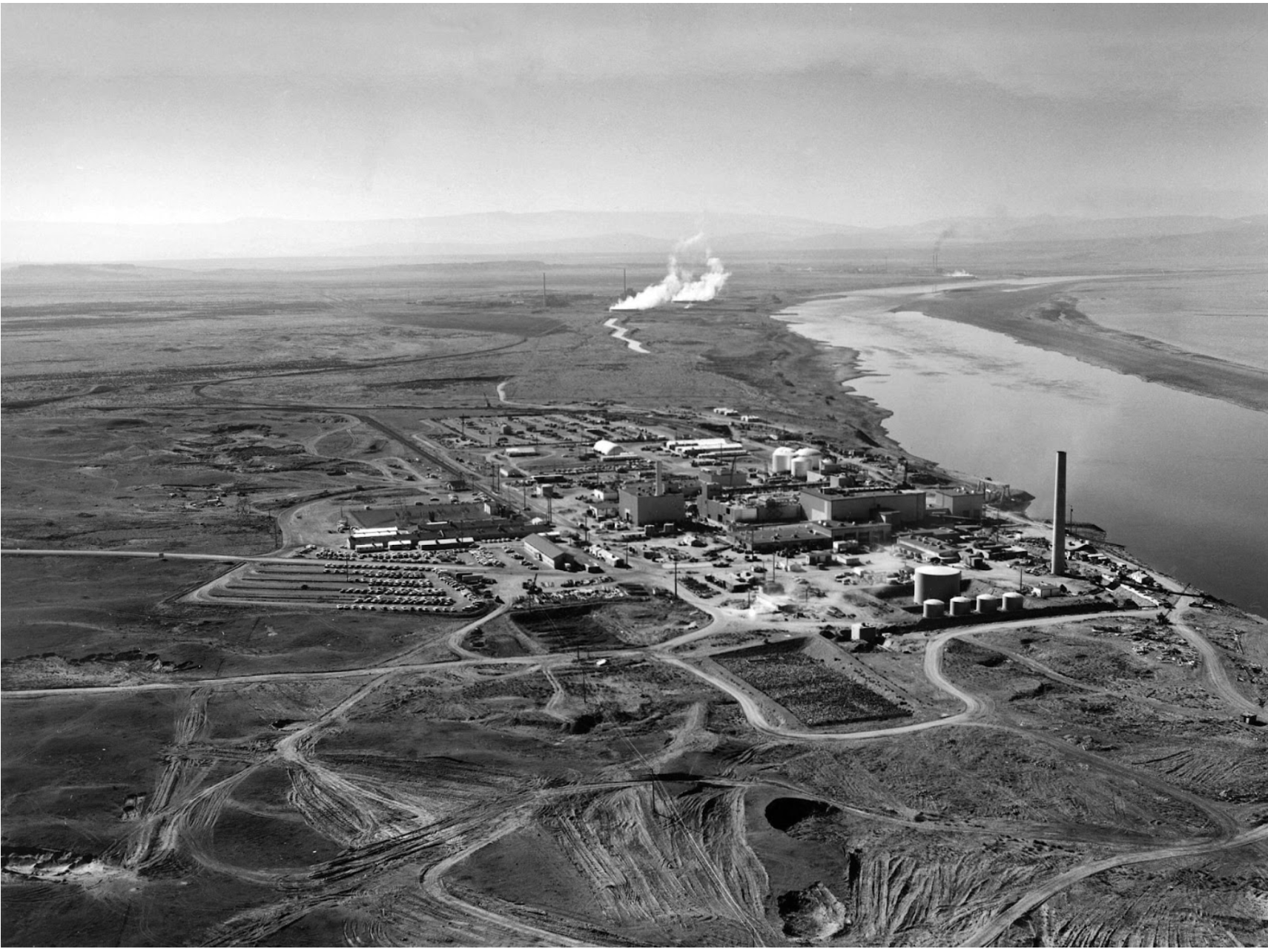

The Secret Congolese Mine That Shaped The Atomic Bomb

The Secret Congolese Mine That Shaped The Atomic Bomb.

TOURISM IS EXPLORING, NOT CELEBRATING, LOCAL CULTURE.

Tourism sells cultural connection, but too often delivers erasure, exploitation, and staged authenticity. From safari pa...

Crypto or Nothing: How African Youth Are Betting on Digital Coins to Escape Broken Systems

Amid inflation and broken systems, African youth are turning to crypto as survival, protest, and empowerment. Is it the ...

We Want Privacy, Yet We Overshare: The Social Media Dilemma

We claim to value privacy, yet we constantly overshare on social media for likes and validation. Learn about the contrad...

Is It Still Village People or Just Poor Planning?

In many African societies, failure is often blamed on “village people” and spiritual forces — but could poor planning, w...

The Digital Financial Panopticon: How Fintech's Convenience Is Hiding a Data Privacy Reckoning

Fintech promised convenience. But are we trading our financial privacy for it? Uncover how algorithms are watching and p...