Accredited Investor Opportunities Explained

The Securities and Exchange Board of India (SEBI) introduced the 'Accredited Investor' framework in 2021, aiming to offer sophisticated investors exclusive investment opportunities and lighter regulatory oversight. Despite its potential benefits, which include reduced investment thresholds and greater flexibility, the framework has seen limited adoption in India. Key reasons for this include a lack of awareness among high-net-worth individuals (HNIs) and family offices, a reluctance from investors to disclose detailed financial information, and a cumbersome, tedious accreditation process. As of 2025, India has only approximately 650 accredited investors, a stark contrast to the 24 million in the USA.

The concept of an accredited investor acknowledges that not all investors are equal, recognizing those with superior financial acumen and a higher risk appetite. This two-tiered system allows certified wealthy individuals to access a less restrictive investment arena, distinguishing them from retail investors. Sandeep Jethwani, Co-Founder of Dezerv, emphasizes that such investors possess the capacity to go beyond standard investment requirements. Shobhit Mathur, Co-founder of Ionic Wealth by AngelOne, points out that the framework provides lighter-touch regulation for a growing segment of high-value investors seeking aspirational opportunities unconstrained by standard regulations.

To qualify as an accredited investor, individuals must meet specific financial criteria. These include having an annual income of Rs.2 crore or more, or a net worth of Rs.7.5 crore or more (with at least Rs.3.75 crore in financial assets), or an annual income of Rs.1 crore coupled with a net worth of Rs.5 crore (with at least Rs.2.5 crore in financial assets). It is important to note that the value of the primary residence is excluded from net worth calculations, though an unoccupied second house can be included. Proof of income and assets is typically verified through the latest income tax returns or a net worth certificate.

The accredited investor designation unlocks a wide array of investment opportunities. Sanat Mondal, Head of Private Markets at Sanctum Wealth, notes that accreditation enables access to curated, high-quality opportunities often restricted to sophisticated participants. While bigger investors already have options like Portfolio Management Services (PMS) and Alternate Investment Funds (AIF) with minimum ticket sizes of Rs.50 lakh and Rs.1 crore respectively, accredited investors can circumvent these limits. For instance, an accredited individual can invest in a PMS for as low as Rs.10 lakh or an AIF for Rs.25 lakh, facilitating diversification across multiple strategies. Beyond customised PMS and AIF offerings, accredited investors can tap into private placements, pre-IPO deals, venture capital, private equity, hedge funds, and other alternative investments unavailable to the general public. They also gain access to upcoming Specialized Investment Funds (SIF) at lower ticket sizes and benefit from reduced barriers for overseas investments housed in the GIFT City, with entry points as low as $25,000 compared to $150,000 for regular investors.

Accredited investors also enjoy benefits beyond unique investment solutions. Abhijit Bhave, a wealth management expert, highlights lower minimum investments, greater flexibility in exposure limits, and more tailored exit options. For large value PMS (minimum investment of Rs.10 crore), accredited investors can place 100% of their investment in unlisted securities, as opposed to the 25% limit for regular investors. Similarly, in large value AIFs (minimum commitment of Rs.70 crore), accredited investors can allocate higher percentages of their assets under management (AUM) to individual companies within various AIF categories. Furthermore, accredited investors can negotiate more flexible fee arrangements with Registered Investment Advisers (RIAs), potentially including hybrid or performance-based fees, and can receive both advisory and distribution services from the same RIA, unlike regular investors. This framework is seen as an acknowledgment from regulators that these investors have earned the right to invest like sophisticated professionals.

Despite these advantages, the framework faces significant challenges in achieving broader adoption. Apart from lack of awareness and reluctance to disclose financial details, the accreditation process itself is a major hurdle. Currently, only two operational accreditation agencies exist in India: CDSL Ventures Limited and NSDL Data Management Limited, both subsidiaries of stock exchanges or depositories. This requirement for third-party verification, unlike in other countries where funds or service providers conduct due diligence, complicates matters. The process can take 3-4 weeks, creating bottlenecks, especially in competitive deal environments. Accreditation also has a limited shelf life, valid for two or three years depending on the eligibility criteria, and incurs a recurring cost of Rs.10,000 to Rs.14,500. Market participants feel there isn't sufficient incentive, such as consistently differentiated pricing or lower fees, to motivate accreditation.

Recognizing these bottlenecks, SEBI has proposed changes to the accreditation framework in a recent consultation paper. These proposals include expanding eligibility criteria for accreditation agencies to include all KRAs (KYC Registration Agencies), which should ease capacity constraints and foster competition. Additionally, AIFs may be permitted to provisionally onboard an investor as accredited based on their own due diligence, pending official certification from an accreditation agency. This provisional onboarding could significantly reduce the time-to-investment. While the accredited investor framework is still in its formative stages and requires further improvements, its adoption represents a natural evolution of India's financial market as it grows in size and depth, making it a space to watch in the coming years.

You may also like...

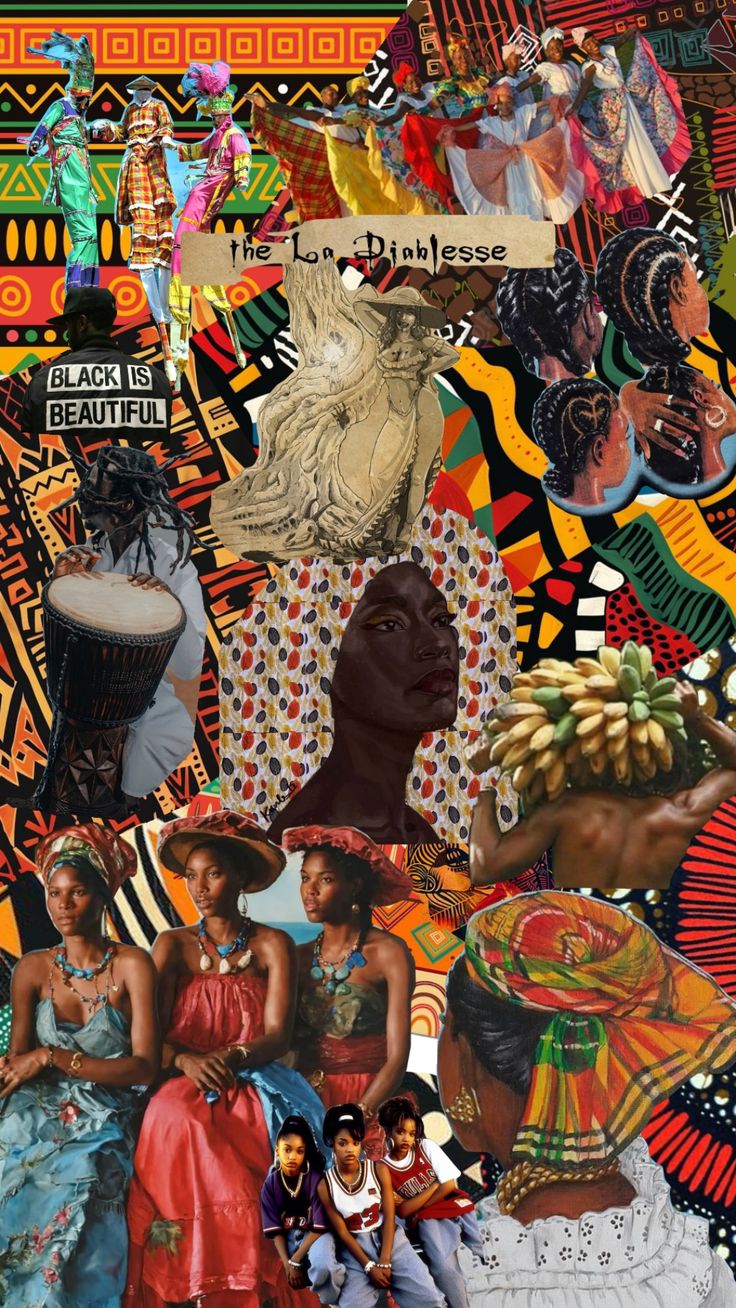

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

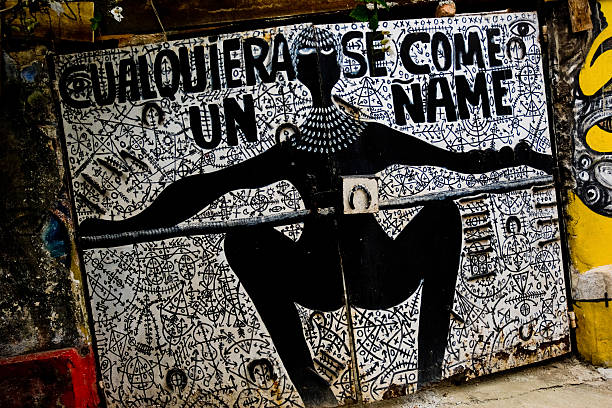

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

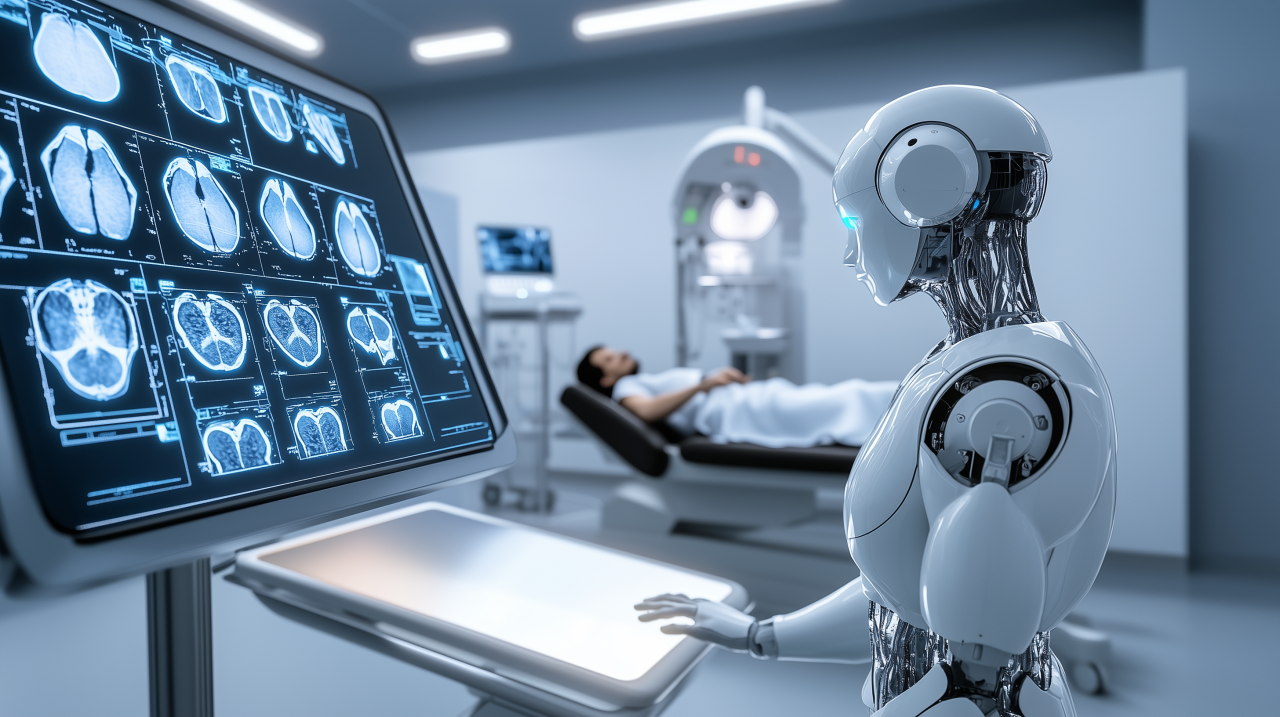

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

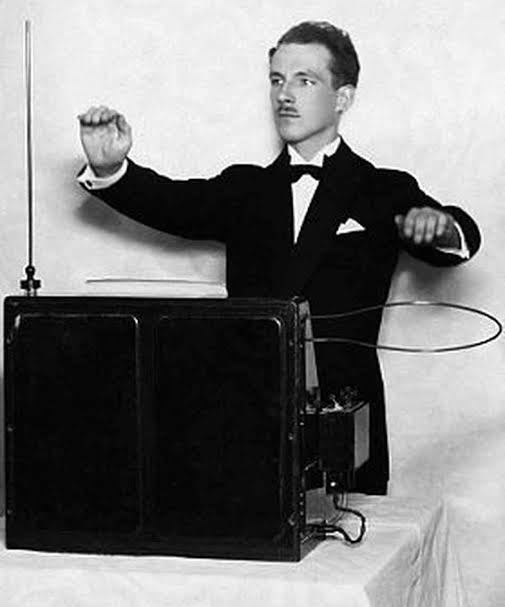

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...